- Finland

- /

- Healthcare Services

- /

- HLSE:ORIOLA

European Penny Stocks To Watch With Market Caps Over €30M

Reviewed by Simply Wall St

The European market has recently seen mixed performances across its major indices, with the pan-European STOXX Europe 600 Index edging slightly higher amid dovish signals from U.S. Fed Chair Jerome Powell and easing U.S.-China trade tensions. For investors looking beyond established giants, penny stocks—often representing smaller or newer companies—remain an area of interest despite their historical connotations. In this article, we explore three European penny stocks that exhibit strong financial health and potential for growth, offering intriguing opportunities for those willing to explore underappreciated segments of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.19M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €2.01 | €26.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €227.2M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.55 | DKK115.8M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.53 | €38.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.965 | €77.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Faes Farma (BME:FAE) | €4.50 | €1.4B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.035 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0786 | €8.46M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Lhyfe (ENXTPA:LHYFE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Lhyfe SA produces and supplies renewable green hydrogen for mobility and industry markets, with a market cap of €147.55 million.

Operations: The company's revenue segment is derived entirely from Oil & Gas - Exploration & Production, amounting to €8.07 million.

Market Cap: €147.55M

Lhyfe SA, with a market cap of €147.55 million, is an emerging player in the renewable green hydrogen sector. Despite being unprofitable and facing increased losses over the past five years, its revenue for H1 2025 rose to €4.64 million from €1.67 million a year ago, indicating significant growth potential. The company has achieved RFNBO certification across its four production sites in France and Germany, enhancing its credibility and positioning it as Europe's largest producer of RFNBO hydrogen by installed capacity. Lhyfe's robust regional coverage and modern container fleet further strengthen its distribution network across Europe.

- Jump into the full analysis health report here for a deeper understanding of Lhyfe.

- Learn about Lhyfe's future growth trajectory here.

Oriola Oyj (HLSE:ORIOLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oriola Oyj operates in the wholesale distribution of pharmaceuticals and health products across Sweden, Finland, and internationally, with a market cap of €206.73 million.

Operations: The company's revenue is primarily derived from its Distribution segment, which accounts for €1.47 billion, followed by the Wholesale segment contributing €337 million.

Market Cap: €206.73M

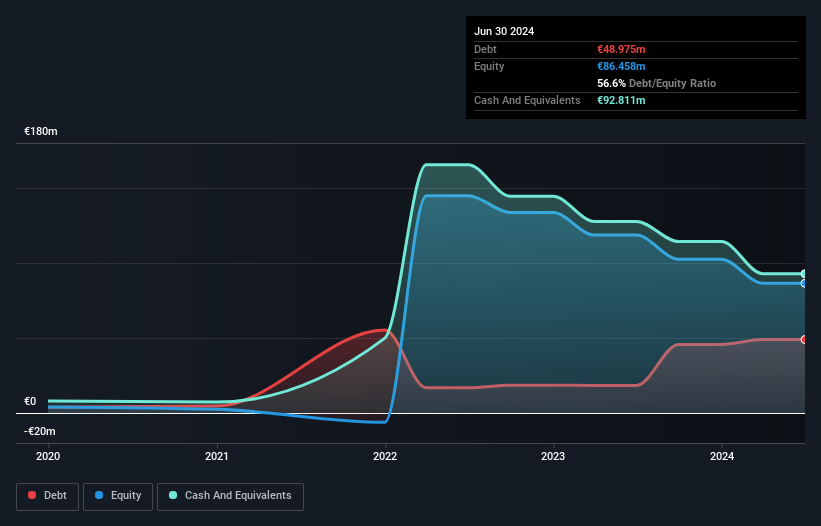

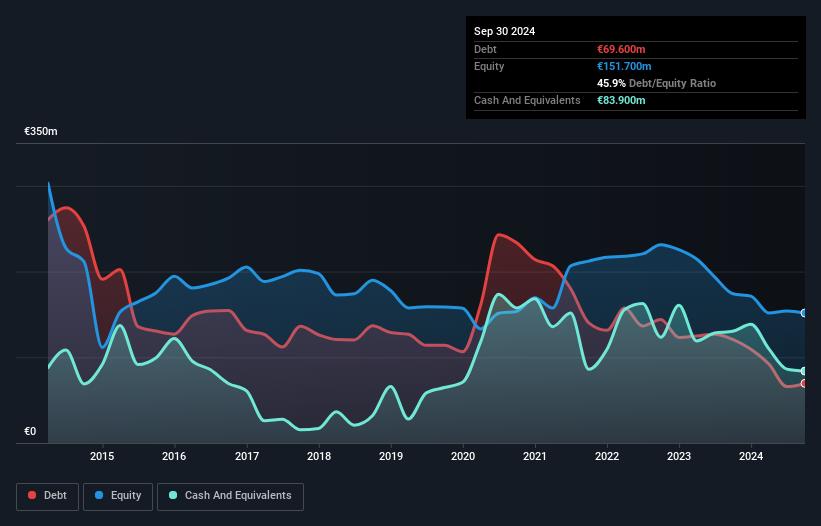

Oriola Oyj, with a market cap of €206.73 million, operates in pharmaceutical distribution across Sweden and Finland. Despite being unprofitable, Oriola's Distribution segment generates substantial revenue of €1.47 billion annually. The company has more cash than its total debt, and its interest payments are well-covered by EBIT at 3.1x coverage. However, short-term liabilities exceed short-term assets by €140 million, presenting a liquidity challenge. Recent management changes include the appointment of Maria Lundell as Chief People Officer starting November 2025, indicating ongoing leadership restructuring to potentially improve operational efficiency and strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Oriola Oyj.

- Evaluate Oriola Oyj's prospects by accessing our earnings growth report.

Atende (WSE:ATD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Atende S.A. is a company that specializes in the integration of IT systems in Poland, with a market capitalization of PLN135.56 million.

Operations: The company's revenue is primarily derived from the integration of Atende ICT systems, including technical infrastructure, amounting to PLN318.46 million, and the integration of tele-information systems of subsidiary entities contributing PLN49.85 million.

Market Cap: PLN135.56M

Atende S.A., with a market cap of PLN135.56 million, focuses on IT system integration in Poland. The company generated PLN318.46 million from Atende ICT systems and PLN49.85 million from its subsidiaries' tele-information systems, showcasing solid revenue streams despite facing challenges like declining earnings growth over the past five years and low return on equity at -12.3%. While short-term assets exceed both short-term and long-term liabilities, indicating financial stability, profit margins have decreased to 0.1% from 1.2% last year, raising concerns about profitability sustainability amidst stable weekly volatility and experienced management tenure averaging 8 years.

- Navigate through the intricacies of Atende with our comprehensive balance sheet health report here.

- Understand Atende's track record by examining our performance history report.

Where To Now?

- Unlock our comprehensive list of 277 European Penny Stocks by clicking here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ORIOLA

Oriola Oyj

Engages in the wholesale of pharmaceuticals and health products in Sweden, Finland, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives