- Sweden

- /

- Communications

- /

- OM:NETI B

Betolar Oyj And 2 Other European Penny Stocks With Promising Potential

Reviewed by Simply Wall St

The European market has shown resilience, with major stock indexes like the STOXX Europe 600 and Germany's DAX posting gains, reflecting a broader trend of economic recovery and consumer confidence. In such an environment, investors often look towards smaller or newer companies that might offer both affordability and growth potential. The term 'penny stocks' may seem outdated, but these stocks can still represent significant opportunities for those who focus on companies with strong financials and clear growth paths.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.11 | €16.49M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.99 | €27.5M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.69 | DKK118.83M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.95 | €76.66M | ✅ 2 ⚠️ 4 View Analysis > |

| Faes Farma (BME:FAE) | €4.46 | €1.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0794 | €8.39M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.908 | €30.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 275 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Betolar Oyj (HLSE:BETOLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Betolar Oyj is a materials technology company that develops solutions for utilizing industrial sidestreams to create low-carbon and cement-free products for the mining, metals, and construction sectors across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of €28.04 million.

Operations: Betolar Oyj generates its revenue primarily from the construction materials segment, amounting to €0.90 million.

Market Cap: €28.04M

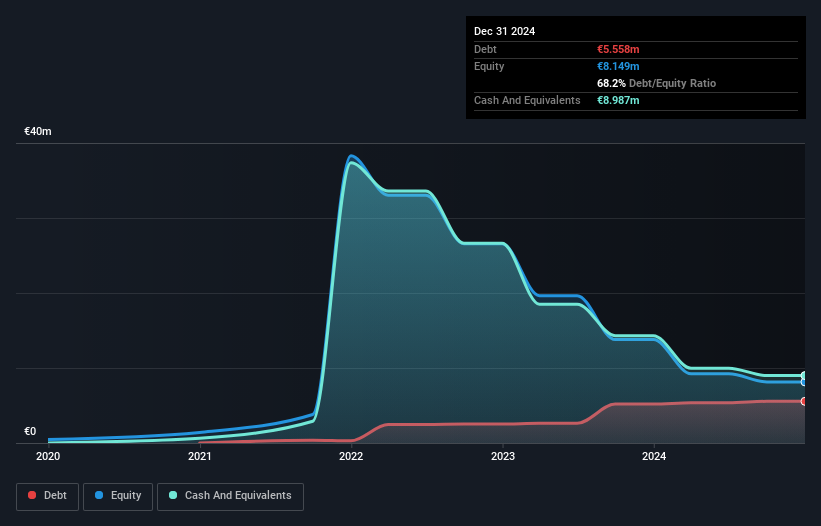

Betolar Oyj, a materials technology company, is navigating the penny stock landscape with a market cap of €28.04 million and limited revenue of €0.90 million, indicating it is pre-revenue. Recent developments include securing an order worth €1.4 million for an infrastructure project in Finland and strategic alliances aimed at commercializing sustainable construction solutions globally. Despite its innovative initiatives, Betolar remains unprofitable with increasing losses over the past five years and high volatility in share price. The company has sufficient cash runway for 1.7 years but faces challenges due to its inexperienced management team and high debt-to-equity ratio.

- Click here to discover the nuances of Betolar Oyj with our detailed analytical financial health report.

- Gain insights into Betolar Oyj's future direction by reviewing our growth report.

Net Insight (OM:NETI B)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Net Insight AB (publ) offers media network solutions globally and has a market cap of SEK1.32 billion.

Operations: The company's revenue from Media Networks amounts to SEK546.59 million.

Market Cap: SEK1.32B

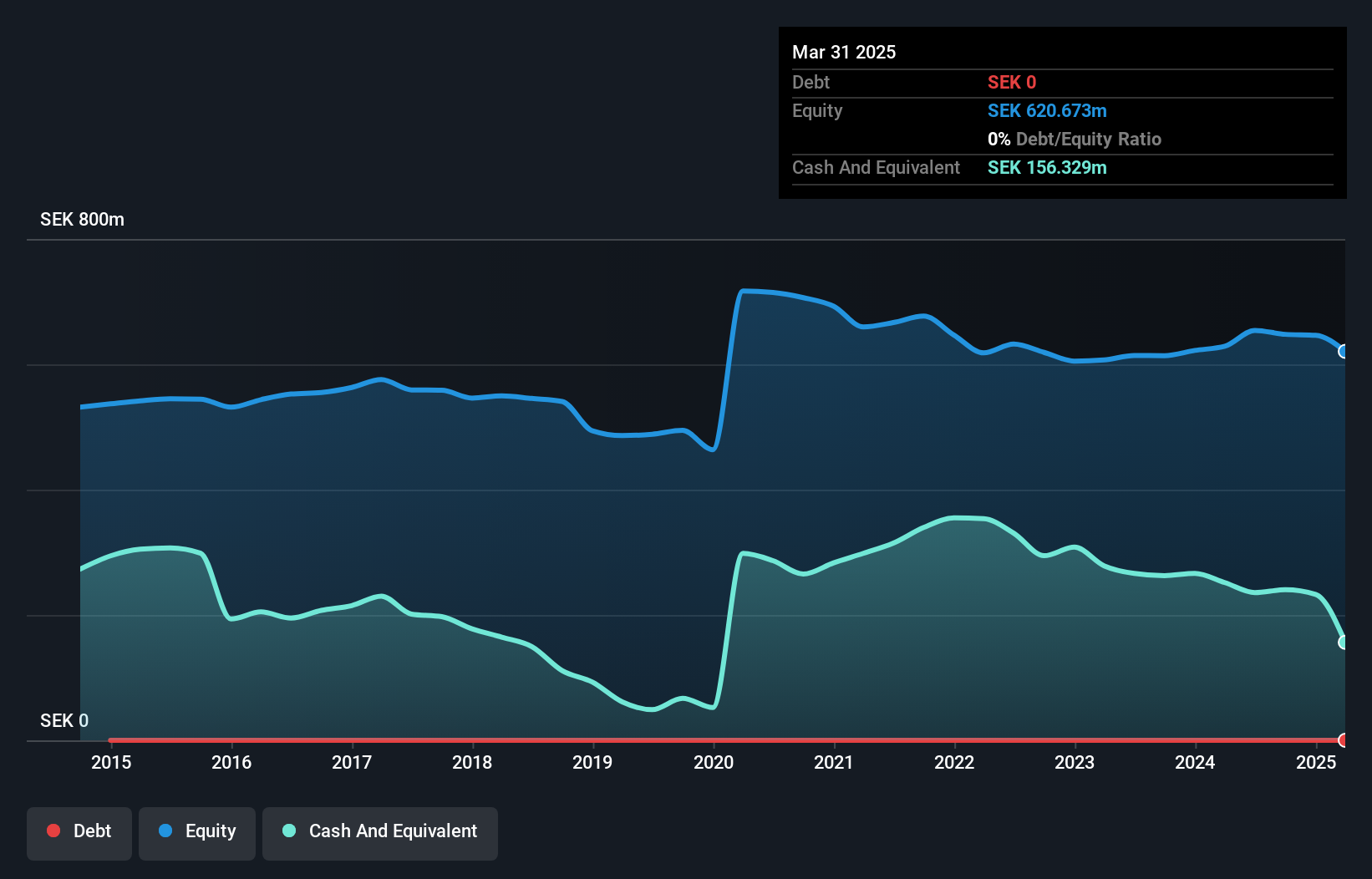

Net Insight AB, with a market cap of SEK1.32 billion, is navigating the penny stock terrain by leveraging its media network solutions. The company has shown profitability growth over the past five years and maintains a debt-free balance sheet, with short-term assets covering both short- and long-term liabilities. Recent strategic product launches enhance its Nimbra platform's IP-flexibility and 400G capabilities, aligning with industry trends toward IP-based workflows in live sports broadcasting. However, recent management changes suggest potential instability at the executive level despite the company's technical advancements supporting continued development in media networks.

- Dive into the specifics of Net Insight here with our thorough balance sheet health report.

- Assess Net Insight's future earnings estimates with our detailed growth reports.

Molecular Partners (SWX:MOLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Molecular Partners AG is a clinical-stage biotechnology company focused on developing ankyrin repeat protein therapeutics for oncology treatments in Switzerland, with a market cap of CHF108.81 million.

Operations: Molecular Partners AG has not reported any specific revenue segments.

Market Cap: CHF108.81M

Molecular Partners AG, with a market cap of CHF108.81 million, is navigating the penny stock landscape as a pre-revenue biotech firm focused on oncology therapeutics. Despite its unprofitability and increasing losses, the company benefits from being debt-free and having sufficient cash runway for over two years based on current free cash flow trends. The recent appointment of Martin Steegmaier as Chief Scientific Officer adds significant expertise in oncology drug development to the management team. However, investors should be mindful of its highly volatile share price and negative return on equity amid ongoing financial challenges.

- Click to explore a detailed breakdown of our findings in Molecular Partners' financial health report.

- Examine Molecular Partners' earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Dive into all 275 of the European Penny Stocks we have identified here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Net Insight might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:NETI B

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives