- Finland

- /

- Professional Services

- /

- HLSE:PNA1V

Panostaja Oyj's (HEL:PNA1V) Price Is Out Of Tune With Revenues

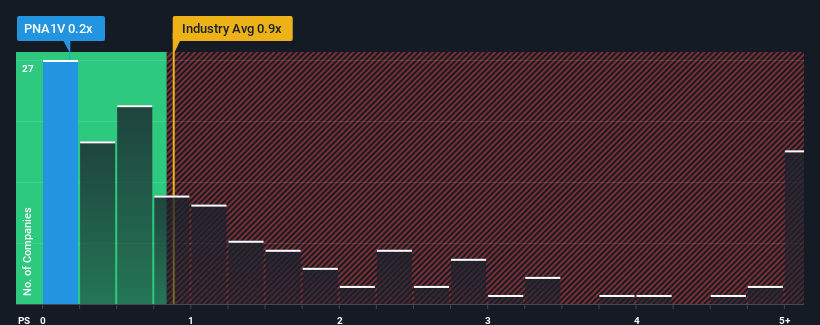

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Professional Services industry in Finland, you could be forgiven for feeling indifferent about Panostaja Oyj's (HEL:PNA1V) P/S ratio of 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Panostaja Oyj

What Does Panostaja Oyj's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Panostaja Oyj's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Panostaja Oyj will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Panostaja Oyj?

In order to justify its P/S ratio, Panostaja Oyj would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's top line. As a result, revenue from three years ago have also fallen 13% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 2.7% per year over the next three years. That's shaping up to be materially lower than the 5.3% each year growth forecast for the broader industry.

With this information, we find it interesting that Panostaja Oyj is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Panostaja Oyj's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given that Panostaja Oyj's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

It is also worth noting that we have found 2 warning signs for Panostaja Oyj that you need to take into consideration.

If you're unsure about the strength of Panostaja Oyj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Panostaja Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:PNA1V

Panostaja Oyj

A private equity firm specializing in investments in expansions through corporate acquisitions, industry consolidations, and mature and middle market investments in small and medium-sized companies through acquisitions in sectors undergoing growth and restructuring.

Undervalued with moderate growth potential.

Market Insights

Community Narratives