With EPS Growth And More, Kemira Oyj (HEL:KEMIRA) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kemira Oyj (HEL:KEMIRA). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Kemira Oyj

How Quickly Is Kemira Oyj Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Kemira Oyj's EPS has grown 36% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

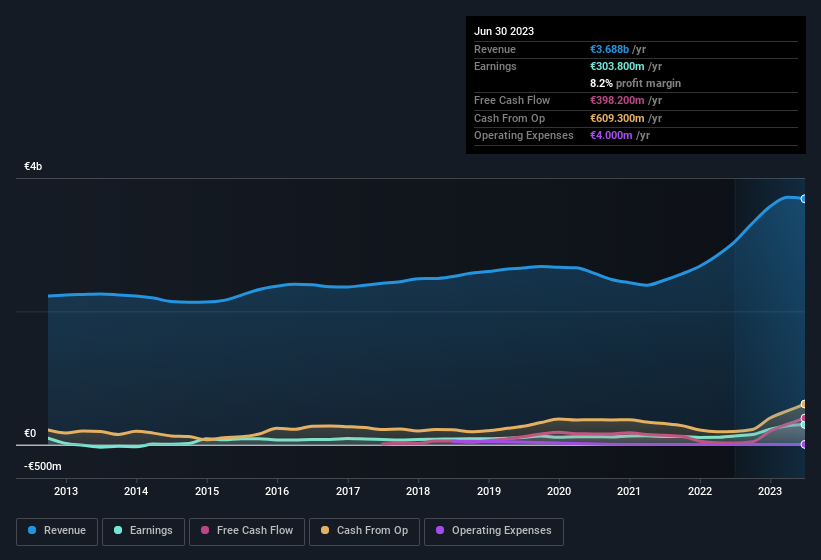

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Kemira Oyj shareholders can take confidence from the fact that EBIT margins are up from 6.7% to 12%, and revenue is growing. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Kemira Oyj's future EPS 100% free.

Are Kemira Oyj Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One gleaming positive for Kemira Oyj, in the last year, is that a certain insider has buying shares with ample enthusiasm. Indeed, Vice Chairman of the Board Annika Paasikivi has accumulated shares over the last year, paying a total of €25m at an average price of about €16.20. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

Along with the insider buying, another encouraging sign for Kemira Oyj is that insiders, as a group, have a considerable shareholding. Given insiders own a significant chunk of shares, currently valued at €47m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Is Kemira Oyj Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Kemira Oyj's strong EPS growth. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. So it's fair to say that this stock may well deserve a spot on your watchlist. Before you take the next step you should know about the 1 warning sign for Kemira Oyj that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Kemira Oyj, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kemira Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:KEMIRA

Kemira Oyj

Operates as a chemicals company in Finland, rest of Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives