- Spain

- /

- Real Estate

- /

- BME:LIB

European Market Insights: Libertas 7 And Two Other Promising Penny Stocks

Reviewed by Simply Wall St

As the European markets continue to ride a wave of optimism, with the STOXX Europe 600 Index marking its longest streak of weekly gains since August 2012, investors are increasingly looking for opportunities in less conventional areas. Penny stocks, often smaller or newer companies, present an intriguing opportunity for growth at lower price points despite being considered a somewhat outdated term. This article will explore several promising penny stocks that stand out for their financial strength and potential to offer value beyond traditional investment avenues.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.82 | SEK286.44M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.135 | €295.47M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK3.98 | SEK242.14M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.19 | SEK207.01M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.72 | €53.43M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.996 | €33.35M | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.02 | SEK1.93B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.40 | €24.25M | ★★★★★☆ |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €1.03 | €82.97M | ★★★★★☆ |

| Arcure (ENXTPA:ALCUR) | €4.82 | €27.87M | ★★★★☆☆ |

Click here to see the full list of 435 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Libertas 7 (BME:LIB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Libertas 7, S.A. operates in the real estate and investment sectors in Spain with a market cap of €36.82 million.

Operations: Libertas 7, S.A. does not have any reported revenue segments.

Market Cap: €36.82M

Libertas 7, S.A., with a market cap of €36.82 million, operates in the real estate sector and recently reported annual sales of €5.5 million, up from €4.81 million the previous year. Despite achieving profitability over the past five years with earnings growth of 39.7% annually, recent negative earnings growth poses challenges against industry averages. The company benefits from a seasoned board and reduced debt levels over time; however, its dividend coverage is weak and return on equity remains low at 2.2%. Additionally, while short-term assets exceed liabilities comfortably, share price volatility persists alongside high weekly volatility compared to peers.

- Click to explore a detailed breakdown of our findings in Libertas 7's financial health report.

- Gain insights into Libertas 7's past trends and performance with our report on the company's historical track record.

Afarak Group (HLSE:AFAGR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Afarak Group SE is involved in the extraction, processing, marketing, and trading of specialized metals across Finland, other EU countries, the United States, China, Africa, and internationally with a market cap of €84.17 million.

Operations: Afarak Group SE has not reported any specific revenue segments.

Market Cap: €84.17M

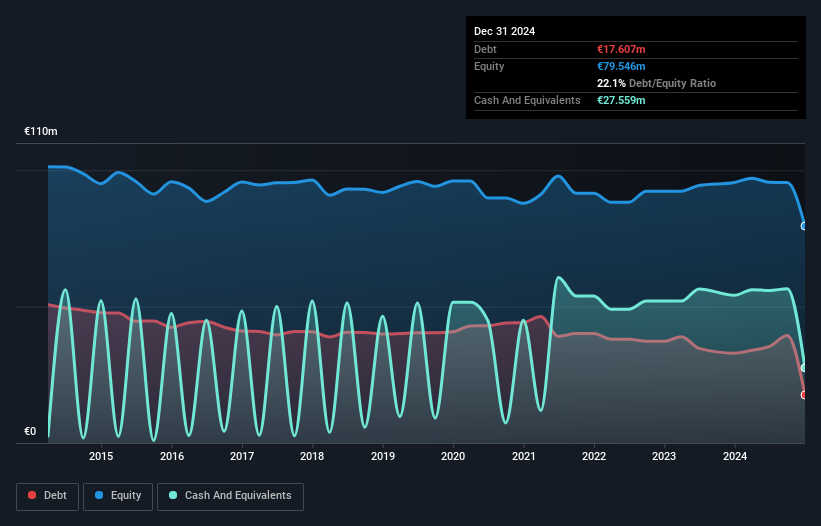

Afarak Group SE, with a market cap of €84.17 million, operates in the metals sector and faces challenges typical of penny stocks. Despite being debt-free and having short-term assets (€57.8M) that exceed both its short-term (€17.9M) and long-term liabilities (€31.7M), the company is currently unprofitable with a net loss of €7.57 million for 2024, down from a net income the previous year. Its share price remains highly volatile, although weekly volatility has stabilized somewhat over the past year. The board is experienced; however, management's tenure suggests recent changes in leadership dynamics might impact strategic direction.

- Click here and access our complete financial health analysis report to understand the dynamics of Afarak Group.

- Explore historical data to track Afarak Group's performance over time in our past results report.

Nightingale Health Oyj (HLSE:HEALTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nightingale Health Oyj is a health technology company that provides a health data platform for detecting disease risks across Finland, the United Kingdom, Europe, the United States, and internationally; it has a market cap of €164.14 million.

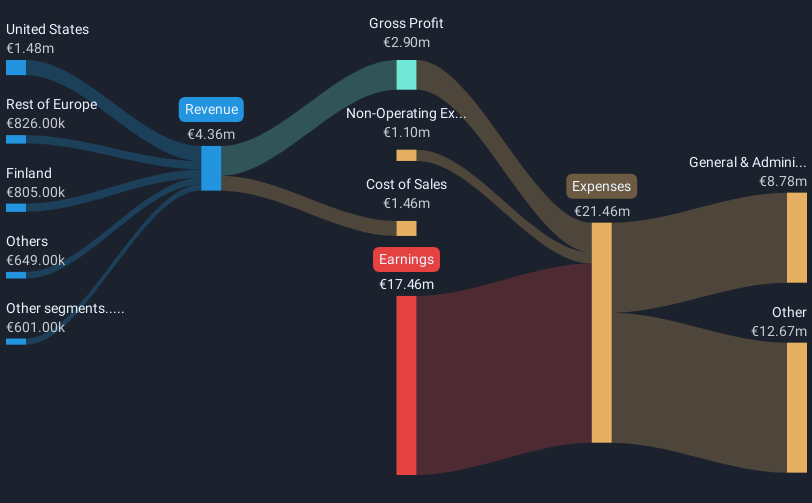

Operations: The company's revenue is generated from its Medical Labs & Research segment, amounting to €4.36 million.

Market Cap: €164.14M

Nightingale Health Oyj, with a market cap of €164.14 million, is navigating the complexities typical of penny stocks in the health technology sector. Despite being unprofitable and lacking meaningful revenue (€4.36M), it has a strong financial position with short-term assets (€68.4M) exceeding liabilities and sufficient cash runway for over three years. The company is expanding internationally, notably establishing a laboratory in New York to circumvent FDA premarket review requirements until 2027, enhancing its U.S. entry strategy. Additionally, Nightingale's innovative LLM-based tool aims to personalize health insights from blood tests, potentially broadening consumer engagement globally.

- Jump into the full analysis health report here for a deeper understanding of Nightingale Health Oyj.

- Understand Nightingale Health Oyj's earnings outlook by examining our growth report.

Key Takeaways

- Discover the full array of 435 European Penny Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:LIB

Libertas 7

Engages in the real estate and investment businesses in Spain.

Adequate balance sheet slight.

Market Insights

Community Narratives