Discover 3 European Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As European markets navigate a complex landscape of mixed stock index performances and cautious monetary policy decisions, investors are increasingly focused on identifying opportunities that align with current economic conditions. In this environment, growth companies with strong insider ownership can offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

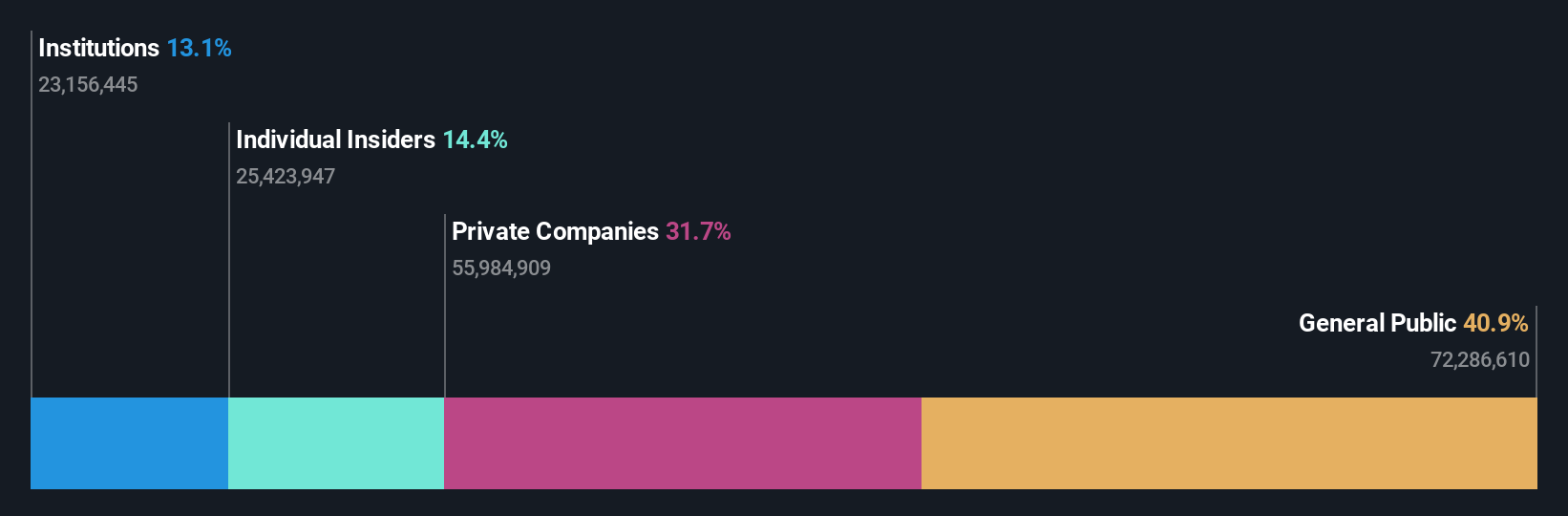

| Xbrane Biopharma (OM:XBRANE) | 13.1% | 112.0% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 91.4% |

| KebNi (OM:KEBNI B) | 38% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 64.6% |

Let's dive into some prime choices out of the screener.

CapMan Oyj (HLSE:CAPMAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CapMan Oyj is a Nordic private assets management and investment firm specializing in growth capital, industry consolidation, special situations, and more, with a market cap of €318 million.

Operations: CapMan Oyj generates revenue through its activities in private equity and venture capital, focusing on growth capital investments, industry consolidation, special situations, turnaround opportunities, recapitalization, middle market buyouts, credit and mezzanine financing for unquoted companies; as well as value-add and income-focused real estate investments and ventures in transportation infrastructure and small to mid-cap companies.

Insider Ownership: 14.9%

CapMan Oyj's growth potential is reflected in its significant insider buying over the past three months, indicating confidence in future prospects. Despite a forecasted revenue growth of 11% annually, which surpasses the Finnish market average, its Return on Equity is expected to remain low at 14.2%. Recent financials show a decline in net income and earnings per share compared to last year. CapMan announced a special dividend of €0.07 per share amid ongoing M&A discussions regarding its stake in Valokuitunen Oy.

- Unlock comprehensive insights into our analysis of CapMan Oyj stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of CapMan Oyj shares in the market.

MilDef Group (OM:MILDEF)

Simply Wall St Growth Rating: ★★★★★☆

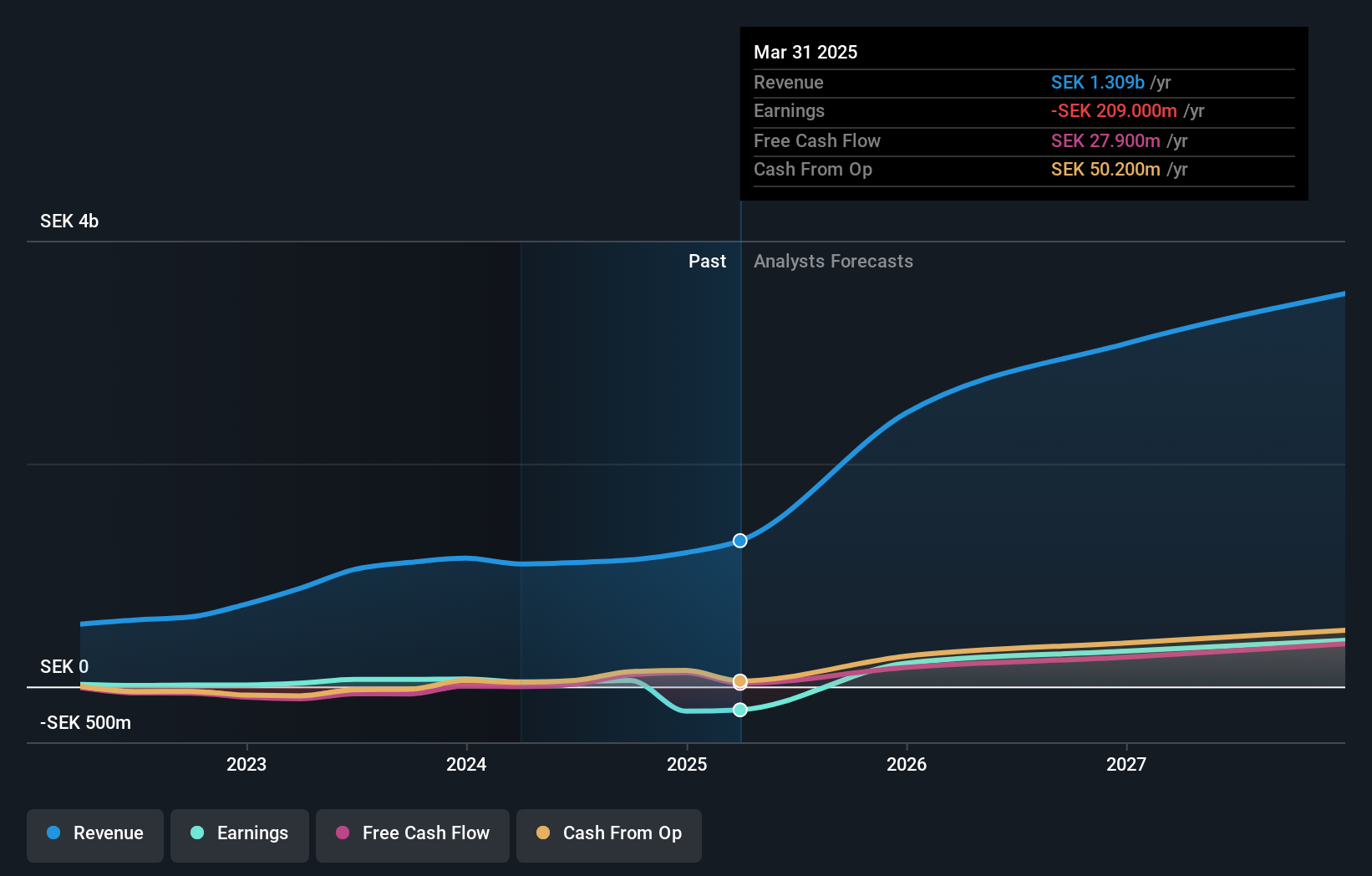

Overview: MilDef Group AB, along with its subsidiaries, develops, manufactures, and sells rugged IT solutions across several countries including Sweden, Norway, and the United States; it has a market cap of approximately SEK9.51 billion.

Operations: The company's revenue from its rugged IT solutions, specifically in the Computer Hardware segment, amounts to SEK1.39 billion.

Insider Ownership: 13.7%

MilDef Group's growth trajectory is underscored by high insider ownership and recent insider buying, albeit modest in volume. The company is trading at 17% below its estimated fair value, with revenue expected to grow at 29.9% annually, outpacing the Swedish market. However, shareholders experienced dilution last year. MilDef's strategic focus includes M&A activities and a share repurchase program to support its LTIP 2025/2028 initiative, indicating a commitment to long-term growth strategies.

- Delve into the full analysis future growth report here for a deeper understanding of MilDef Group.

- Upon reviewing our latest valuation report, MilDef Group's share price might be too pessimistic.

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation globally and has a market cap of €520.39 million.

Operations: The company generates revenue of €292.95 million from its Wireless Communications Equipment segment, focusing on intelligent transportation solutions for the public transit sector worldwide.

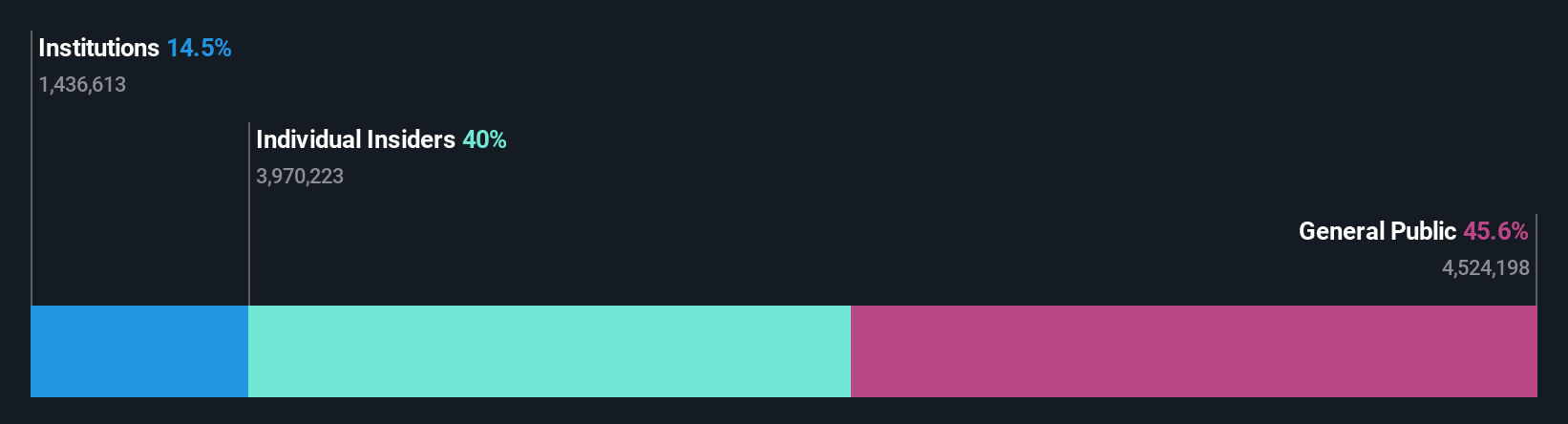

Insider Ownership: 40%

init innovation in traffic systems demonstrates strong growth potential with earnings forecasted to grow significantly at 31.2% annually, outpacing the German market. Despite a recent decline in profit margins, the company has raised its revenue guidance for 2025 due to increased project funding from MARTA, expecting EUR 340-370 million in revenue. While insider trading activity is not substantial recently, high insider ownership aligns management interests with shareholders and supports long-term growth prospects.

- Click here and access our complete growth analysis report to understand the dynamics of init innovation in traffic systems.

- Upon reviewing our latest valuation report, init innovation in traffic systems' share price might be too optimistic.

Where To Now?

- Click here to access our complete index of 216 Fast Growing European Companies With High Insider Ownership.

- Curious About Other Options? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if init innovation in traffic systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:IXX

init innovation in traffic systems

Engages in the provision of intelligent transportation systems solutions for public transportation worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives