What Cargotec Corporation's (HEL:CGCBV) 29% Share Price Gain Is Not Telling You

Cargotec Corporation (HEL:CGCBV) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 51%.

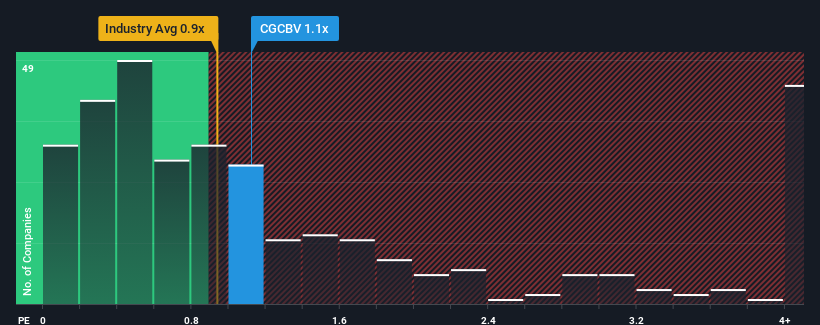

Since its price has surged higher, given close to half the companies operating in Finland's Machinery industry have price-to-sales ratios (or "P/S") below 0.6x, you may consider Cargotec as a stock to potentially avoid with its 1.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Cargotec

What Does Cargotec's Recent Performance Look Like?

Recent times have been advantageous for Cargotec as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cargotec.How Is Cargotec's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Cargotec's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The latest three year period has also seen an excellent 47% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 1.5% per year during the coming three years according to the four analysts following the company. With the industry predicted to deliver 4.3% growth per annum, that's a disappointing outcome.

With this in mind, we find it intriguing that Cargotec's P/S is closely matching its industry peers. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

What Does Cargotec's P/S Mean For Investors?

Cargotec's P/S is on the rise since its shares have risen strongly. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Cargotec's analyst forecasts revealed that its shrinking revenue outlook isn't drawing down its high P/S anywhere near as much as we would have predicted. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Cargotec with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hiab Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:HIAB

Hiab Oyj

Provides smart and on road load-handling solutions and services in Finland.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives