Nordea Bank (HLSE:NDA FI): Assessing Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Nordea Bank Abp.

Nordea Bank Abp’s recent momentum has caught the market’s attention, with a 15.83% share price return over the last 90 days and a total shareholder return of 53.53% over the past year. The stock’s climb reflects both improving sentiment and confidence in the bank’s outlook as investors look for resilient financials and steady growth potential.

If Nordea’s strong run has you curious about where else opportunity might be building, consider broadening your watchlist and discovering fast growing stocks with high insider ownership

Given Nordea’s recent gains and modest underlying growth, the key question is whether the stock remains attractively valued, or if the market has already factored in all the good news, leaving little room for upside.

Most Popular Narrative: Fairly Valued

With Nordea Bank Abp closing at €15.37 and the narrative fair value set at €15.34, the market appears tightly aligned with analyst expectations. This appraisal comes with a slightly higher discount rate and near-stable projected growth, which creates a narrow band around current pricing.

Nordea's disciplined focus on efficiency and capital optimization, with cost-to-income ratio maintained around 46% and continued active capital return via buybacks, creates strong potential for sustained EPS and ROE outperformance. As secular shifts toward digital and sustainable banking accelerate revenue opportunities, these factors remain important.

What makes analysts settle here, despite the share price's recent surge? The most widely followed narrative hinges on a bold set of profitability and margin assumptions. However, the most critical quantitative forecasts are hidden in plain sight. Want to know what financial projections could move the market from “just about right” to wildly off base? Only the full narrative breaks down the numbers behind this knife-edge valuation.

Result: Fair Value of $15.34 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued margin compression and heightened regulatory scrutiny could quickly shift the outlook. These factors could serve as catalysts for a new narrative on Nordea’s valuation.

Find out about the key risks to this Nordea Bank Abp narrative.

Another View: Discounted Cash Flow Signals Deep Value

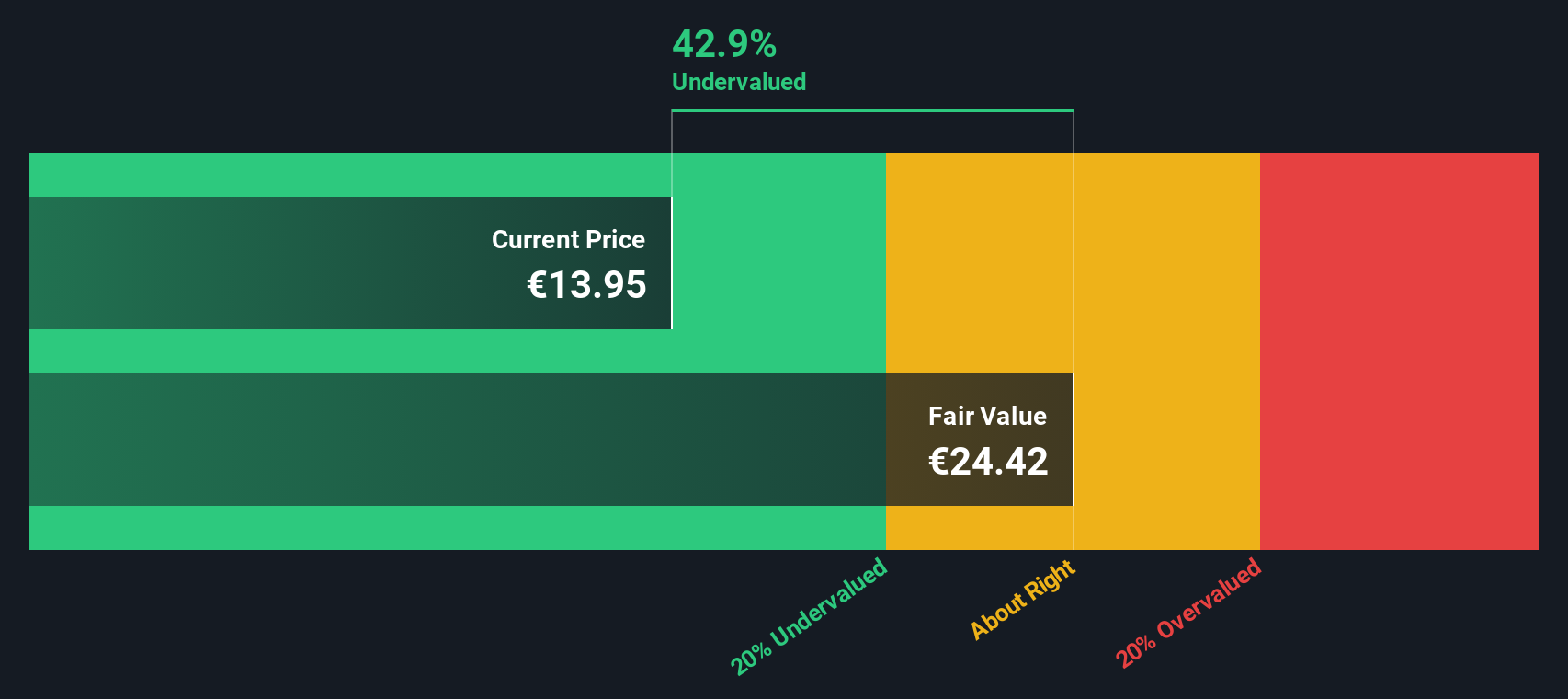

While analysts see Nordea as fairly priced based on earnings trends, our SWS DCF model tells a very different story. According to discounted cash flow analysis, Nordea is trading at nearly 40% below its estimated fair value. Is the market missing hidden upside, or are DCF assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nordea Bank Abp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nordea Bank Abp Narrative

If you see potential for a different story or want to dig deeper yourself, you can put together your own narrative in just a few minutes. Do it your way

A great starting point for your Nordea Bank Abp research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock even more ways to strengthen your portfolio using the Simply Wall Street Screener. There are rare opportunities waiting, but you have to act to find them.

- Tap into the hottest trends in artificial intelligence by checking out these 25 AI penny stocks, which are poised to benefit from rapid advances in machine learning and automation.

- Capture the upside of attractive dividend yields with these 14 dividend stocks with yields > 3%, a selection tailored for steady income and robust cash returns.

- Accelerate your search for value by targeting these 928 undervalued stocks based on cash flows, featuring companies trading below intrinsic worth with strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordea Bank Abp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NDA FI

Nordea Bank Abp

Offers banking products and services for individuals, families, and businesses in Sweden, Finland, Norway, Denmark, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026