- Finland

- /

- Consumer Durables

- /

- HLSE:YIT

Shareholders in YIT Oyj (HEL:YIT) have lost 41%, as stock drops 10% this past week

Ideally, your overall portfolio should beat the market average. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term YIT Oyj (HEL:YIT) shareholders for doubting their decision to hold, with the stock down 52% over a half decade. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

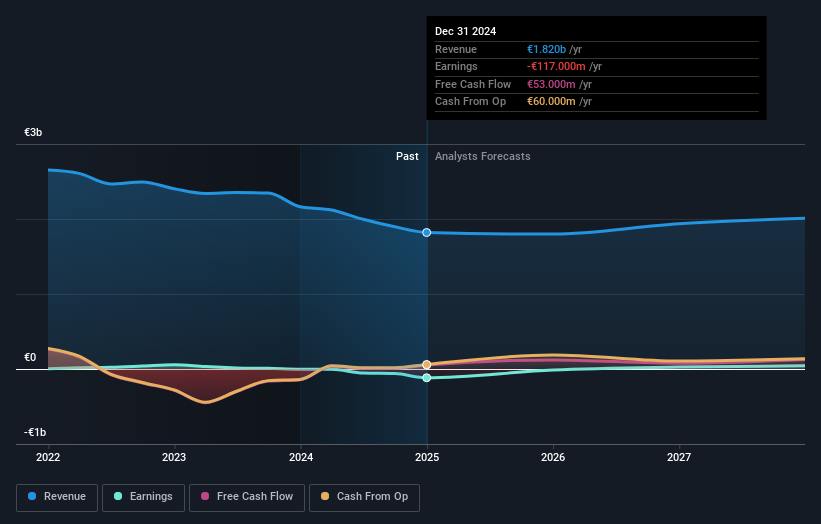

Given that YIT Oyj didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years YIT Oyj saw its revenue shrink by 12% per year. That's definitely a weaker result than most pre-profit companies report. It seems appropriate, then, that the share price slid about 9% annually during that time. We don't generally like to own companies that lose money and don't grow revenues. You might be better off spending your money on a leisure activity. You'd want to research this company pretty thoroughly before buying, it looks a bit too risky for us.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at YIT Oyj's financial health with this free report on its balance sheet .

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. Many would argue the TSR gives a more complete picture of the value a stock brings to its holders. YIT Oyj's TSR over the last 5 years is -41%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

It's nice to see that YIT Oyj shareholders have received a total shareholder return of 7.2% over the last year. Notably the five-year annualised TSR loss of 7% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for YIT Oyj that you should be aware of before investing here.

We will like YIT Oyj better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:YIT

YIT Oyj

Provides construction services in Finland, the Czech Republic, Slovakia, Poland, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives