- Finland

- /

- Medical Equipment

- /

- HLSE:REG1V

3 European Stocks That May Be Trading Below Intrinsic Value By Up To 37%

Reviewed by Simply Wall St

The European stock market has recently experienced a notable upswing, with the pan-European STOXX Europe 600 Index reaching record levels amid a rally in technology stocks and expectations for lower U.S. borrowing costs. In this context, identifying stocks that may be trading below their intrinsic value can present attractive opportunities for investors seeking to capitalize on favorable market conditions. A good stock in such an environment is one that not only appears undervalued based on fundamental analysis but also shows resilience and potential for growth amidst economic fluctuations and evolving monetary policies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €1.19 | €2.33 | 48.8% |

| Profoto Holding (OM:PRFO) | SEK17.90 | SEK34.88 | 48.7% |

| Midsummer (OM:MIDS) | SEK2.70 | SEK5.36 | 49.6% |

| Lingotes Especiales (BME:LGT) | €5.65 | €11.11 | 49.1% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.36 | €12.58 | 49.4% |

| E-Globe (BIT:EGB) | €0.64 | €1.26 | 49.1% |

| Circle (BIT:CIRC) | €8.20 | €16.22 | 49.5% |

| Atea (OB:ATEA) | NOK143.60 | NOK281.70 | 49% |

| Allegro.eu (WSE:ALE) | PLN33.80 | PLN66.37 | 49.1% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK501.15 | 49.1% |

We'll examine a selection from our screener results.

Endomines Finland Oyj (HLSE:PAMPALO)

Overview: Endomines Finland Oyj is involved in the mining and exploration of gold deposits in Finland and the United States, with a market cap of €318.67 million.

Operations: The company's revenue is primarily generated from its Pampalo Production segment, which amounts to €37.10 million.

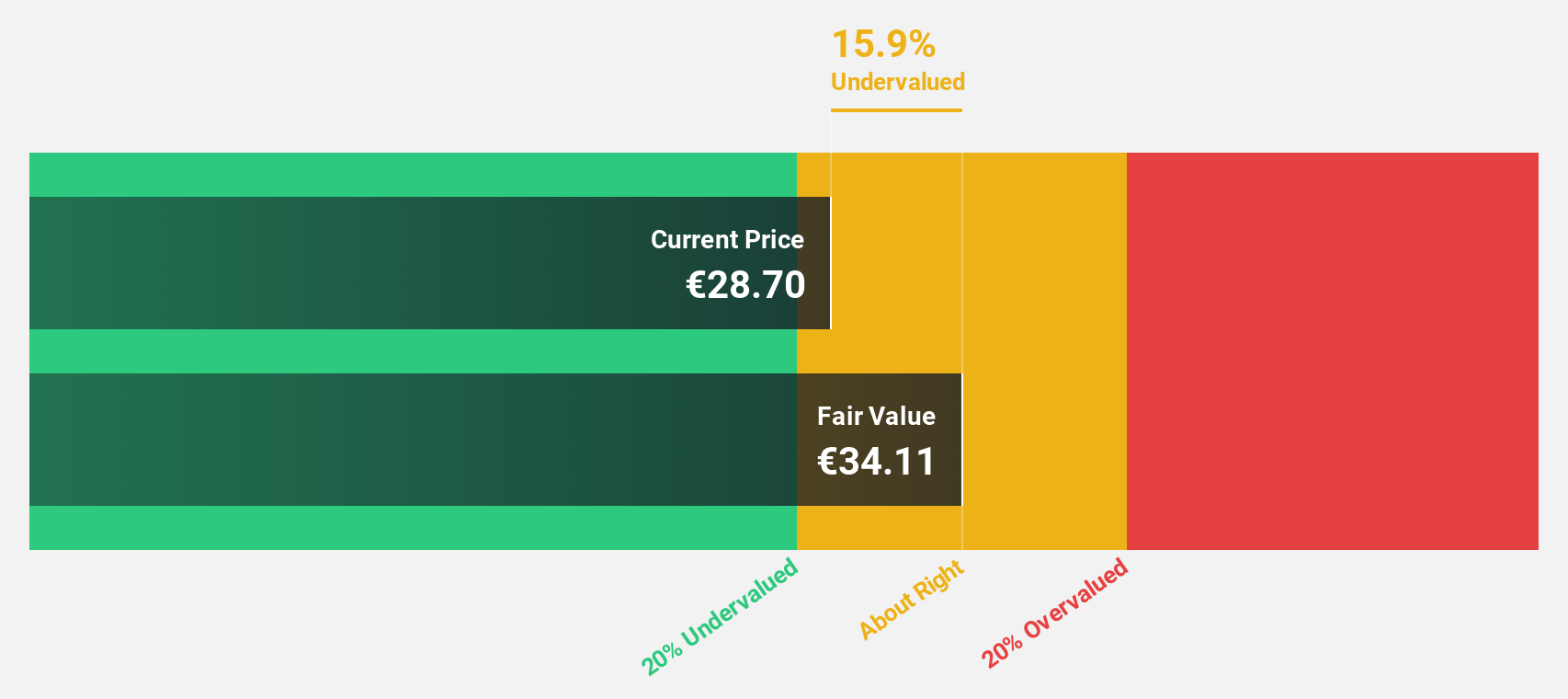

Estimated Discount To Fair Value: 30.1%

Endomines Finland Oyj appears undervalued, trading 30.1% below its estimated fair value of €41, with a current price of €28.65. The company has transitioned to profitability this year, reporting a net income of €2.3 million for H1 2025 compared to a loss the previous year. Recent drilling results at Ukkolanvaara and Pampalo indicate significant gold potential, supporting future revenue growth forecasts of 18.7% annually, outpacing the Finnish market's average growth rate.

- The analysis detailed in our Endomines Finland Oyj growth report hints at robust future financial performance.

- Dive into the specifics of Endomines Finland Oyj here with our thorough financial health report.

Revenio Group Oyj (HLSE:REG1V)

Overview: Revenio Group Oyj specializes in ophthalmological devices and software solutions for diagnosing glaucoma, macular degeneration, and diabetic retinopathy, serving markets in Finland, the United States, and internationally with a market cap of €631.82 million.

Operations: The company's revenue is primarily generated from its Health Tech segment, which accounts for €107.22 million.

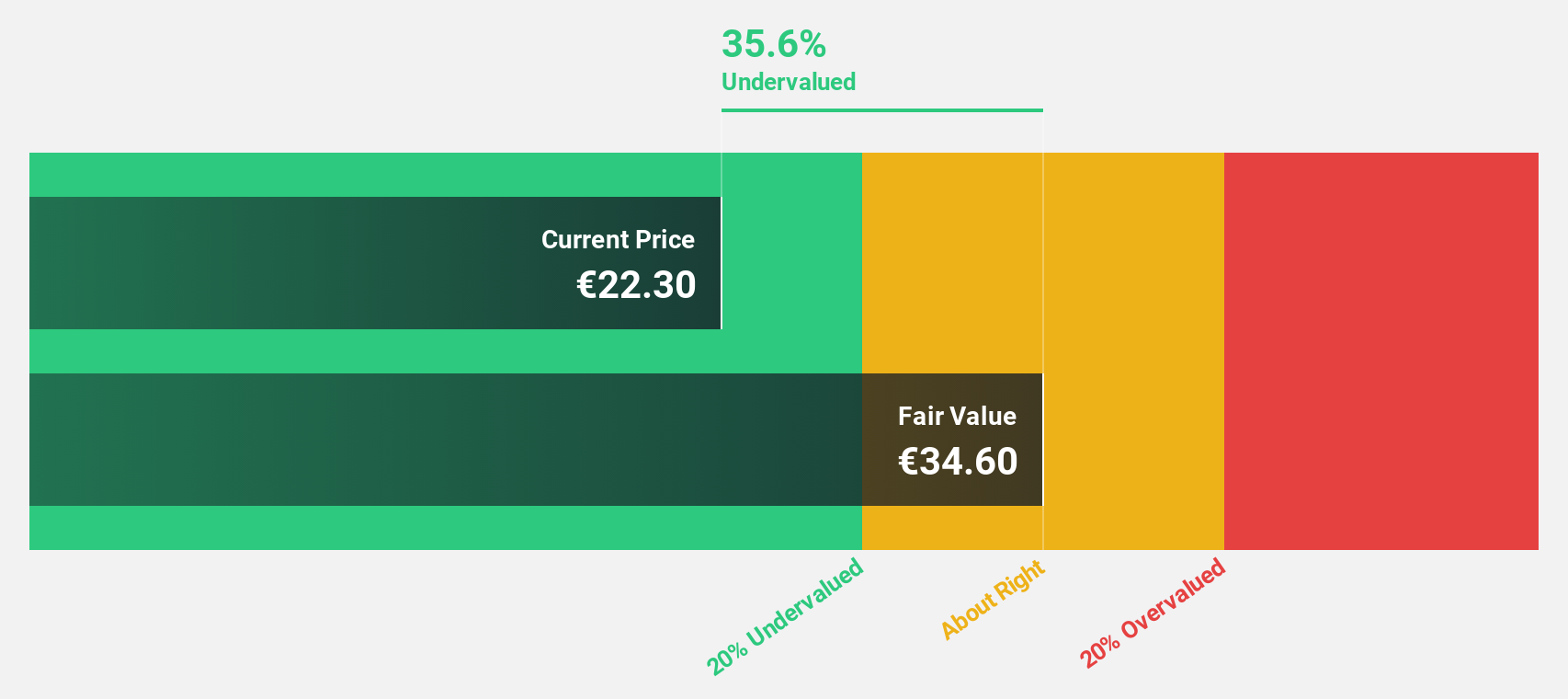

Estimated Discount To Fair Value: 35.7%

Revenio Group Oyj is trading at €23.75, significantly below its estimated fair value of €36.96, indicating potential undervaluation based on cash flows. The company's earnings are projected to grow at 19.6% annually, surpassing the Finnish market's growth rate of 16.5%. However, recent financial results showed a decline in net income for Q2 and H1 2025 compared to the previous year, which may impact short-term investor sentiment despite favorable long-term growth projections.

- In light of our recent growth report, it seems possible that Revenio Group Oyj's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Revenio Group Oyj.

CellaVision (OM:CEVI)

Overview: CellaVision AB (publ) develops and sells instruments, software, and reagents for blood and body fluids analysis in Sweden and internationally, with a market cap of approximately SEK4.39 billion.

Operations: The company's revenue segment primarily consists of Automated Microscopy Systems and Reagents in the field of Hematology, generating SEK751.47 million.

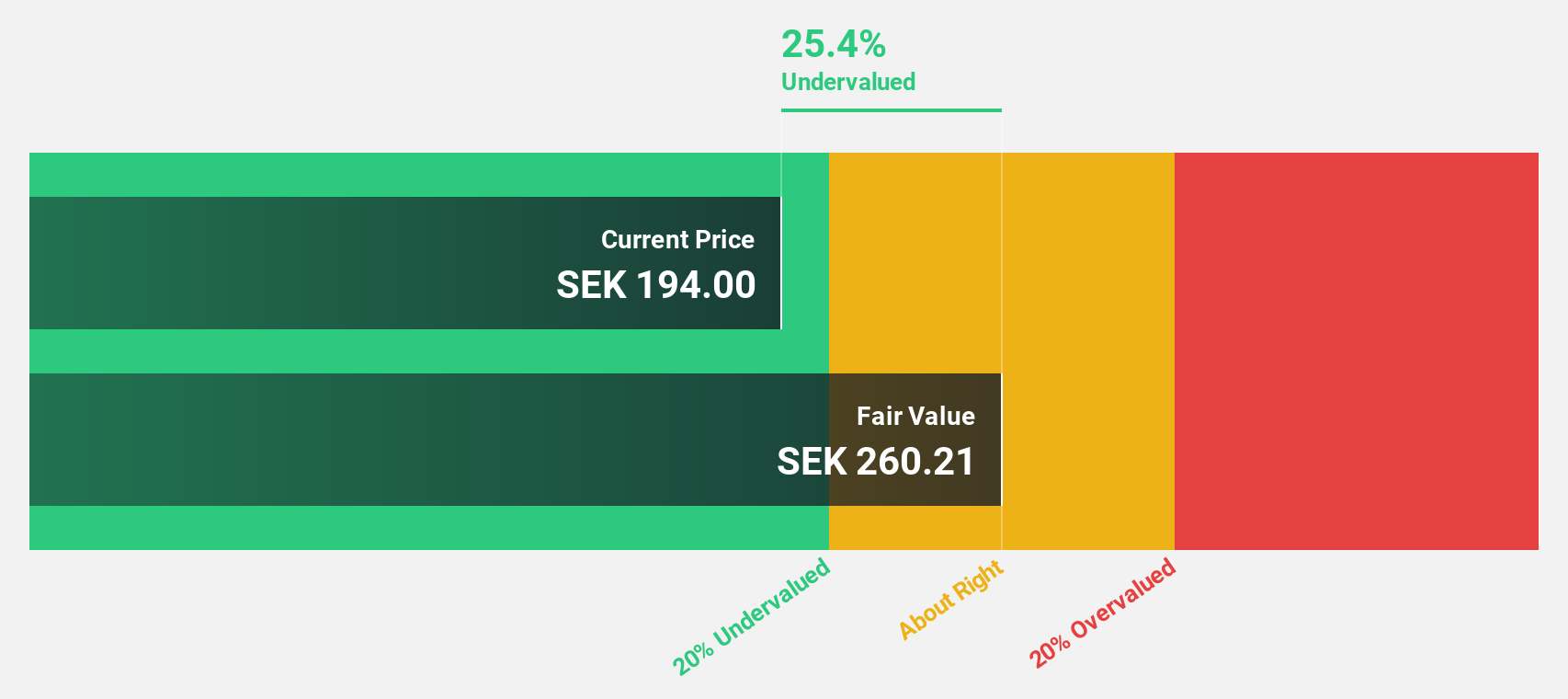

Estimated Discount To Fair Value: 37%

CellaVision is trading at SEK 184.2, significantly below its estimated fair value of SEK 292.29, highlighting potential undervaluation based on cash flows. Despite a modest past earnings growth of 4.2%, future earnings are forecasted to grow at a robust 17.7% annually, outpacing the Swedish market's average growth rate of 16.4%. Recent executive changes and stable financial performance in Q2 and H1 2025 may influence investor confidence positively moving forward.

- Our comprehensive growth report raises the possibility that CellaVision is poised for substantial financial growth.

- Click to explore a detailed breakdown of our findings in CellaVision's balance sheet health report.

Seize The Opportunity

- Click this link to deep-dive into the 205 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:REG1V

Revenio Group Oyj

Provides ophthalmological devices and software solutions for the diagnosis of glaucoma, macular degeneration, and diabetic retinopathy in Finland, the United States, and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.