The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Nexstim Plc (HEL:NXTMH) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Nexstim

How Much Debt Does Nexstim Carry?

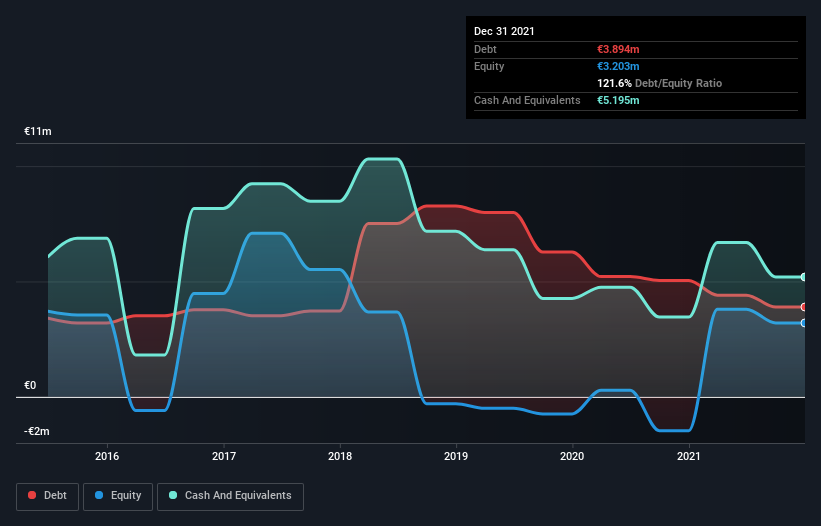

The image below, which you can click on for greater detail, shows that Nexstim had debt of €3.89m at the end of December 2021, a reduction from €5.04m over a year. However, it does have €5.19m in cash offsetting this, leading to net cash of €1.30m.

A Look At Nexstim's Liabilities

The latest balance sheet data shows that Nexstim had liabilities of €3.56m due within a year, and liabilities of €3.27m falling due after that. Offsetting this, it had €5.19m in cash and €1.65m in receivables that were due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Nexstim's balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the €29.8m company is short on cash, but still worth keeping an eye on the balance sheet. Simply put, the fact that Nexstim has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Nexstim can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Nexstim wasn't profitable at an EBIT level, but managed to grow its revenue by 81%, to €7.6m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Nexstim?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Nexstim had an earnings before interest and tax (EBIT) loss, over the last year. And over the same period it saw negative free cash outflow of €3.7m and booked a €832k accounting loss. With only €1.30m on the balance sheet, it would appear that its going to need to raise capital again soon. Nexstim's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Nexstim that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Nexstim might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:NXTMH

Nexstim

A medical technology company, engages in the development of non-invasive brain stimulation technologies in Finland, rest of Europe, North America, and internationally.

High growth potential with excellent balance sheet.