Robit Oyj (HEL:ROBIT) Soars 37% But It's A Story Of Risk Vs Reward

Robit Oyj (HEL:ROBIT) shares have continued their recent momentum with a 37% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 17% in the last twelve months.

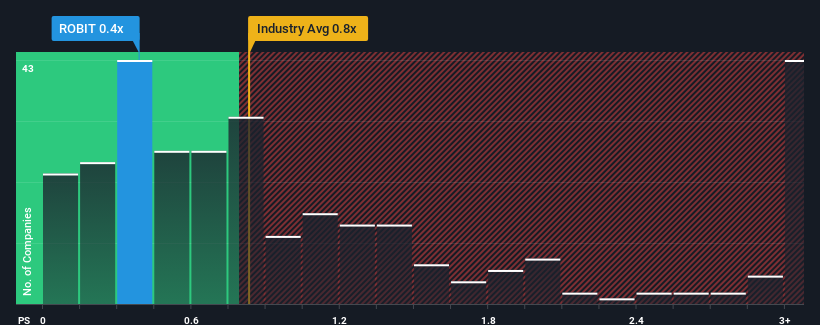

Although its price has surged higher, it's still not a stretch to say that Robit Oyj's price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Machinery industry in Finland, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Robit Oyj

What Does Robit Oyj's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Robit Oyj's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Robit Oyj's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Robit Oyj's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 17%. At least revenue has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 7.1% per annum over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 3.6% each year, which is noticeably less attractive.

In light of this, it's curious that Robit Oyj's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Robit Oyj appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Robit Oyj currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 2 warning signs for Robit Oyj (1 is a bit concerning!) that we have uncovered.

If these risks are making you reconsider your opinion on Robit Oyj, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:ROBIT

Robit Oyj

Engages in the design, manufacture, and sale of drilling consumables for mining, quarrying, construction, and well drilling industries in Finland.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives