Discovering Unifiedpost Group And 2 Other Promising European Penny Stocks

Reviewed by Simply Wall St

As European markets experience a lift in sentiment following the de-escalation of U.S.-China trade tensions, investors are exploring diverse opportunities across the continent. Penny stocks, though often associated with past trading eras, continue to capture interest due to their potential for substantial growth when backed by solid financials. These smaller or newer companies can offer surprising opportunities for those looking beyond mainstream investments, and this article will highlight three such stocks that combine balance sheet resilience with promising prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.29 | SEK2.19B | ✅ 5 ⚠️ 1 View Analysis > |

| KebNi (OM:KEBNI B) | SEK1.68 | SEK455.54M | ✅ 3 ⚠️ 4 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.23 | SEK217.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.70 | SEK277.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN4.07 | PLN137.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.69 | €56.74M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.95 | €31.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.75 | €17.76M | ✅ 2 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.155 | €297.53M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 451 stocks from our European Penny Stocks screener.

We'll examine a selection from our screener results.

Unifiedpost Group (ENXTBR:UPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Unifiedpost Group SA is a fintech company that operates a cloud-based platform for administrative and financial services in Belgium and internationally, with a market cap of €131.82 million.

Operations: Unifiedpost Group generates revenue from Digital Services (€46.41 million) and Traditional Communication Services (€37.14 million).

Market Cap: €131.82M

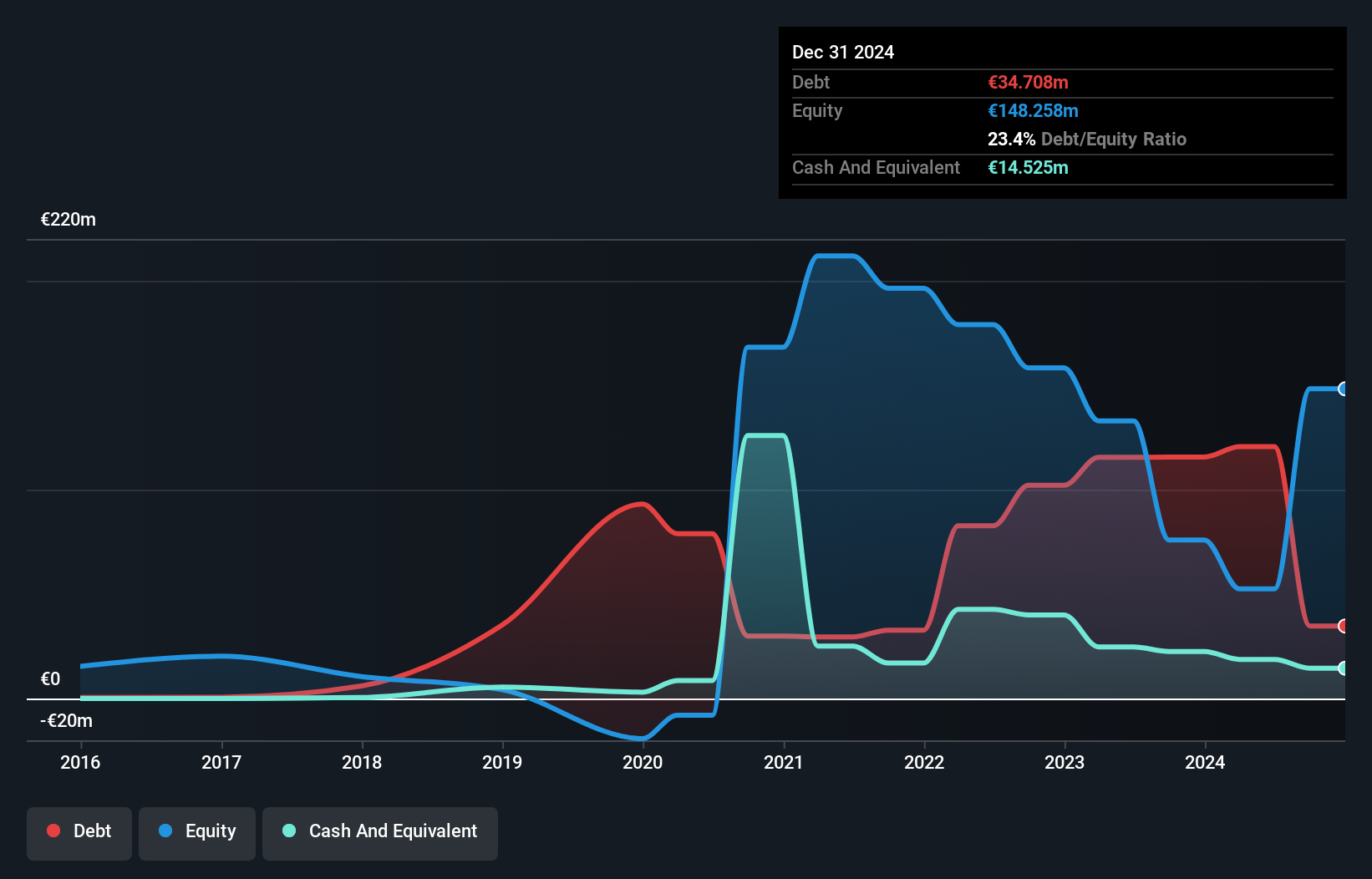

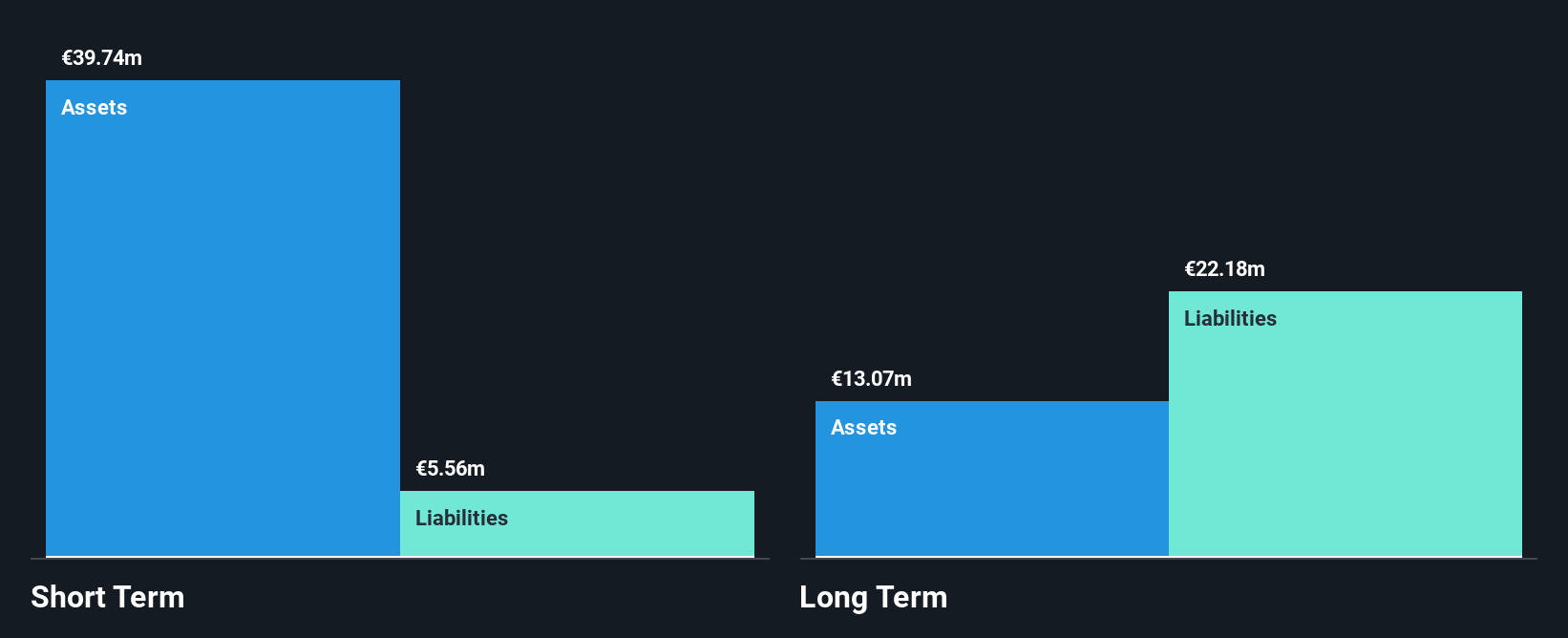

Unifiedpost Group, with a market cap of €131.82 million, is navigating the challenges typical of penny stocks. Despite being unprofitable and having a negative return on equity, its revenue from digital and traditional communication services shows potential for growth at 10.33% annually. The company's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management. However, concerns about its viability have been raised by auditors expressing doubts over its going concern status. While it reported a net income turnaround in 2024, volatility remains high compared to most Belgian stocks.

- Unlock comprehensive insights into our analysis of Unifiedpost Group stock in this financial health report.

- Assess Unifiedpost Group's future earnings estimates with our detailed growth reports.

Nanoform Finland Oyj (HLSE:NANOFH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharma and biotech industries in Europe and the United States, with a market cap of €82.97 million.

Operations: Currently, Nanoform Finland Oyj does not report any specific revenue segments.

Market Cap: €82.97M

Nanoform Finland Oyj, with a market cap of €82.97 million, is a pre-revenue company in the nanotechnology sector. Despite its unprofitability and negative return on equity, it remains debt-free and boasts an experienced board and management team. The company's short-term assets significantly exceed its liabilities, providing a strong liquidity position. Recent earnings reported sales of €0.876 million for Q1 2025, up from €0.602 million the previous year, with net losses narrowing to €5.36 million from €6.97 million year-on-year. Revenue growth is forecast at 46.34% annually despite ongoing volatility in share price movements.

- Click here and access our complete financial health analysis report to understand the dynamics of Nanoform Finland Oyj.

- Review our growth performance report to gain insights into Nanoform Finland Oyj's future.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC), with operations in Germany, the United States, and internationally, and has a market cap of €155.66 million.

Operations: The company generates revenue primarily from its ADC Technology and Customer Specific Research segment, amounting to €6.85 million.

Market Cap: €155.66M

Heidelberg Pharma AG, with a market cap of €155.66 million, is an unprofitable biopharmaceutical company focusing on oncology and antibody targeted amanitin conjugates. Despite its financial challenges, including a negative return on equity and increasing losses over the past five years, it remains debt-free with short-term assets exceeding liabilities. Recent earnings show revenue growth to €2.87 million for Q1 2025 from €1.86 million the previous year; however, net loss increased to €5.94 million from €4.49 million year-on-year. The company's cash runway is extended into 2027 due to royalty financing agreements providing substantial incremental payments.

- Dive into the specifics of Heidelberg Pharma here with our thorough balance sheet health report.

- Understand Heidelberg Pharma's earnings outlook by examining our growth report.

Seize The Opportunity

- Click here to access our complete index of 451 European Penny Stocks.

- Curious About Other Options? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HPHA

Heidelberg Pharma

A biopharmaceutical company, focuses on oncology and antibody targeted amanitin conjugates (ATAC) in Germany, the United States, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives