- Finland

- /

- Paper and Forestry Products

- /

- HLSE:STERV

Revenues Tell The Story For Stora Enso Oyj (HEL:STERV)

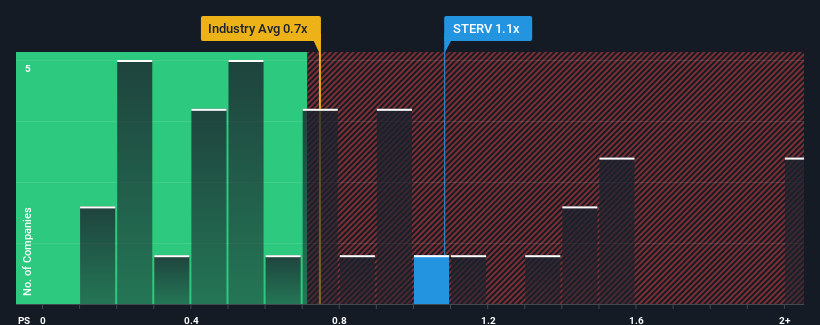

It's not a stretch to say that Stora Enso Oyj's (HEL:STERV) price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" for companies in the Forestry industry in Finland, where the median P/S ratio is around 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Stora Enso Oyj

How Stora Enso Oyj Has Been Performing

Recent times haven't been great for Stora Enso Oyj as its revenue has been falling quicker than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Stora Enso Oyj will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Stora Enso Oyj's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 20%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 9.9% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 4.0% each year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 3.4% per annum, which is not materially different.

With this in mind, it makes sense that Stora Enso Oyj's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Stora Enso Oyj maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Stora Enso Oyj with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:STERV

Stora Enso Oyj

Provides renewable solutions for the packaging, biomaterials, wooden constructions, and paper industries in Finland and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives