As the European market navigates a mixed landscape, with the pan-European STOXX Europe 600 Index seeing modest gains amid easing U.S.-China trade tensions and dovish signals from the Federal Reserve, investors are keenly observing sectors that demonstrate resilience and potential for growth. In this environment, companies with high insider ownership often stand out as promising candidates; their alignment of interests can signal confidence in long-term prospects, making them attractive to those seeking stability and growth amidst economic fluctuations.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.4% |

| KebNi (OM:KEBNI B) | 36.3% | 74% |

| Elliptic Laboratories (OB:ELABS) | 22.5% | 97.9% |

| Egetis Therapeutics (OM:EGTX) | 10.3% | 85% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.1% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 41.6% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

We'll examine a selection from our screener results.

Moltiply Group (BIT:MOL)

Simply Wall St Growth Rating: ★★★★★☆

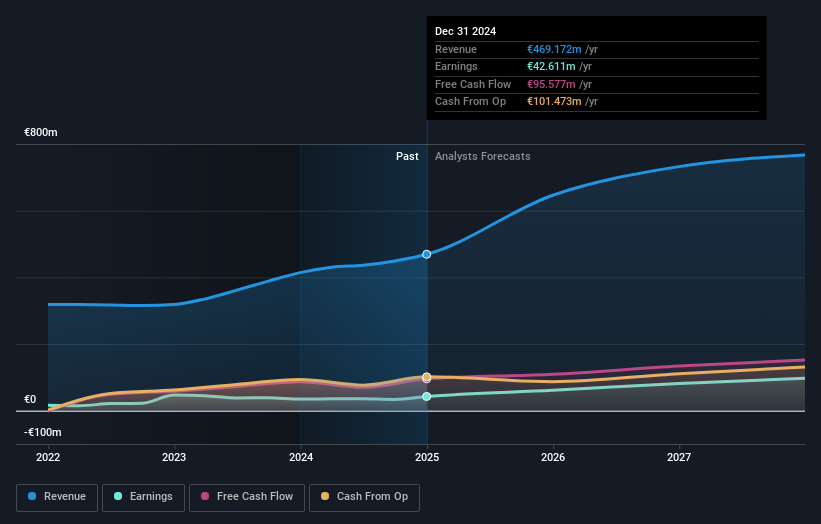

Overview: Moltiply Group S.p.A. is a holding company engaged in the financial services industry, with a market cap of €1.65 billion.

Operations: The company's revenue is derived from two main segments: the Mavriq Division, which generates €282.92 million, and Moltiply BPO&Tech, contributing €258.09 million.

Insider Ownership: 24.4%

Earnings Growth Forecast: 31% p.a.

Moltiply Group is poised for significant earnings growth, with forecasts suggesting a 31% annual increase over the next three years, outpacing the Italian market. Despite slower revenue growth at 13.4% annually, it surpasses the local market's 4.9%. Insider activity shows more buying than selling recently, indicating confidence in future prospects. However, operating cash flow does not adequately cover debt obligations. Recent earnings reported sales of €311.65 million and net income of €21.16 million for H1 2025.

- Unlock comprehensive insights into our analysis of Moltiply Group stock in this growth report.

- The analysis detailed in our Moltiply Group valuation report hints at an inflated share price compared to its estimated value.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

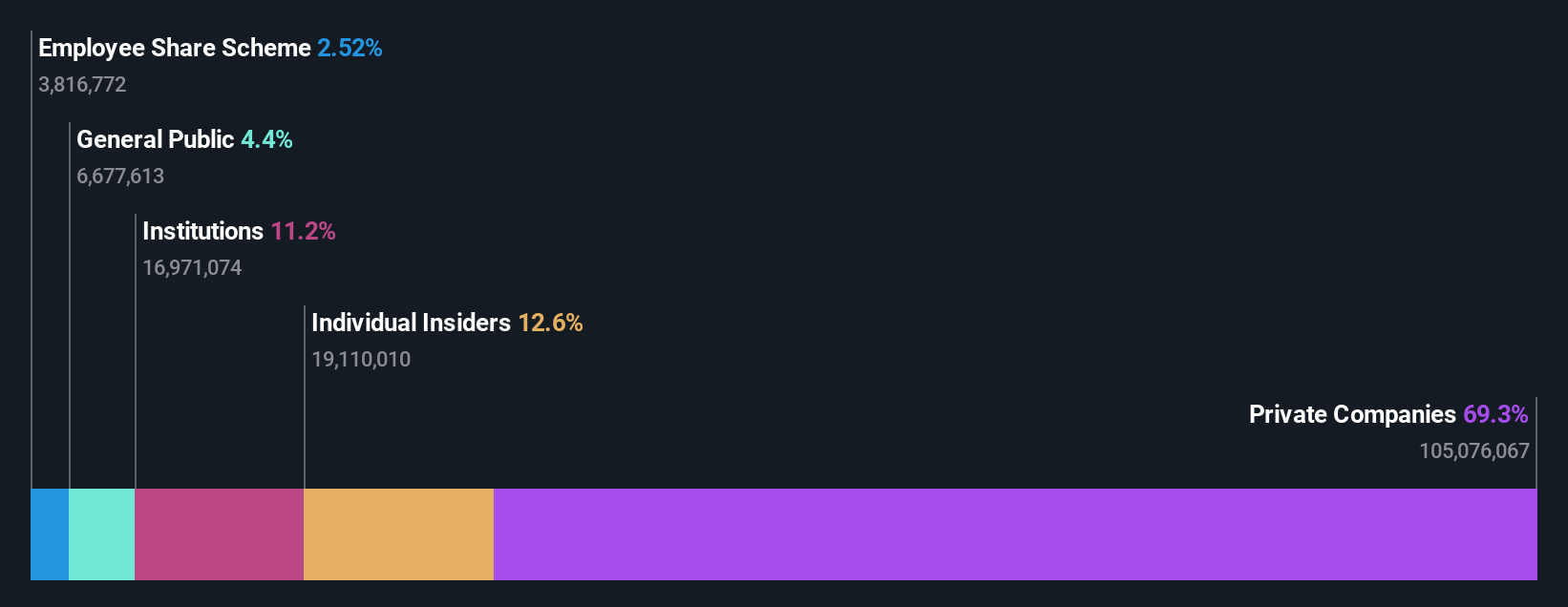

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions, with a market cap of approximately €1.70 billion.

Operations: The company's revenue is primarily generated from its Private Cloud segment at €655.28 million, followed by Public Cloud at €198.23 million, and Web Cloud & Other services at €189.46 million.

Insider Ownership: 12.6%

Earnings Growth Forecast: 65.2% p.a.

OVH Groupe's recent profitability marks a turnaround, with net income of €0.4 million for the year ending August 2025, compared to a previous loss. The company's strategic partnership with Bitdefender enhances its position in Europe's cloud market by offering advanced cybersecurity solutions. Revenue growth is forecasted at 9.1% annually, outpacing the French market's 5.5%. However, interest payments are not well covered by earnings, highlighting financial vulnerabilities despite high insider ownership and projected strong earnings growth of 65.2% annually.

- Dive into the specifics of OVH Groupe here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, OVH Groupe's share price might be too optimistic.

YIT Oyj (HLSE:YIT)

Simply Wall St Growth Rating: ★★★★☆☆

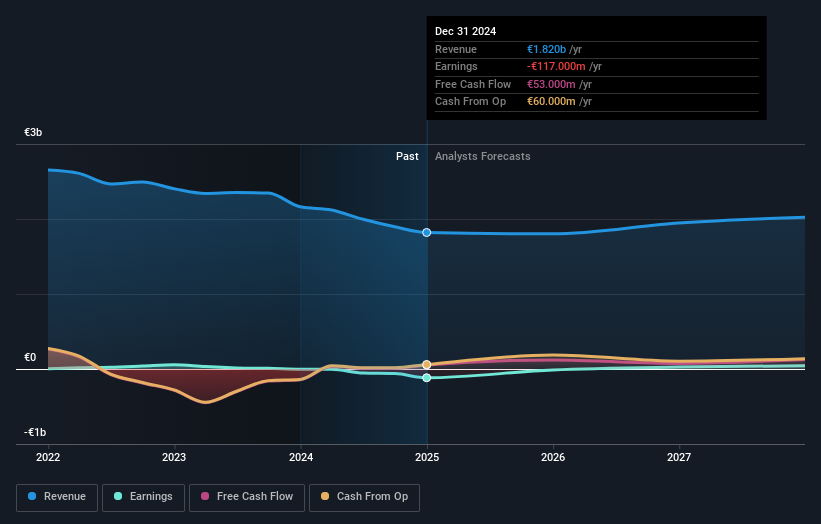

Overview: YIT Oyj offers construction services across Finland, the Czech Republic, Slovakia, Poland, and internationally, with a market cap of €642.58 million.

Operations: The company's revenue is primarily derived from its Building Construction segment at €672 million and Infrastructure segment at €452 million.

Insider Ownership: 10.4%

Earnings Growth Forecast: 90.7% p.a.

YIT Oyj demonstrates potential for growth with insider ownership, underpinned by a series of strategic projects across Europe, including a €25 million residential development in Prague. Despite recent net losses, YIT is forecasted to become profitable within three years and expects revenue growth of 7.6% annually, surpassing the Finnish market average. However, its financial position shows vulnerabilities as debt coverage by operating cash flow is inadequate. The stock trades below estimated fair value compared to peers and industry standards.

- Take a closer look at YIT Oyj's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of YIT Oyj shares in the market.

Next Steps

- Investigate our full lineup of 195 Fast Growing European Companies With High Insider Ownership right here.

- Looking For Alternative Opportunities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives