Huhtamäki Oyj (HEL:HUH1V) Has Announced That It Will Be Increasing Its Dividend To €0.50

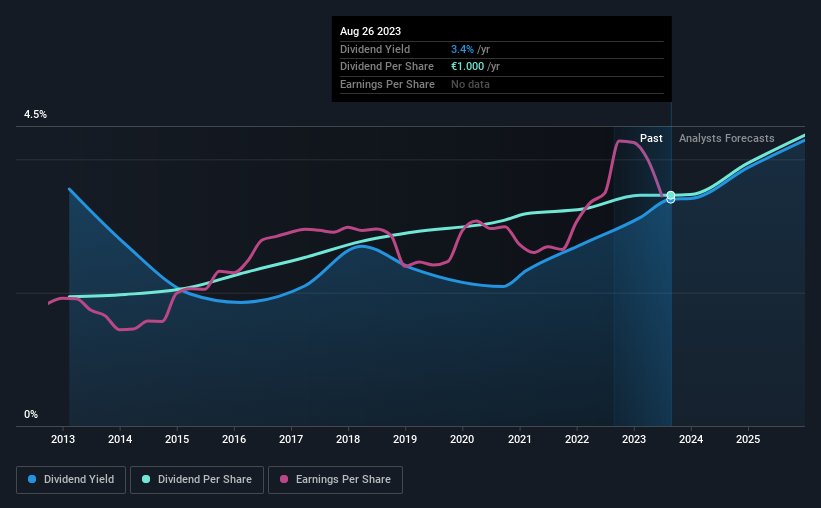

The board of Huhtamäki Oyj (HEL:HUH1V) has announced that it will be paying its dividend of €0.50 on the 9th of October, an increased payment from last year's comparable dividend. Based on this payment, the dividend yield for the company will be 3.4%, which is fairly typical for the industry.

Check out our latest analysis for Huhtamäki Oyj

Huhtamäki Oyj's Dividend Is Well Covered By Earnings

Solid dividend yields are great, but they only really help us if the payment is sustainable. Prior to this announcement, Huhtamäki Oyj was quite comfortably covering its dividend with earnings and it was paying more than 75% of its free cash flow to shareholders. The business is earning enough to make the dividend feasible, but the cash payout ratio of 75% indicates it is more focused on returning cash to shareholders than growing the business.

The next year is set to see EPS grow by 31.5%. If the dividend continues on this path, the payout ratio could be 38% by next year, which we think can be pretty sustainable going forward.

Huhtamäki Oyj Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2013, the annual payment back then was €0.56, compared to the most recent full-year payment of €1.00. This works out to be a compound annual growth rate (CAGR) of approximately 6.0% a year over that time. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Huhtamäki Oyj May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Earnings have grown at around 3.1% a year for the past five years, which isn't massive but still better than seeing them shrink. Huhtamäki Oyj is struggling to find viable investments, so it is returning more to shareholders. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

Our Thoughts On Huhtamäki Oyj's Dividend

Overall, we always like to see the dividend being raised, but we don't think Huhtamäki Oyj will make a great income stock. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Huhtamäki Oyj has been making. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for Huhtamäki Oyj that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Huhtamäki Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:HUH1V

Huhtamäki Oyj

Provides packaging solutions in the United States, Germany, the United Kingdom, India, Turkey, Australia, Thailand, Poland, South Africa, Spain, Finland, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026