Key Takeaways

- Rapid pivot to AI-driven digital services and platform consolidation fuels margin expansion, revenue growth, and improved profitability as print declines.

- Local expertise and regulatory agility enhance competitive positioning, customer retention, and pricing power amid a fragmented, compliance-focused European market.

- Persistent macroeconomic and advertising market weakness, high ongoing costs, and intensifying global competition threaten Alma Media's revenue, margins, and growth without successful digital and strategic execution.

Catalysts

About Alma Media Oyj- A media company, engages in digital services and journalistic media content in Finland and the rest of Europe.

- Alma Media's accelerating integration of AI and automation across digital marketplaces, news, and insights services is expected to drive sustained operating margin expansion through enhanced personalization, internal productivity, and product innovation, directly boosting net margins and earnings in the medium-to-long term.

- The company is executing on a transition away from volatile print toward a portfolio dominated by high-growth digital services (now 85%+ of revenue), positioning Alma to benefit as European digital advertising, transactional online marketplaces, and digital subscriptions continue to structurally outgrow legacy channels-positively impacting revenue growth.

- As the workforce becomes increasingly digital and remote across Europe, Alma's scale and technology-led recruitment platforms (Monster, Teamio) are poised to recover and capture growing demand once regional labor markets normalize and employers accelerate digital hiring, supporting medium-term revenue rebound.

- The "Career United" project, consolidation of platforms, and cloud migration create substantial latent operating leverage; as transition costs roll off by 2026, management expects a step change in profitability-removing redundancy and materially improving group-level net margins.

- Alma's local-language focus, proprietary datasets, and regulatory agility position it to gain share as advertisers and users seek trusted, compliant digital platforms in an increasingly regulated and fragmented landscape-supporting customer retention, pricing power, and thus improving both top-line and long-term earnings quality.

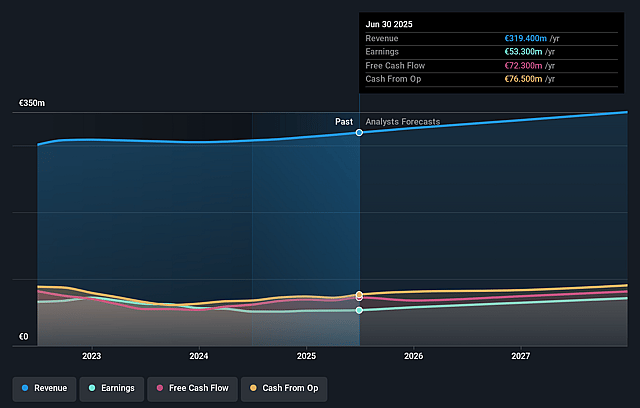

Alma Media Oyj Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Alma Media Oyj's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.7% today to 20.9% in 3 years time.

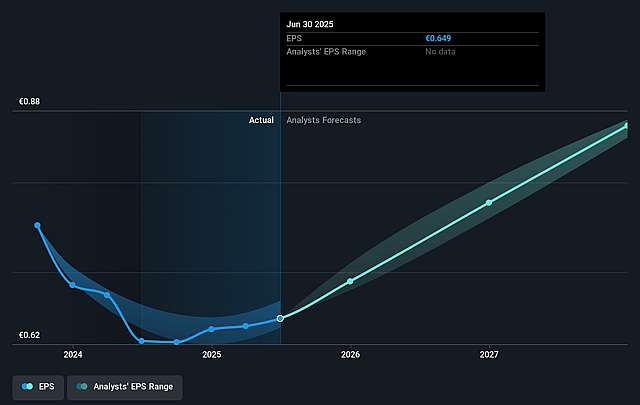

- Analysts expect earnings to reach €73.4 million (and earnings per share of €0.89) by about September 2028, up from €53.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.2x on those 2028 earnings, down from 21.3x today. This future PE is lower than the current PE for the GB Media industry at 20.1x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.68%, as per the Simply Wall St company report.

Alma Media Oyj Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent macroeconomic headwinds in Central and Eastern Europe, particularly weak GDP growth and ongoing labor market stagnation in Alma Career's key markets, risk continued sluggish or declining revenues in the recruitment/classifieds segment, directly impacting top-line growth and earnings.

- Fragility of the Finnish advertising market-with overall ad spend, including digital, still declining and customer companies struggling-raises the possibility of further revenue pressure and heightened earnings volatility, especially in Alma's core News Media and Marketplaces segments.

- Ongoing high operational costs from the Career United project, notably double technology and personnel expenses, have so far offset savings and will weigh on net margins and group profitability until full integration is completed by end of 2026 or later.

- Intensifying competition from international tech players and global platforms in digital advertising, classified, and AI-driven insights risks Alma's ability to retain clients and premium pricing, and may lead to increased customer churn, reducing both revenue growth and net margins over the long term.

- The company's growth and margin improvements remain heavily reliant on further digital transformation, successful M&A, and AI/product innovation; failure to execute at the pace of more agile, globally-resourced competitors could lead to market share loss and stalled earnings expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €14.567 for Alma Media Oyj based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €352.0 million, earnings will come to €73.4 million, and it would be trading on a PE ratio of 19.2x, assuming you use a discount rate of 5.7%.

- Given the current share price of €13.8, the analyst price target of €14.57 is 5.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.