- Finland

- /

- Consumer Durables

- /

- HLSE:FSKRS

Fiskars (HLSE:FSKRS) Margin Decline Challenges Recovery Narrative Despite 41% Earnings Growth Forecast

Reviewed by Simply Wall St

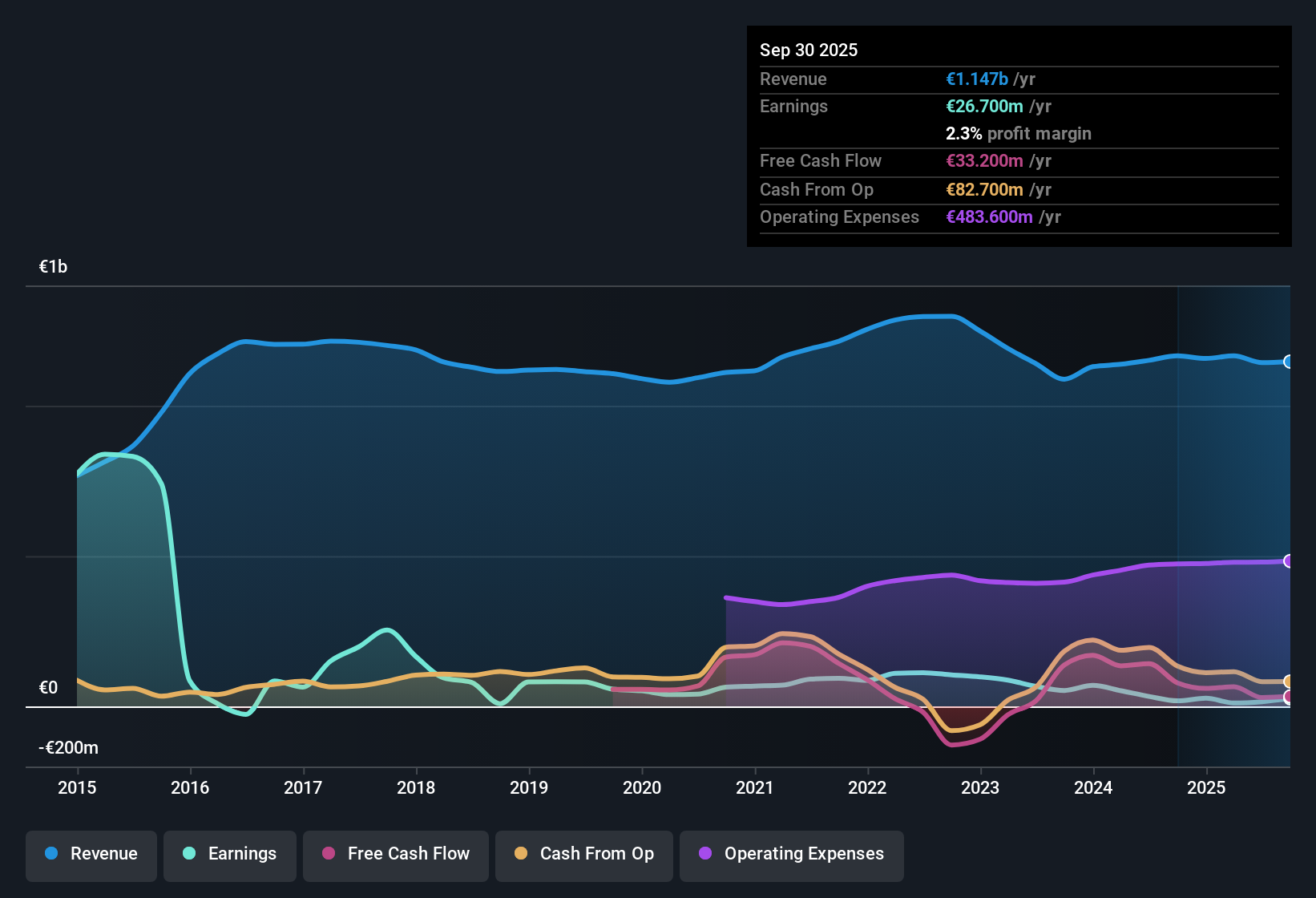

Fiskars Oyj Abp (HLSE:FSKRS) reported net profit margins of 1.4%, down from 2.9% a year ago, with earnings showing a negative trend and an average annual decline of 23.2% over the past five years. Despite this weak profitability, analysts are penciling in a sharp turnaround, forecasting earnings to grow at an average rate of 41.1% per year over the next three years. However, revenue growth is expected to lag slightly behind the Finnish market. Investors are left weighing the promise of strong future growth against recent margins and a notably high price-to-earnings ratio.

See our full analysis for Fiskars Oyj Abp.Next up, we'll see how these results measure up when set against the current narratives in the market. Expect some surprises as the numbers get put to the test.

See what the community is saying about Fiskars Oyj Abp

DCF Fair Value Signals Room for Upside

- Fiskars trades at €12.36, which is roughly 35% lower than its DCF fair value of €18.98. This highlights a significant disconnect versus underlying cash flow estimates.

- Analysts' consensus view points to resilience driven by expected profit margin recovery from 1.4% today to 7.2% in three years, and sees room for upside if direct-to-consumer efforts and category expansion play out as forecasted.

- Consensus also notes that strong double-digit sales growth in China and expanding digital sales channels give management levers to improve both top-line and margins beyond legacy markets.

- The narrative cautions, however, that consensus price targets suggest only limited upside versus today’s share price. Conviction depends on believing earnings will hit projected gains and that sustained premium branding supports long-term growth.

- See if these long-term drivers really set Fiskars apart in the full Consensus Narrative. 📊 Read the full Fiskars Oyj Abp Consensus Narrative.

Earnings Rebound Hinges on Margin Recovery

- Profit margins are forecast to increase substantially, rising from 1.4% now to 7.2% within three years, suggesting a sharp turnaround after five years of a 23.2% average annual earnings decline.

- Analysts' consensus narrative argues that margin expansion is achievable as direct-to-consumer and emerging markets drive growth, but warns of ongoing risk from dependence on the U.S. market and cost structure inflexibility.

- Margin rebound may be accelerated by active cost-cutting and productivity measures if management can deliver EBIT margin and free cash flow recovery through 2024 and beyond.

- Still, operational leverage and high exposure to tariff risk in the U.S. mean that a slow recovery or trade shocks could reverse the projected margin gains.

Premium Valuation Against Industry and Peers

- Fiskars’ Price-to-Earnings Ratio stands at 63.9x, well above the European Consumer Durables industry average of 15.3x and peer average of 28.8x. This implies the stock is priced for significant improvement in future earnings power.

- Analysts' consensus view highlights tension between the company trading below DCF fair value, yet at a premium to sector and peer multiples. The view argues that investors are paying up for projected growth and strategic pivots, but must carefully weigh weaker recent cash flow and returns.

- The current median analyst price target of €12.50 sits only slightly above the share price, reinforcing that much of the recovery story may already be priced in despite DCF upside. True outperformance will rely on management converting category expansion and sustainability investments into sustained profitability.

- Heightened risk around dividend sustainability and operational cash flow means that continued weak performance could prompt a sharp valuation reset if strategic initiatives fail to deliver near-term margin or sales gains.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Fiskars Oyj Abp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something new in these figures? Put your own perspective to work and share your take on Fiskars’ future in just a few minutes. Do it your way

A great starting point for your Fiskars Oyj Abp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Fiskars’ lofty valuation and dependence on a margin turnaround make its recovery story vulnerable if growth or profitability falls short of expectations.

If you want more predictable value and lower risk, use these 877 undervalued stocks based on cash flows to identify companies trading below fair value with stronger earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:FSKRS

Fiskars Oyj Abp

Manufactures and markets consumer products for indoor and outdoor living in Europe, the Americas, and the Asia Pacific.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives