Cautious Investors Not Rewarding Norrhydro Group Oyj's (HEL:NORRH) Performance Completely

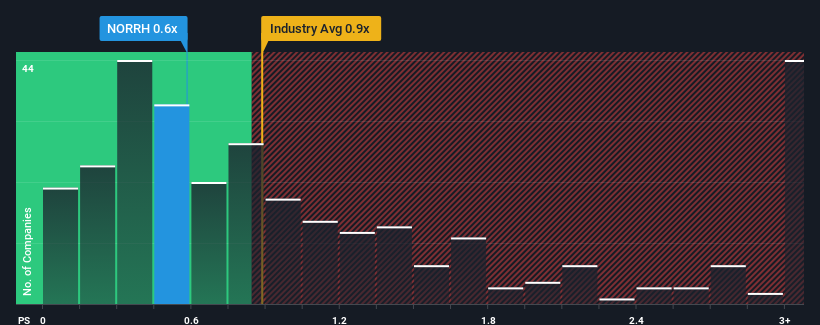

There wouldn't be many who think Norrhydro Group Oyj's (HEL:NORRH) price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S for the Machinery industry in Finland is very similar. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Norrhydro Group Oyj

How Has Norrhydro Group Oyj Performed Recently?

Norrhydro Group Oyj's revenue growth of late has been pretty similar to most other companies. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Norrhydro Group Oyj will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Norrhydro Group Oyj.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Norrhydro Group Oyj would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 53% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 15% per annum during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.3% per year, which is noticeably less attractive.

With this information, we find it interesting that Norrhydro Group Oyj is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Norrhydro Group Oyj's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Norrhydro Group Oyj's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 4 warning signs for Norrhydro Group Oyj (2 are potentially serious!) that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Norrhydro Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:NORRH

Norrhydro Group Oyj

Develops, manufactures, and sells hydraulic cylinders and linear motion control systems in the Nordic countries.

Slight and fair value.

Market Insights

Community Narratives