Ponsse (HLSE:PON1V) Margin Recovery Beats Bearish Narratives on Profitability

Reviewed by Simply Wall St

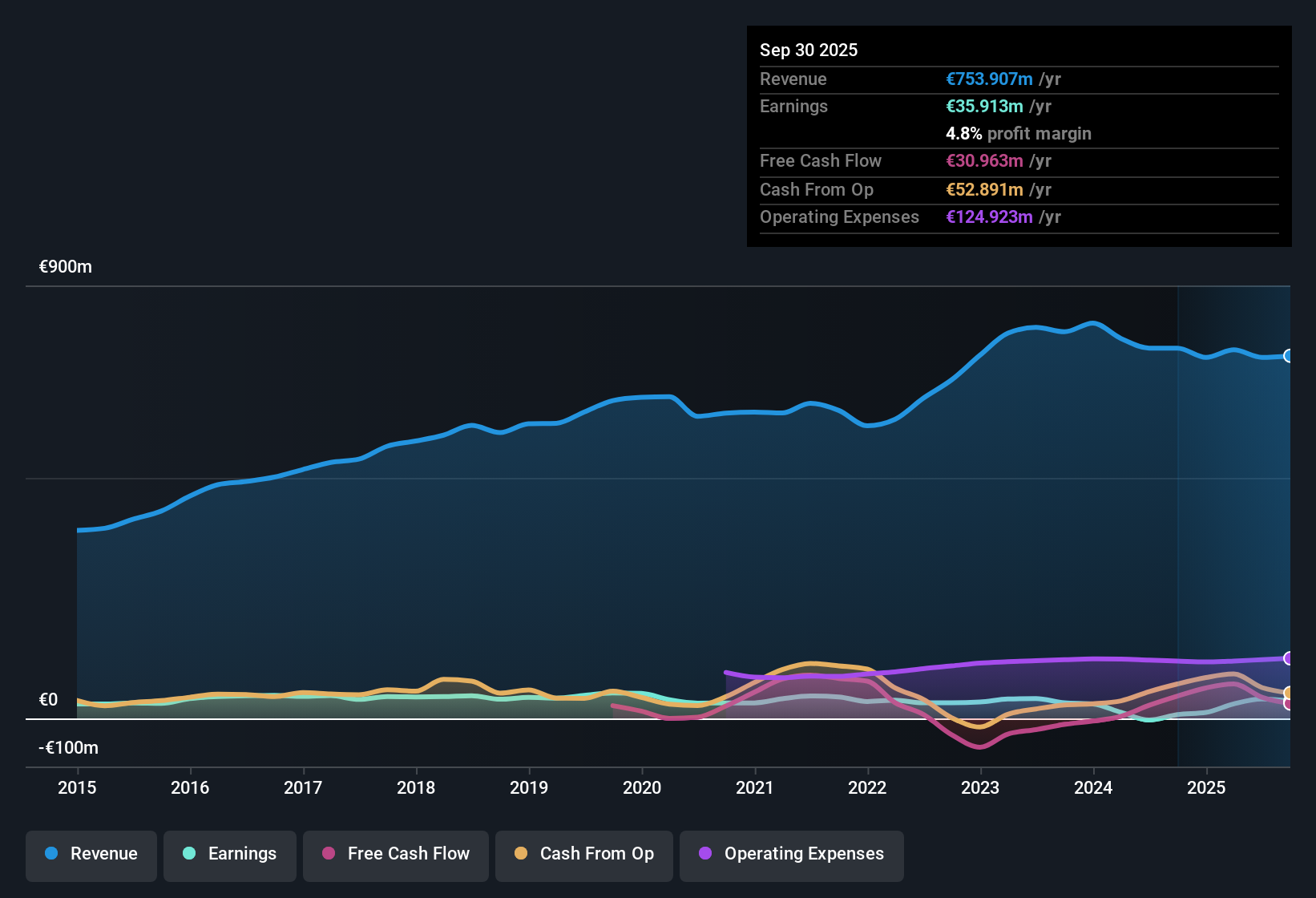

Ponsse Oyj (HLSE:PON1V) posted standout results, with forecasted revenue set to grow 6.8% annually, ahead of the Finnish market’s 4% average, and earnings expected to climb 18.8% per year, outpacing the market’s 16.1%. The company’s net profit margin jumped to 4.8% from last year’s 1%, and recent earnings growth was especially strong, with a 352.6% surge over the past year after several years of declines. With no major risks flagged and growth trends comfortably ahead of sector norms, value-focused investors are likely to take a positive view on Ponsse’s outlook.

See our full analysis for Ponsse Oyj.The next section goes deeper, lining up the headline numbers with the consensus narratives that shape market perspectives. This reveals where the data and the stories converge, and where they might conflict.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Rebound Drives Outperformance

- Ponsse’s net profit margin stands at 4.8%, after having risen strongly from last year’s 1%, spotlighting a clear acceleration in profitability far above its long-term trend of a 12.1% per year average decline over five years.

- Heavily supporting the bullish case, this rapid margin rebound anchors optimism about operational efficiency.

- Earnings climbed by 352.6% over the past year, far outpacing past annual declines and reflecting sharp improvements across core activities.

- Bulls emphasize that margin gains in tandem with strong revenue increases are rare for cyclical manufacturers, which helps justify investor enthusiasm even in a premium valuation environment.

Growth Premium Versus Industry Peers

- Ponsse’s price-to-earnings ratio is 20.3x, a clear premium to the European machinery industry’s 19.8x and its direct peer average of 16x, underscoring investors’ willingness to pay up for stronger anticipated growth.

- The prevailing market view sees this higher multiple as warranted, given forecasts for 6.8% annual revenue and 18.8% annual earnings expansion.

- With market averages for growth at just 4% for revenue and 16.1% for earnings, Ponsse’s outlook implies it can maintain a leading pace, which tends to attract higher valuations.

- What is notable is that despite this premium, no major risks have been cited in filings, signaling investor confidence in the ongoing trajectory.

Valuation Gaps and Future Upside

- While Ponsse’s current share price is €26.00, its DCF fair value is estimated at €37.09, suggesting meaningful upside potential if growth trends persist and market assumptions hold steady.

- This gap heavily influences the prevailing market view, which expects that operational momentum and sector positioning, especially in lower-emission machinery, may drive the share price closer to intrinsic value.

- The combination of strong forecasted growth and improving margins gives further rationale for the stock’s valuation gap to potentially narrow over time.

- Yet, investors will be watching closely to see if this momentum can be sustained in the face of sector volatility and competitive benchmarking.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ponsse Oyj's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong earnings growth and margin recovery, Ponsse trades at a valuation premium. This may not appeal to investors seeking greater value.

If finding more attractively priced opportunities is your priority, check out these 879 undervalued stocks based on cash flows to discover companies that could offer better value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:PON1V

Ponsse Oyj

Operates as manufacturer of cut-to-length forest machines Nordic and Baltic countries, Central and Southern Europe, South America and North America, Asia, Australia, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives