- Sweden

- /

- Medical Equipment

- /

- OM:SUS

CapMan Oyj And 2 Other Stocks Estimated To Be Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing value shares. In this environment, identifying undervalued stocks can be a strategic approach for investors looking to capitalize on potential discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.66 | US$36.99 | 49.6% |

| Hancom (KOSDAQ:A030520) | ₩24650.00 | ₩49094.79 | 49.8% |

| Nuvoton Technology (TWSE:4919) | NT$96.10 | NT$191.31 | 49.8% |

| Smurfit Westrock (NYSE:SW) | US$55.30 | US$109.74 | 49.6% |

| IDP Education (ASX:IEL) | A$12.12 | A$24.11 | 49.7% |

| Solum (KOSE:A248070) | ₩17610.00 | ₩34899.00 | 49.5% |

| Com2uS (KOSDAQ:A078340) | ₩48200.00 | ₩96034.26 | 49.8% |

| Saipem (BIT:SPM) | €2.341 | €4.67 | 49.8% |

| Likewise Group (AIM:LIKE) | £0.185 | £0.37 | 49.8% |

| Constellium (NYSE:CSTM) | US$9.24 | US$18.27 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

CapMan Oyj (HLSE:CAPMAN)

Overview: CapMan Oyj is a leading Nordic private assets management and investment firm specializing in growth capital, middle market buyouts, and infrastructure investments, with a market cap of €346.28 million.

Operations: CapMan Oyj generates revenue primarily through its Management Company Business, which accounts for €56.76 million, and its Service Business segment, contributing €0.27 million.

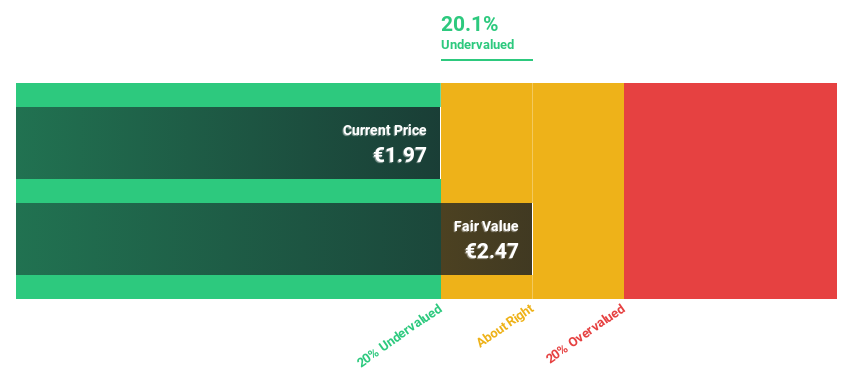

Estimated Discount To Fair Value: 19.4%

CapMan Oyj, trading at €1.96, is undervalued by 19.4% compared to its fair value of €2.43 based on discounted cash flow analysis. The company's earnings are expected to grow significantly at 29% annually over the next three years, outpacing the Finnish market's growth rate of 11.9%. However, despite strong revenue growth and a substantial increase in net income last year, dividend sustainability remains a concern due to insufficient coverage by earnings or free cash flows.

- Our growth report here indicates CapMan Oyj may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in CapMan Oyj's balance sheet health report.

Surgical Science Sweden (OM:SUS)

Overview: Surgical Science Sweden AB (publ) develops and markets virtual reality simulators for evidence-based medical training across Europe, the Americas, Asia, and other international markets, with a market cap of SEK9.63 billion.

Operations: The company's revenue is derived from two segments: Industry/OEM, generating SEK419.66 million, and Educational Products, contributing SEK440.17 million.

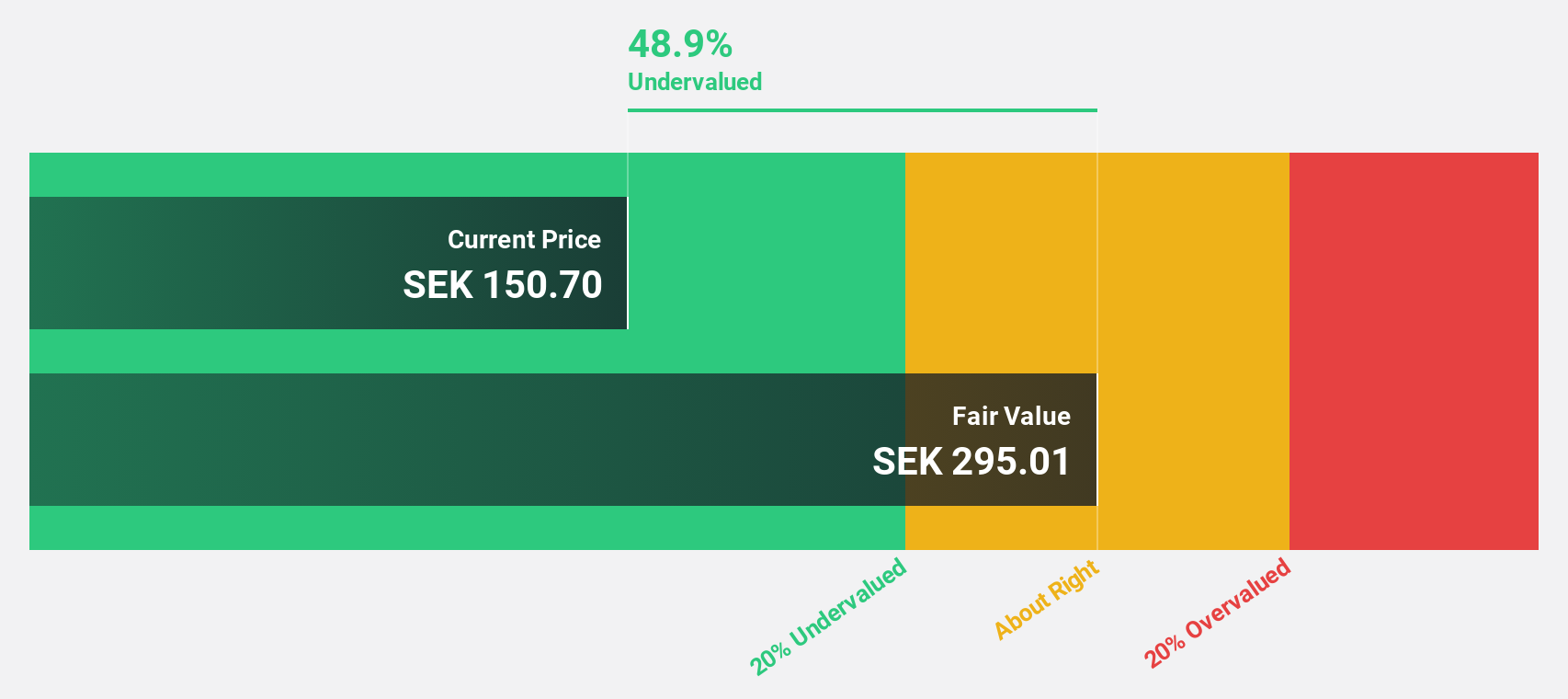

Estimated Discount To Fair Value: 38.9%

Surgical Science Sweden, trading at SEK 188.8, is undervalued by 38.9% against its fair value of SEK 308.96 based on discounted cash flow analysis. Recent collaborations, such as integrating simulation software with Intuitive's da Vinci systems and expanding into defense markets with a US$4.7 million order, bolster growth prospects. Despite a low future return on equity forecast of 6.4%, earnings are expected to grow significantly at over 32% annually, surpassing Swedish market averages.

- Insights from our recent growth report point to a promising forecast for Surgical Science Sweden's business outlook.

- Click here to discover the nuances of Surgical Science Sweden with our detailed financial health report.

West Holdings (TSE:1407)

Overview: West Holdings Corporation, along with its subsidiaries, operates in the renewable energy sector both in Japan and internationally, with a market cap of ¥69.72 billion.

Operations: The company's revenue segments include renewable energy operations both domestically and globally.

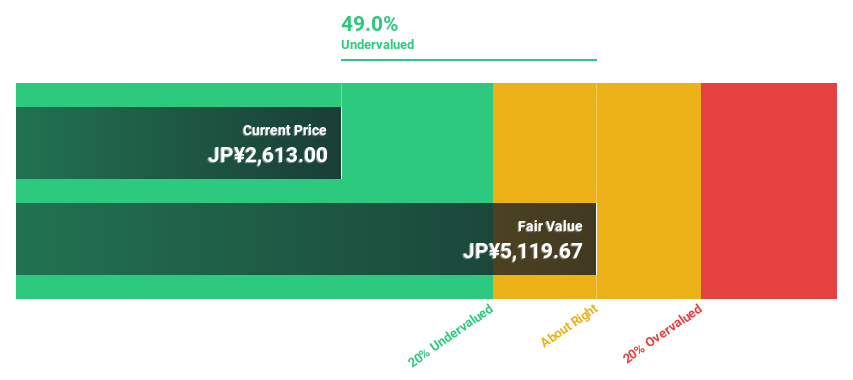

Estimated Discount To Fair Value: 38.3%

West Holdings, priced at ¥1758, is undervalued by over 20% compared to its fair value of ¥2847.77 according to discounted cash flow analysis. The company anticipates revenue growth of 12.6% annually, outpacing the Japanese market's 4.2%. However, its debt isn't well covered by operating cash flow and a volatile share price has been observed recently. Earnings are projected to grow at 14.9% per year, exceeding market averages but dividends remain inadequately covered by free cash flows.

- The growth report we've compiled suggests that West Holdings' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of West Holdings.

Where To Now?

- Embark on your investment journey to our 924 Undervalued Stocks Based On Cash Flows selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:SUS

Surgical Science Sweden

Develops and markets virtual reality simulators for evidence-based medical training in Europe, North and South America, Asia, and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives