- Hong Kong

- /

- Real Estate

- /

- SEHK:28

3 Excellent Dividend Stocks Yielding Up To 6%

Reviewed by Simply Wall St

As global markets show signs of recovery with major U.S. indexes approaching record highs, investors are increasingly focusing on stable income sources amid geopolitical uncertainties and economic shifts. In this context, dividend stocks offering yields up to 6% can be attractive for those seeking consistent returns; such stocks typically exhibit strong fundamentals and a history of reliable payouts, making them a potential consideration in today's dynamic market environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.34% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.55% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.29% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.64% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.42% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

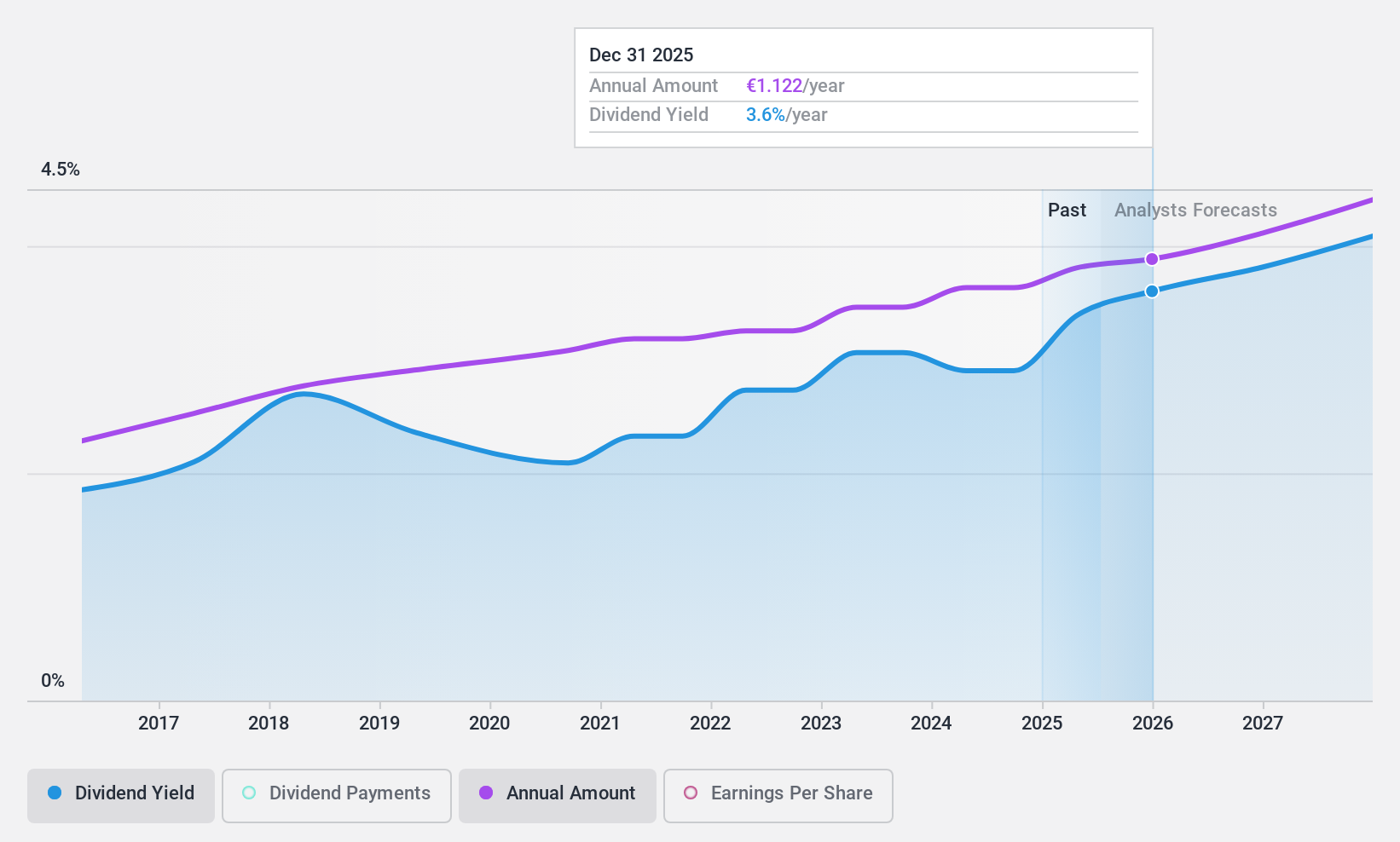

Huhtamäki Oyj (HLSE:HUH1V)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Huhtamäki Oyj is a global provider of packaging solutions operating in countries including the United States, Germany, and India, with a market cap of €3.56 billion.

Operations: Huhtamäki Oyj generates its revenue primarily from North America (€1.45 billion), Flexible Packaging (€1.31 billion), Foodservice Europe-Asia-Oceania (€990.60 million), and Fiber Packaging (€353.50 million).

Dividend Yield: 3.1%

Huhtamäki Oyj offers a reliable dividend yield of 3.09%, though it falls short compared to top Finnish dividend payers. Its dividends are well-covered by earnings and cash flows, with a payout ratio of 44.4% and cash payout ratio of 55.7%. Despite high debt levels, the company trades at a significant discount to its estimated fair value and has shown robust earnings growth recently. Recent refinancing efforts include a €450 million sustainability-linked credit facility, enhancing financial flexibility.

- Dive into the specifics of Huhtamäki Oyj here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Huhtamäki Oyj shares in the market.

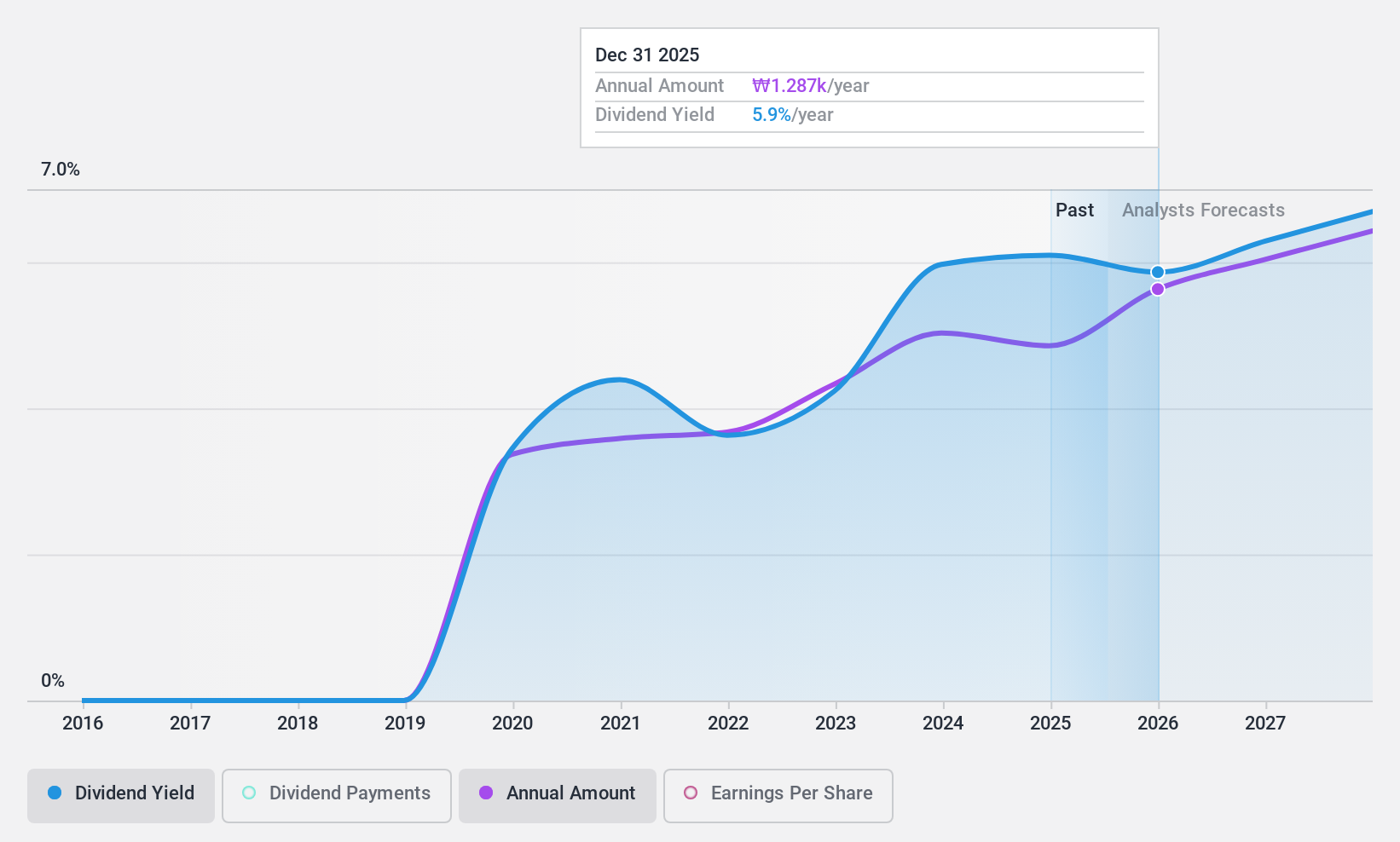

Cheil Worldwide (KOSE:A030000)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cheil Worldwide Inc. offers a range of marketing solutions globally and has a market cap of approximately ₩1.85 trillion.

Operations: Cheil Worldwide Inc.'s revenue is primarily derived from its diverse marketing solutions offered across global markets.

Dividend Yield: 6.1%

Cheil Worldwide offers a strong dividend yield of 6.08%, placing it in the top 25% of Korean dividend payers. The company's dividends are covered by both earnings and cash flows, with payout ratios of 60.2% and 81.4%, respectively, indicating sustainability. While dividends have been stable and growing, Cheil has only a five-year history of payments. Trading at 71% below its estimated fair value, the stock is considered undervalued with positive growth forecasts for earnings.

- Unlock comprehensive insights into our analysis of Cheil Worldwide stock in this dividend report.

- Our valuation report unveils the possibility Cheil Worldwide's shares may be trading at a discount.

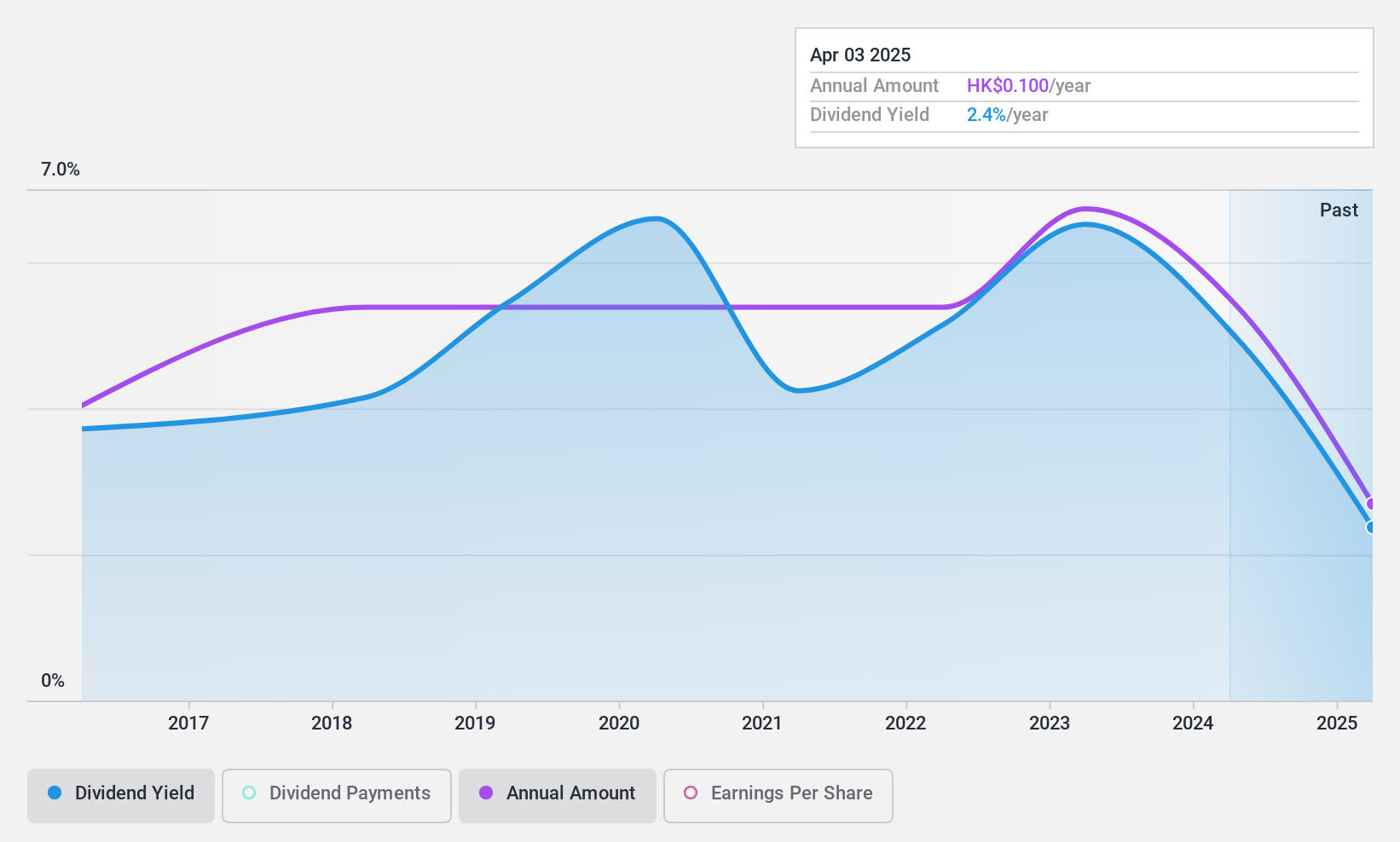

Tian An China Investments (SEHK:28)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia with a market capitalization of HK$5.57 billion.

Operations: Tian An China Investments Company Limited generates revenue primarily through its Property Development segment, contributing HK$1.10 billion, and its Property Investment segment, contributing HK$581.17 million.

Dividend Yield: 5.3%

Tian An China Investments provides a reliable dividend yield of 5.26%, though it falls short of the top 25% in Hong Kong. Dividends are well covered by earnings and cash flows, with payout ratios around 41%, suggesting sustainability. Over the past decade, dividends have been stable and growing with little volatility. The stock is trading at a discount of 21.8% to its estimated fair value, potentially offering good value for investors seeking income stability.

- Take a closer look at Tian An China Investments' potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Tian An China Investments is trading behind its estimated value.

Taking Advantage

- Embark on your investment journey to our 1981 Top Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tian An China Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:28

Tian An China Investments

An investment holding company, invests in, develops, and manages properties in the People's Republic of China, Hong Kong, and the United Kingdom.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives