- Finland

- /

- Consumer Durables

- /

- HLSE:FSKRS

This Is Why Fiskars Oyj Abp's (HEL:FSKRS) CEO Compensation Looks Appropriate

Key Insights

- Fiskars Oyj Abp's Annual General Meeting to take place on 13th of March

- Salary of €1.26m is part of CEO Nathalie Ahlstrom's total remuneration

- The overall pay is comparable to the industry average

- Fiskars Oyj Abp's total shareholder return over the past three years was 15% while its EPS grew by 1.4% over the past three years

Performance at Fiskars Oyj Abp (HEL:FSKRS) has been reasonably good and CEO Nathalie Ahlstrom has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 13th of March, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

View our latest analysis for Fiskars Oyj Abp

Comparing Fiskars Oyj Abp's CEO Compensation With The Industry

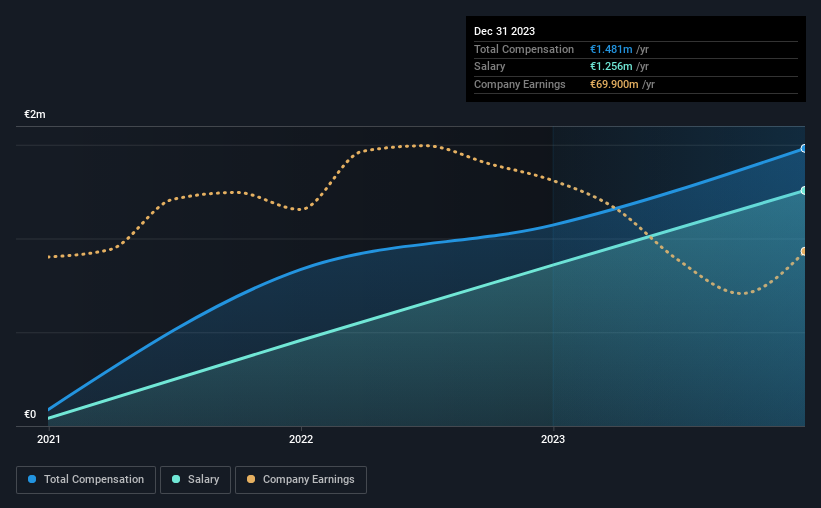

According to our data, Fiskars Oyj Abp has a market capitalization of €1.3b, and paid its CEO total annual compensation worth €1.5m over the year to December 2023. Notably, that's an increase of 38% over the year before. We note that the salary portion, which stands at €1.26m constitutes the majority of total compensation received by the CEO.

On examining similar-sized companies in the Finnish Consumer Durables industry with market capitalizations between €918m and €2.9b, we discovered that the median CEO total compensation of that group was €1.5m. This suggests that Fiskars Oyj Abp remunerates its CEO largely in line with the industry average. What's more, Nathalie Ahlstrom holds €1.8m worth of shares in the company in their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.3m | €858k | 85% |

| Other | €224k | €214k | 15% |

| Total Compensation | €1.5m | €1.1m | 100% |

On an industry level, roughly 57% of total compensation represents salary and 43% is other remuneration. Fiskars Oyj Abp pays out 85% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Fiskars Oyj Abp's Growth

Fiskars Oyj Abp's earnings per share (EPS) grew 1.4% per year over the last three years. Its revenue is down 9.5% over the previous year.

We would prefer it if there was revenue growth, but the modest EPS growth gives us some relief. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Fiskars Oyj Abp Been A Good Investment?

With a total shareholder return of 15% over three years, Fiskars Oyj Abp shareholders would, in general, be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Fiskars Oyj Abp that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:FSKRS

Fiskars Oyj Abp

Manufactures and markets consumer products for indoor and outdoor living in Europe, the Americas, and the Asia Pacific.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives