- Finland

- /

- Professional Services

- /

- HLSE:ENENTO

Does The Market Have A Low Tolerance For Enento Group Oyj's (HEL:ENENTO) Mixed Fundamentals?

Enento Group Oyj (HEL:ENENTO) has had a rough month with its share price down 17%. It seems that the market might have completely ignored the positive aspects of the company's fundamentals and decided to weigh-in more on the negative aspects. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Specifically, we decided to study Enento Group Oyj's ROE in this article.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Enento Group Oyj

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Enento Group Oyj is:

6.0% = €16m ÷ €264m (Based on the trailing twelve months to June 2023).

The 'return' refers to a company's earnings over the last year. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.06.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Enento Group Oyj's Earnings Growth And 6.0% ROE

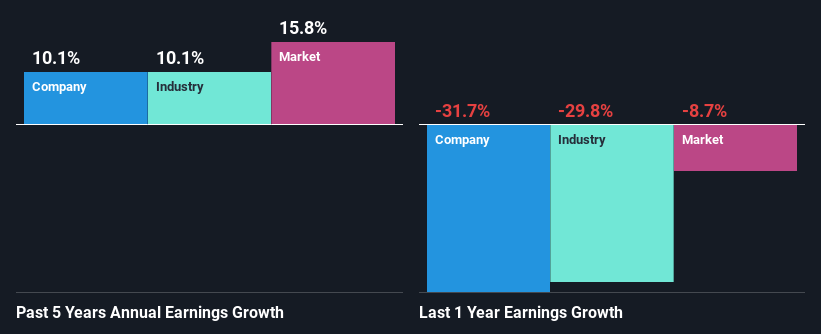

On the face of it, Enento Group Oyj's ROE is not much to talk about. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 8.3% either. Although, we can see that Enento Group Oyj saw a modest net income growth of 10% over the past five years. So, there might be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then performed a comparison between Enento Group Oyj's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 10% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is ENENTO worth today? The intrinsic value infographic in our free research report helps visualize whether ENENTO is currently mispriced by the market.

Is Enento Group Oyj Using Its Retained Earnings Effectively?

Enento Group Oyj's high three-year median payout ratio of 108% suggests that the company is paying out more to its shareholders than what it is making. In spite of this, the company was able to grow its earnings respectably, as we saw above. That being said, the high payout ratio could be worth keeping an eye on in case the company is unable to keep up its current growth momentum. To know the 4 risks we have identified for Enento Group Oyj visit our risks dashboard for free.

Moreover, Enento Group Oyj is determined to keep sharing its profits with shareholders which we infer from its long history of eight years of paying a dividend. Our latest analyst data shows that the future payout ratio of the company is expected to drop to 68% over the next three years. As a result, the expected drop in Enento Group Oyj's payout ratio explains the anticipated rise in the company's future ROE to 10%, over the same period.

Conclusion

Overall, we have mixed feelings about Enento Group Oyj. Although the company has shown a pretty impressive growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. That being so, the latest analyst forecasts show that the company will continue to see an expansion in its earnings. To know more about the company's future earnings growth forecasts take a look at this free report on analyst forecasts for the company to find out more.

Valuation is complex, but we're here to simplify it.

Discover if Enento Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ENENTO

Enento Group Oyj

Through its subsidiaries, provides digital business and consumer information services in the Nordic countries.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.