- Sweden

- /

- Food and Staples Retail

- /

- OM:APOTEA

Exploring Ålandsbanken Abp And 2 Other European Small Cap Gems

Reviewed by Simply Wall St

In recent weeks, the European market has experienced mixed results, with the STOXX Europe 600 Index snapping a ten-week streak of gains amid uncertainties surrounding U.S. trade policy and economic growth forecasts. However, increased spending initiatives in defense and infrastructure by Germany and the European Union have provided some support to investor sentiment. In this environment, identifying small-cap stocks that demonstrate resilience and potential for growth can be particularly rewarding for investors seeking opportunities beyond the mainstream indices.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | -2.23% | 6.18% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Ålandsbanken Abp (HLSE:ALBAV)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ålandsbanken Abp is a commercial bank serving private individuals and companies in Finland and Sweden, with a market capitalization of approximately €608.30 million.

Operations: Revenue primarily stems from Private Banking, contributing €94.99 million, and Premium Banking, adding €71.40 million. The IT segment generates €54.33 million in revenue, while Corporate and Other bring in €12.06 million.

Ålandsbanken Abp, with total assets of €4.9 billion and equity of €336 million, is a noteworthy player in the European banking scene. Its total deposits stand at €3.5 billion against loans of €3.6 billion, reflecting a net interest margin of 2.1%. The bank's allowance for bad loans is currently at 1.6% of total loans, indicating room for improvement in risk management practices. Despite earnings growing by 13% annually over the past five years and trading below estimated fair value by nearly 9%, Ålandsbanken recently announced an annual dividend of €2.40 per share and a special dividend proposal for shareholders' approval.

- Delve into the full analysis health report here for a deeper understanding of Ålandsbanken Abp.

Evaluate Ålandsbanken Abp's historical performance by accessing our past performance report.

Treasure (OB:TRE)

Simply Wall St Value Rating: ★★★★★★

Overview: Treasure ASA holds an 11% interest in Hyundai Glovis Co. and has a market capitalization of NOK6.31 billion.

Operations: Treasure ASA's revenue is derived from its 11% interest in Hyundai Glovis Co., with reported revenue of $0.35 million. The company's market capitalization stands at NOK6.31 billion.

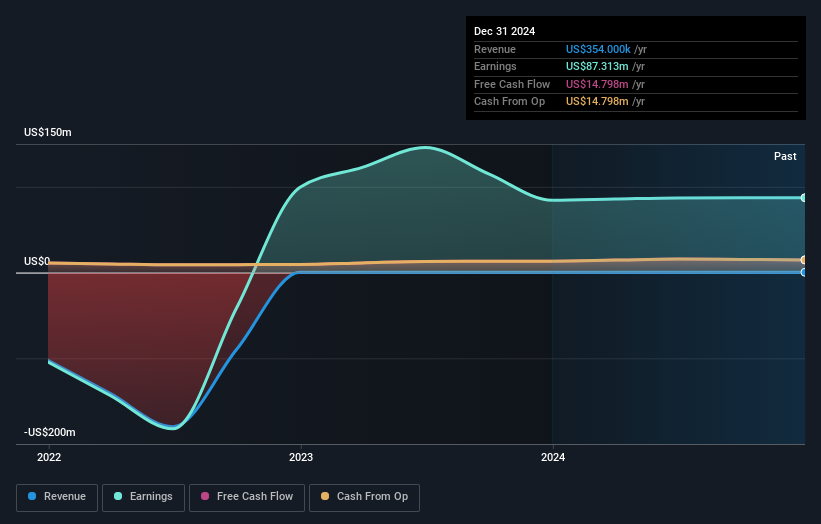

Treasure ASA, a nimble player in the logistics sector, shines with its debt-free status and a price-to-earnings ratio of 6.8x, which is notably below the Norwegian market average of 11.7x. Despite modest revenue at US$0.35 million, it boasts high-quality earnings and an impressive net income of US$87.31 million for 2024. Earnings have grown by 3.5%, outpacing the industry's 0.7% growth rate over the past year, indicating robust operational performance that supports positive free cash flow generation consistently over recent years without any debt burden to weigh it down further.

- Get an in-depth perspective on Treasure's performance by reading our health report here.

Review our historical performance report to gain insights into Treasure's's past performance.

Apotea (OM:APOTEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Apotea AB (publ) is a Swedish company that operates an online pharmacy, with a market capitalization of SEK7.92 billion.

Operations: Apotea generates revenue primarily from its online retail operations, amounting to SEK6.54 billion.

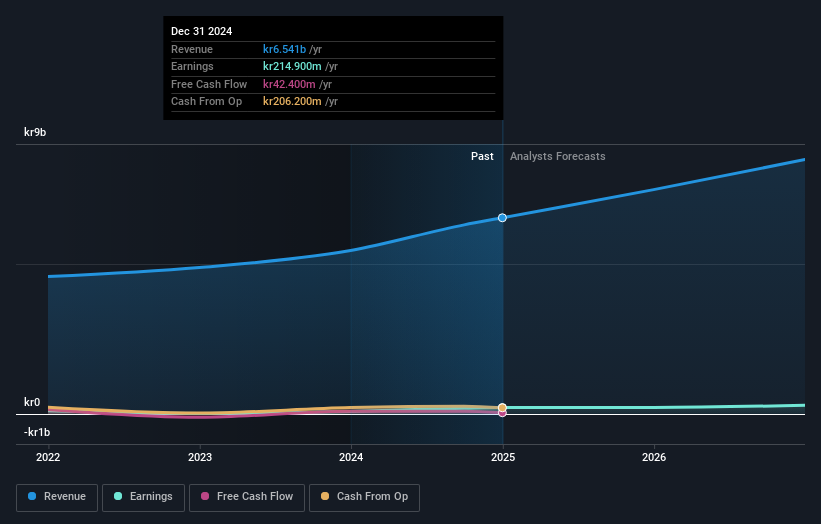

Apotea, a nimble player in the consumer retailing space, has shown impressive financial resilience. Its earnings growth of 147% over the past year outpaced the industry’s -1.4%, highlighting its strong performance. The company's net debt to equity ratio stands at a satisfactory 8.2%, indicating prudent financial management. With an EBIT that covers interest payments 241 times over, Apotea's ability to manage debt is robust. Although levered free cash flow fluctuated from A$146 million in 2021 to A$42 million by early 2025, its profitability ensures that cash runway concerns are minimal and future earnings are projected to grow annually by over 15%.

- Click to explore a detailed breakdown of our findings in Apotea's health report.

Understand Apotea's track record by examining our Past report.

Next Steps

- Click here to access our complete index of 358 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:APOTEA

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives