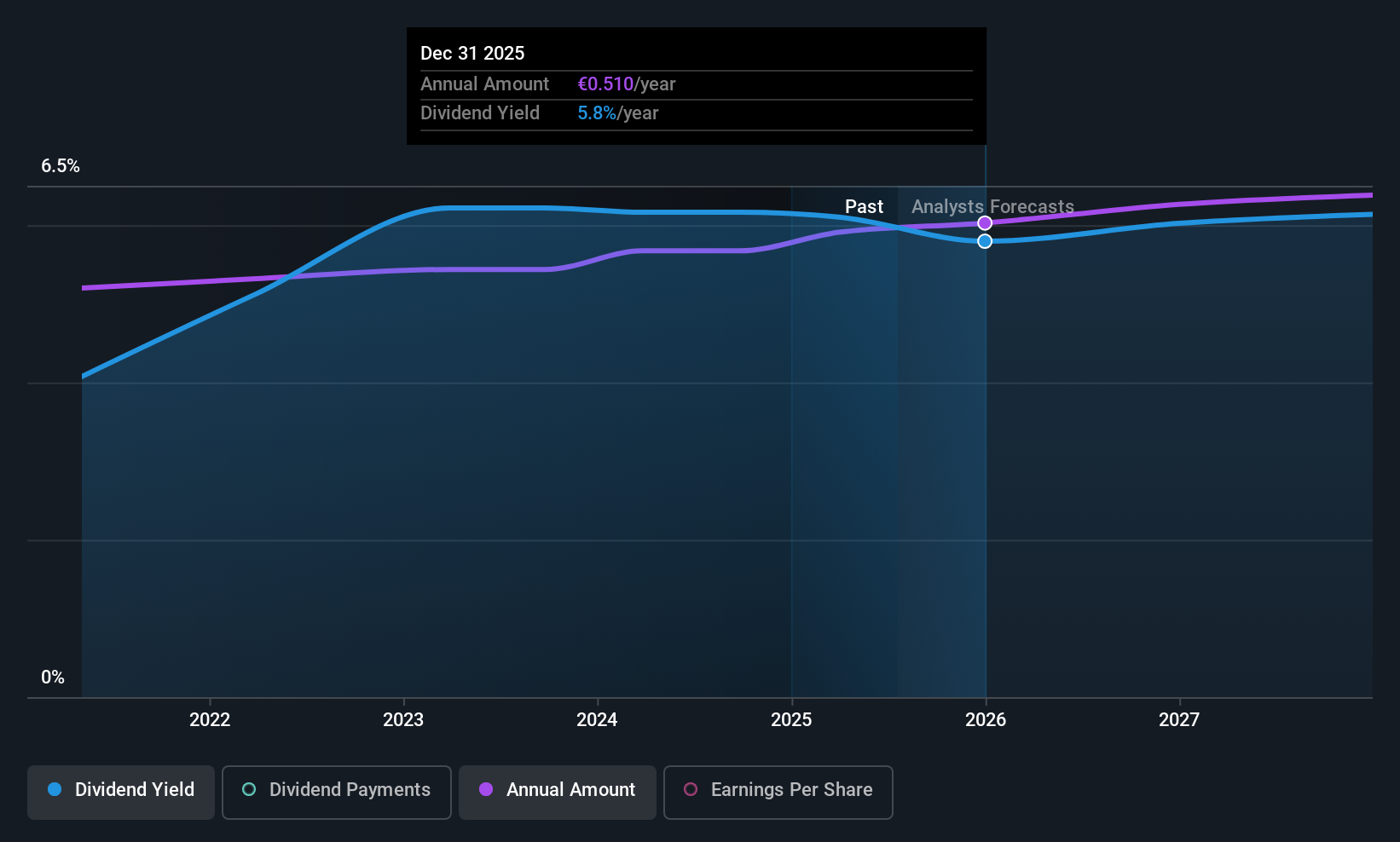

The board of Kreate Group Oyj (HEL:KREATE) has announced that it will pay a dividend on the 2nd of October, with investors receiving €0.25 per share. This will take the dividend yield to an attractive 5.7%, providing a nice boost to shareholder returns.

Kreate Group Oyj's Future Dividend Projections Appear Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before this announcement, Kreate Group Oyj was paying out 90% of earnings, but a comparatively small 23% of free cash flows. This leaves plenty of cash for reinvestment into the business.

The next year is set to see EPS grow by 77.7%. Under the assumption that the dividend will continue along recent trends, we think the payout ratio could be 53% which would be quite comfortable going to take the dividend forward.

See our latest analysis for Kreate Group Oyj

Kreate Group Oyj Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 4 years, which isn't that long in the grand scheme of things. The dividend has gone from an annual total of €0.44 in 2021 to the most recent total annual payment of €0.50. This works out to be a compound annual growth rate (CAGR) of approximately 3.2% a year over that time. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth Is Doubtful

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. Let's not jump to conclusions as things might not be as good as they appear on the surface. It's not great to see that Kreate Group Oyj's earnings per share has fallen at approximately 9.0% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

Our Thoughts On Kreate Group Oyj's Dividend

Overall, we always like to see the dividend being raised, but we don't think Kreate Group Oyj will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 2 warning signs for Kreate Group Oyj that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Kreate Group Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:KREATE

Kreate Group Oyj

Engages in the construction of infrastructure projects for private and public sector customers in Finland.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.