- Finland

- /

- Trade Distributors

- /

- HLSE:RELAIS

Relais Group (HLSE:RELAIS) Margin Decline Contrasts With Growth Narrative in Latest Earnings

Reviewed by Simply Wall St

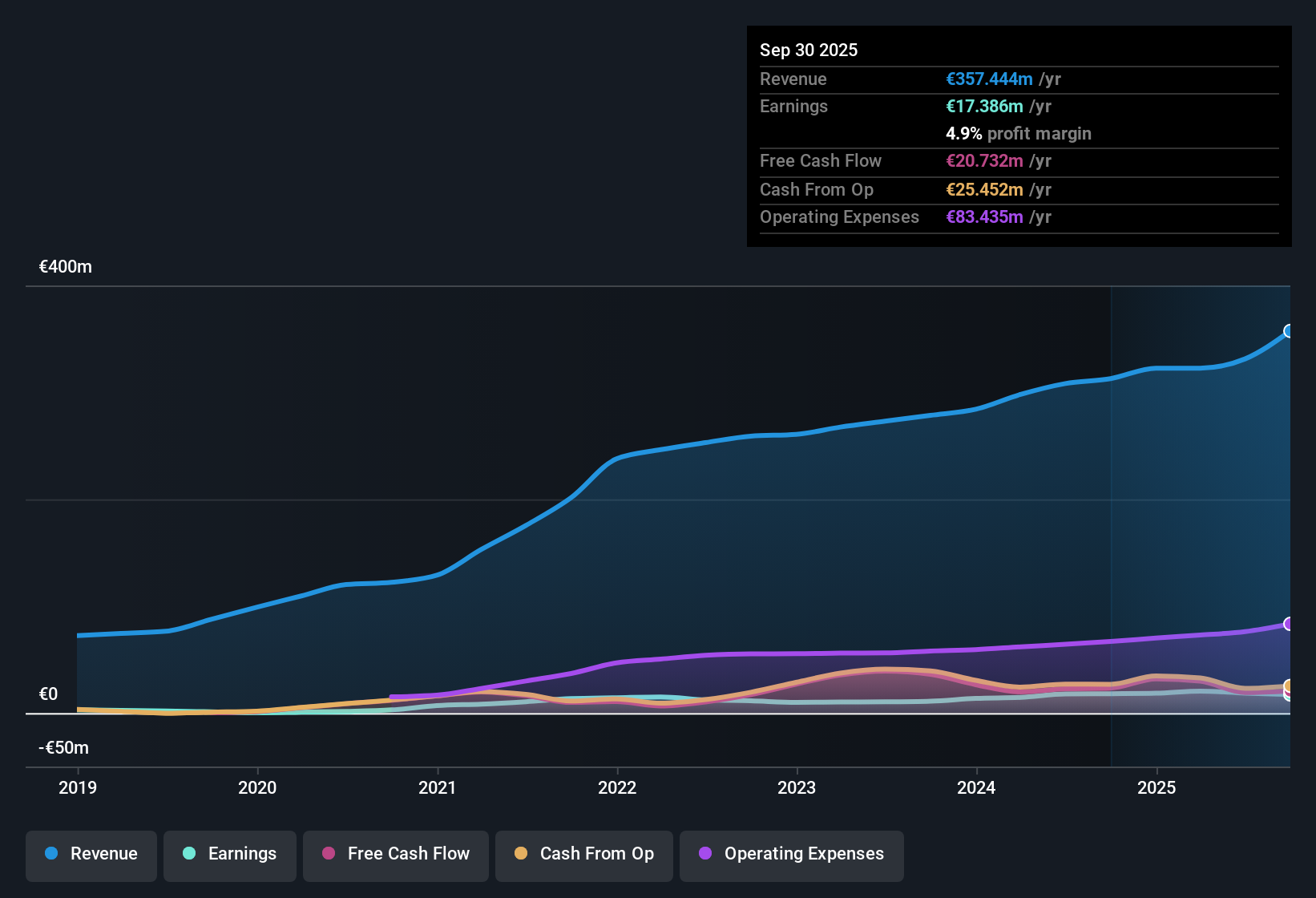

Relais Group Oyj (HLSE:RELAIS) posted 5.1% earnings growth for the most recent period, a slowdown compared to its five-year average of 18.8%. Profit margins slipped slightly to 5.6% from last year's 5.8%. Looking ahead, analysts forecast earnings to climb 15.4% per year and revenue to rise 7.7% per year. Both figures signal solid growth, though not quite matching the broader Finnish market's average pace.

See our full analysis for Relais Group Oyj.Next, we will set these headline figures against the market's consensus narratives to see where investor expectations are confirmed and where surprises might emerge.

See what the community is saying about Relais Group Oyj

Margin Expansion on the Horizon

- Analysts see profit margins climbing from 5.6% today to 6.0% within three years, pointing to expected cost efficiencies as integration of recent acquisitions progresses.

- Analysts' consensus view highlights two key drivers for this improvement:

- Strategic moves such as acquiring Team Verkstad and Matro Group are expected to boost revenue and EBITDA as their operations are fully consolidated. Added benefits are anticipated from cross-selling and branding synergies.

- Relais Group's focus on aftermarket commercial vehicle services is seen as providing a steady stream of demand. This is particularly relevant as the average vehicle age rises across Europe and the Nordics, contributing to both stability and the opportunity for margin improvement.

- Recent investments in logistics and digital platform development are also expected to curb SG&A expenses as a percentage of sales, supporting a path to stronger margins.

Valuation Gap Versus Fair Value

- With a current share price of €16.75 trading well below the DCF fair value of €27.43, the stock appears undervalued by this standard, even though it trades close to peer and industry earnings multiples.

- Analysts' consensus view points to notable tensions in valuation:

- While the DCF fair value suggests substantial upside, the Price-to-Earnings ratio stands at 16.5x, just above the industry average of 16.3x and noticeably higher than peer averages of 12.7x. This indicates the market is pricing in steady but not extraordinary growth compared to close competitors.

- The analyst price target of €19.95 represents a 17.8% premium over the latest share price, with consensus based on successful earnings and margin expansion to justify this rerating.

Balance Sheet Risks Temper Growth Outlook

- Relais Group's accelerated acquisition strategy has led to a heavier reliance on debt to finance growth, with the use of bridge loans and rising lease liabilities highlighted as a core financial concern.

- Analysts' consensus view calls attention to several pressure points:

- Integration risks and higher working capital needs, driven by inventory buildup and management changes, create uncertainty in delivering projected earnings and free cash flow, especially if economic headwinds emerge in key markets.

- The company's limited diversification beyond the Nordics and Baltic regions exposes it to regional economic swings and competitive threats. This underscores why analysts are monitoring execution and leadership transitions closely.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Relais Group Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have another take on the numbers? Share your perspective and put together your own narrative in just a few minutes by clicking Do it your way.

A great starting point for your Relais Group Oyj research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Relais Group Oyj shows earnings growth and margin potential, its reliance on debt and regional concentration present notable financial and operational risks.

If you want to sidestep those balance sheet concerns, discover companies with stronger financial health and resilience through our solid balance sheet and fundamentals stocks screener (1980 results) screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:RELAIS

Relais Group Oyj

Operates as a consolidator and acquisition platform for vehicle aftermarket in the Nordic and Baltic countries.

Acceptable track record second-rate dividend payer.

Market Insights

Community Narratives