Shareholders in Spinnova Oyj (HEL:SPINN) have lost 37%, as stock drops 12% this past week

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. Unfortunately the Spinnova Oyj (HEL:SPINN) share price slid 37% over twelve months. That's disappointing when you consider the market returned 6.9%. We wouldn't rush to judgement on Spinnova Oyj because we don't have a long term history to look at. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Spinnova Oyj

Spinnova Oyj isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, Spinnova Oyj increased its revenue by 2,382%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 37% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

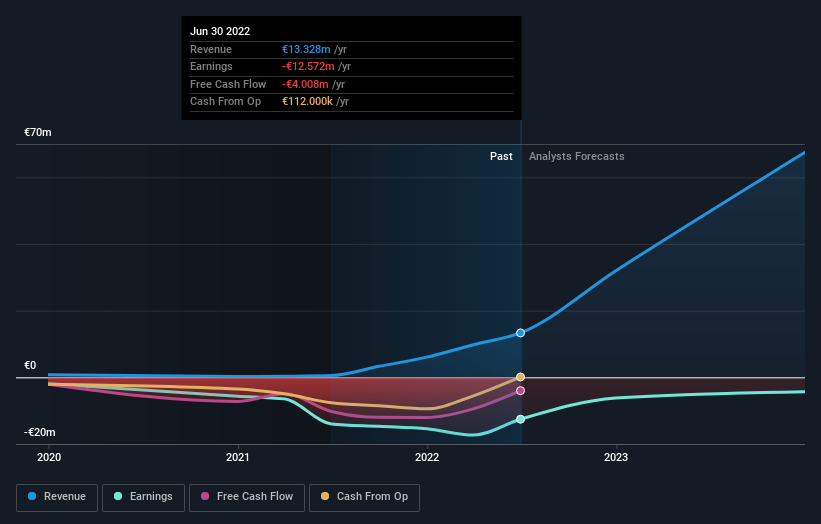

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Spinnova Oyj's financial health with this free report on its balance sheet.

A Different Perspective

While Spinnova Oyj shareholders are down 37% for the year, the market itself is up 6.9%. While the aim is to do better than that, it's worth recalling that even great long-term investments sometimes underperform for a year or more. The share price decline has continued throughout the most recent three months, down 22%, suggesting an absence of enthusiasm from investors. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 2 warning signs we've spotted with Spinnova Oyj .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:SPINN

Spinnova Oyj

Engages in the production and sale of natural fibre materials in Finland and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives