- Finland

- /

- Professional Services

- /

- HLSE:ENENTO

Enento Group Oyj's (HEL:ENENTO) earnings trajectory could turn positive as the stock swells 15% this past week

It is a pleasure to report that the Enento Group Oyj (HEL:ENENTO) is up 34% in the last quarter. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 40% in the last three years, falling well short of the market return.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for Enento Group Oyj

SWOT Analysis for Enento Group Oyj

- Debt is well covered by earnings and cashflows.

- Earnings declined over the past year.

- Dividend is low compared to the top 25% of dividend payers in the Professional Services market.

- Annual earnings are forecast to grow faster than the Finnish market.

- Current share price is below our estimate of fair value.

- Dividends are not covered by earnings.

- Revenue is forecast to grow slower than 20% per year.

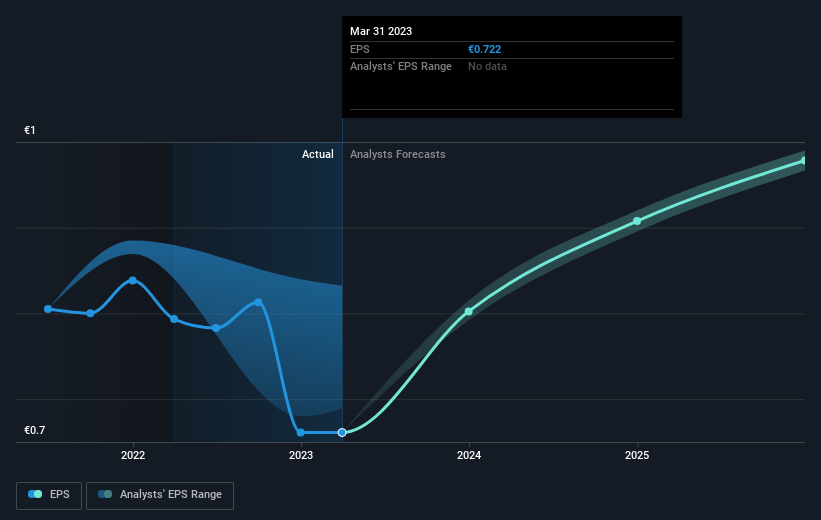

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the three years that the share price fell, Enento Group Oyj's earnings per share (EPS) dropped by 5.1% each year. The share price decline of 16% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Dive deeper into Enento Group Oyj's key metrics by checking this interactive graph of Enento Group Oyj's earnings, revenue and cash flow.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Enento Group Oyj the TSR over the last 3 years was -31%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Enento Group Oyj has rewarded shareholders with a total shareholder return of 12% in the last twelve months. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 0.8% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Enento Group Oyj better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Enento Group Oyj you should be aware of.

But note: Enento Group Oyj may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enento Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ENENTO

Enento Group Oyj

Through its subsidiaries, provides digital business and consumer information services in the Nordic countries.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives