Increases to Oma Säästöpankki Oyj's (HEL:OMASP) CEO Compensation Might Cool off for now

Key Insights

- Oma Säästöpankki Oyj to hold its Annual General Meeting on 26th of March

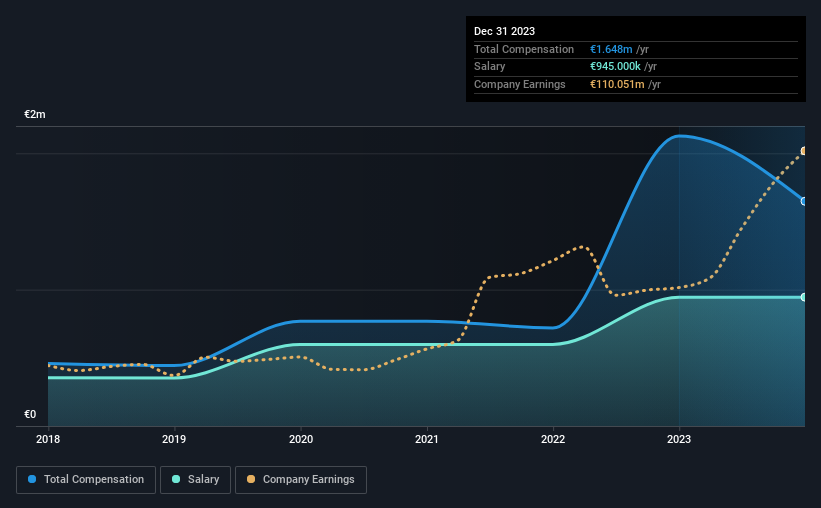

- CEO Pasi Sydanlammi's total compensation includes salary of €945.0k

- Total compensation is 236% above industry average

- Over the past three years, Oma Säästöpankki Oyj's EPS grew by 47% and over the past three years, the total shareholder return was 94%

Under the guidance of CEO Pasi Sydanlammi, Oma Säästöpankki Oyj (HEL:OMASP) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 26th of March. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Oma Säästöpankki Oyj

Comparing Oma Säästöpankki Oyj's CEO Compensation With The Industry

Our data indicates that Oma Säästöpankki Oyj has a market capitalization of €678m, and total annual CEO compensation was reported as €1.6m for the year to December 2023. That's a notable decrease of 22% on last year. In particular, the salary of €945.0k, makes up a fairly large portion of the total compensation being paid to the CEO.

For comparison, other companies in the Finland Banks industry with market capitalizations ranging between €368m and €1.5b had a median total CEO compensation of €490k. Hence, we can conclude that Pasi Sydanlammi is remunerated higher than the industry median. Moreover, Pasi Sydanlammi also holds €2.5m worth of Oma Säästöpankki Oyj stock directly under their own name.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €945k | €945k | 57% |

| Other | €703k | €1.2m | 43% |

| Total Compensation | €1.6m | €2.1m | 100% |

On an industry level, roughly 63% of total compensation represents salary and 37% is other remuneration. Oma Säästöpankki Oyj is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Oma Säästöpankki Oyj's Growth

Over the past three years, Oma Säästöpankki Oyj has seen its earnings per share (EPS) grow by 47% per year. It achieved revenue growth of 63% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. The combination of strong revenue growth with medium-term EPS improvement certainly points to the kind of growth we like to see. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Oma Säästöpankki Oyj Been A Good Investment?

We think that the total shareholder return of 94%, over three years, would leave most Oma Säästöpankki Oyj shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Oma Säästöpankki Oyj that investors should be aware of in a dynamic business environment.

Switching gears from Oma Säästöpankki Oyj, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:OMASP

Oma Säästöpankki Oyj

Provides banking products and services to private customers, small and medium-sized enterprises, and agriculture and forestry entrepreneurs in Finland.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives