Alma Media Oyj (HLSE:ALMA) Is Up 7.5% After Upward 2025 Revenue Guidance Revision - What's Changed

Reviewed by Sasha Jovanovic

- On October 14, 2025, Alma Media Corporation revised its earnings guidance, announcing that its 2025 revenue is now expected to remain at or exceed the 2024 level of €312.7 million, rather than remaining flat as previously projected.

- This updated forecast highlights Alma Media's continued favorable business performance and the positive impact of recent acquisitions, particularly Edilex Oy and Effortia Oy, amid ongoing market uncertainty.

- We'll explore how Alma Media's upward revenue guidance revision, driven by recent acquisitions, influences the company's broader investment thesis and future prospects.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Alma Media Oyj Investment Narrative Recap

To believe in Alma Media as a shareholder, you need confidence in its ability to grow digital revenues and increase operating efficiency despite macroeconomic headwinds and a challenging advertising market. The recent upward revision to 2025 revenue guidance, driven by acquisitions like Edilex Oy and Effortia Oy, is a positive signal, but it doesn't fundamentally change the most important short-term catalyst, the company’s progress in integrating new businesses and extracting value from digital investments, nor does it remove lingering risks around slow labor markets or high integration costs. Among recent developments, Alma Media’s Q2 2025 earnings report stands out. The company delivered year-on-year sales growth to €83.7 million in the quarter and higher net income, reinforcing that ongoing digital transformation and M&A activity are supporting its revenue base, though whether these incremental gains are sustainable as economic pressures persist is still an open question. Yet while recent acquisitions brighten the outlook, investors should be aware that a lingering risk remains if market demand fails to...

Read the full narrative on Alma Media Oyj (it's free!)

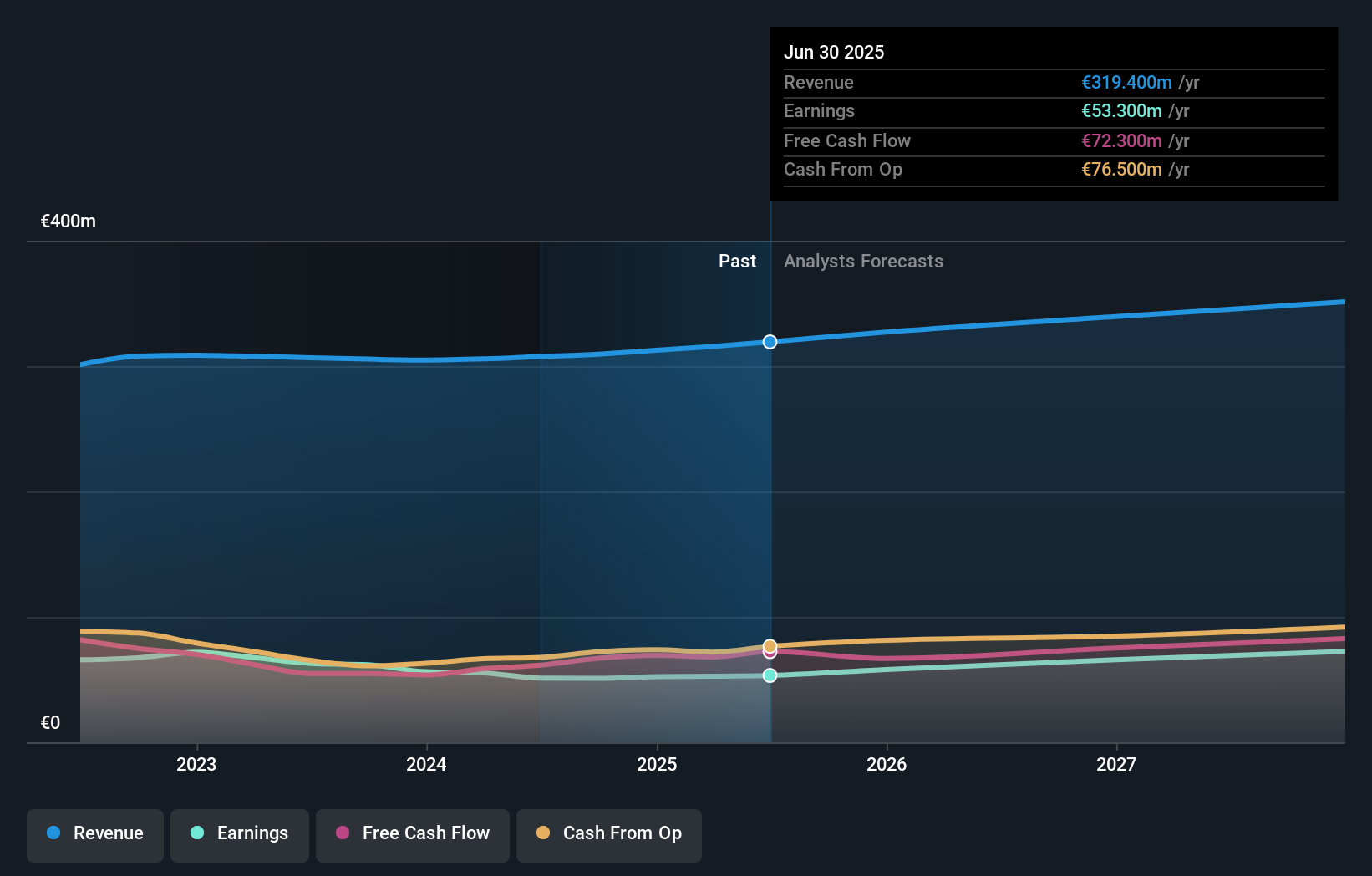

Alma Media Oyj is projected to reach €352.0 million in revenue and €73.4 million in earnings by 2028, based on analysts' assumptions. This outlook implies annual revenue growth of 3.3% and an earnings increase of €20.1 million from current earnings of €53.3 million.

Uncover how Alma Media Oyj's forecasts yield a €15.57 fair value, in line with its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community have issued fair value estimates for Alma Media ranging from €13.00 to €15.57 per share. Many participants are closely watching whether Alma's digital integration and M&A can offset weak labor and advertising markets, inviting you to weigh these varied perspectives.

Explore 2 other fair value estimates on Alma Media Oyj - why the stock might be worth as much as €15.57!

Build Your Own Alma Media Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alma Media Oyj research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Alma Media Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alma Media Oyj's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ALMA

Alma Media Oyj

A media company, engages in digital services and journalistic media content in Finland and the rest of Europe.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives