- Spain

- /

- Renewable Energy

- /

- BME:ADX

Reflecting on Audax Renovables' (BME:ADX) Share Price Returns Over The Last Year

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the Audax Renovables, S.A. (BME:ADX) share price is down 19% in the last year. That contrasts poorly with the market decline of 6.4%. We wouldn't rush to judgement on Audax Renovables because we don't have a long term history to look at. Unfortunately the last month hasn't been any better, with the share price down 23%. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

See our latest analysis for Audax Renovables

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Audax Renovables share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

In contrast, the 14% drop in revenue is a real concern. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

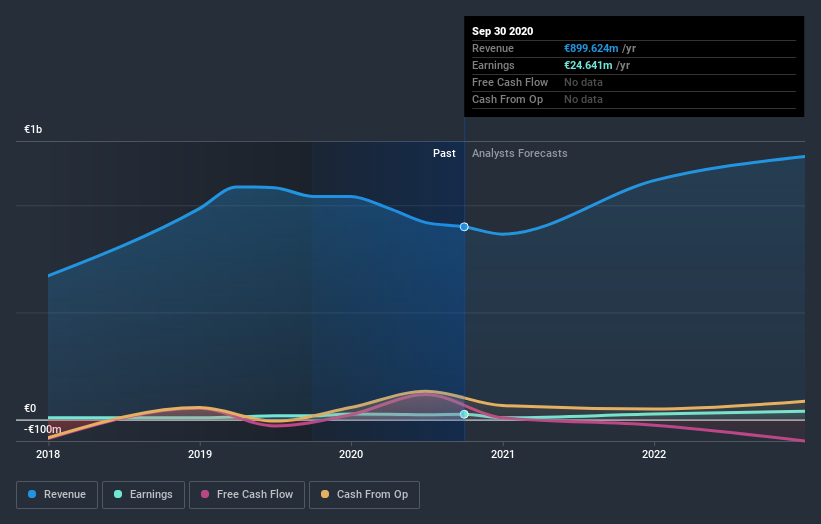

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We doubt Audax Renovables shareholders are happy with the loss of 19% over twelve months. That falls short of the market, which lost 6.4%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 7.9% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Audax Renovables has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

Of course Audax Renovables may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

When trading Audax Renovables or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:ADX

Audax Renovables

Engages in the generation and supplying of renewable electricity and gas in Spain, Portugal, Italy, Poland, Germany, Netherlands, France, Panama, and Hungary.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026