- Switzerland

- /

- Construction

- /

- SWX:BRKN

Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of recent Federal Reserve rate cuts and looming political uncertainties, investors are keeping a close eye on economic indicators that suggest both caution and opportunity. In this environment, dividend stocks can offer a compelling choice for those seeking steady income streams amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Logista Integral (BME:LOG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Logista Integral, S.A. operates as a distributor and logistics operator in Spain, France, Italy, Portugal, and Poland with a market cap of €3.85 billion.

Operations: Logista Integral, S.A.'s revenue is primarily derived from Tobacco and Related Products (€12.09 billion), with additional contributions from Transport Services (€889.98 million) and Pharmaceutical Distribution (€273.42 million).

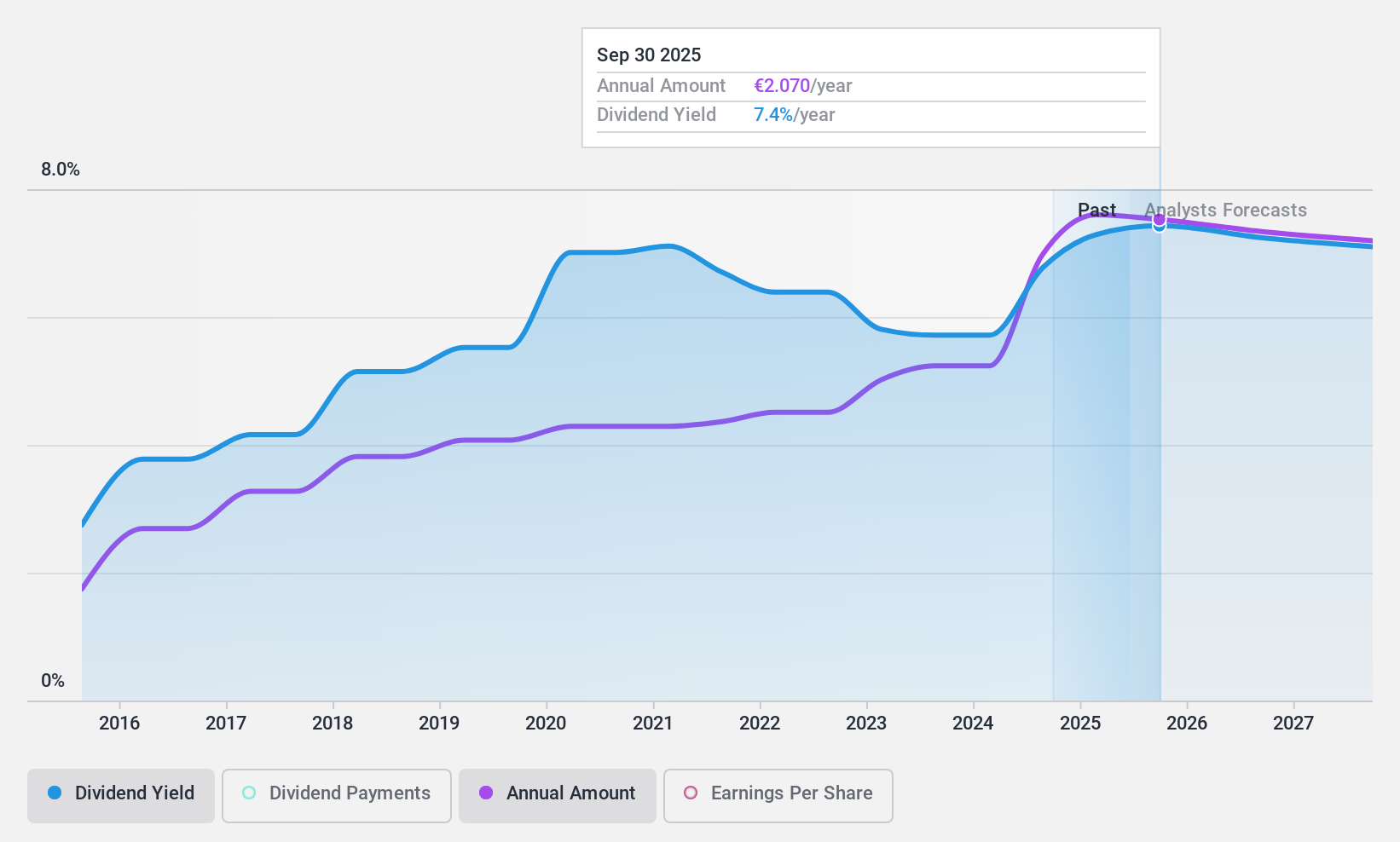

Dividend Yield: 7.2%

Logista Integral proposed a 2024 dividend of €2.09 per share, marking a 30% increase from last year, supported by earnings growth and strong cash flow coverage. Despite trading below estimated fair value and offering a top-tier yield of 7.16%, dividends have been volatile historically, with an 89.5% payout ratio indicating limited flexibility for future increases without corresponding profit growth. Recent earnings rose to €308.24 million on sales of €12.99 billion, reflecting solid financial performance.

- Click to explore a detailed breakdown of our findings in Logista Integral's dividend report.

- According our valuation report, there's an indication that Logista Integral's share price might be on the cheaper side.

Evli Oyj (HLSE:EVLI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Evli Oyj is an asset management company that provides services to institutional, corporate, and private clients in Finland, Sweden, and internationally, with a market cap of €466.13 million.

Operations: Evli Oyj generates its revenue through three main segments: Group Operations (€9.20 million), Advisory and Corporate Clients (€12.80 million), and Wealth Management and Investor Clients (€91.10 million).

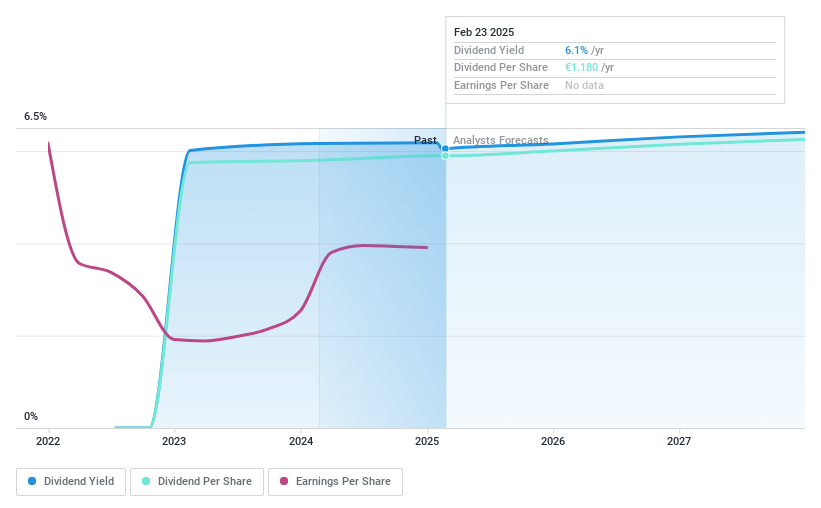

Dividend Yield: 6.6%

Evli Oyj offers a compelling dividend yield of 6.59%, ranking in the top 25% of Finnish dividend payers, supported by a reasonable payout ratio of 68.5%. Despite only two years of dividend history, payments have grown and remain stable. However, high debt levels and forecasted earnings decline pose potential risks. Recent earnings show significant growth with net income rising to €37.7 million for nine months in 2024, enhancing its financial position amidst valuation below fair value estimates.

- Click here to discover the nuances of Evli Oyj with our detailed analytical dividend report.

- Our valuation report unveils the possibility Evli Oyj's shares may be trading at a discount.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burkhalter Holding AG, with a market cap of CHF958.52 million, operates through its subsidiaries to offer electrical engineering services to the construction sector in Switzerland.

Operations: Burkhalter Holding AG generates revenue of CHF1.18 billion through its electrical engineering services in Switzerland's construction sector.

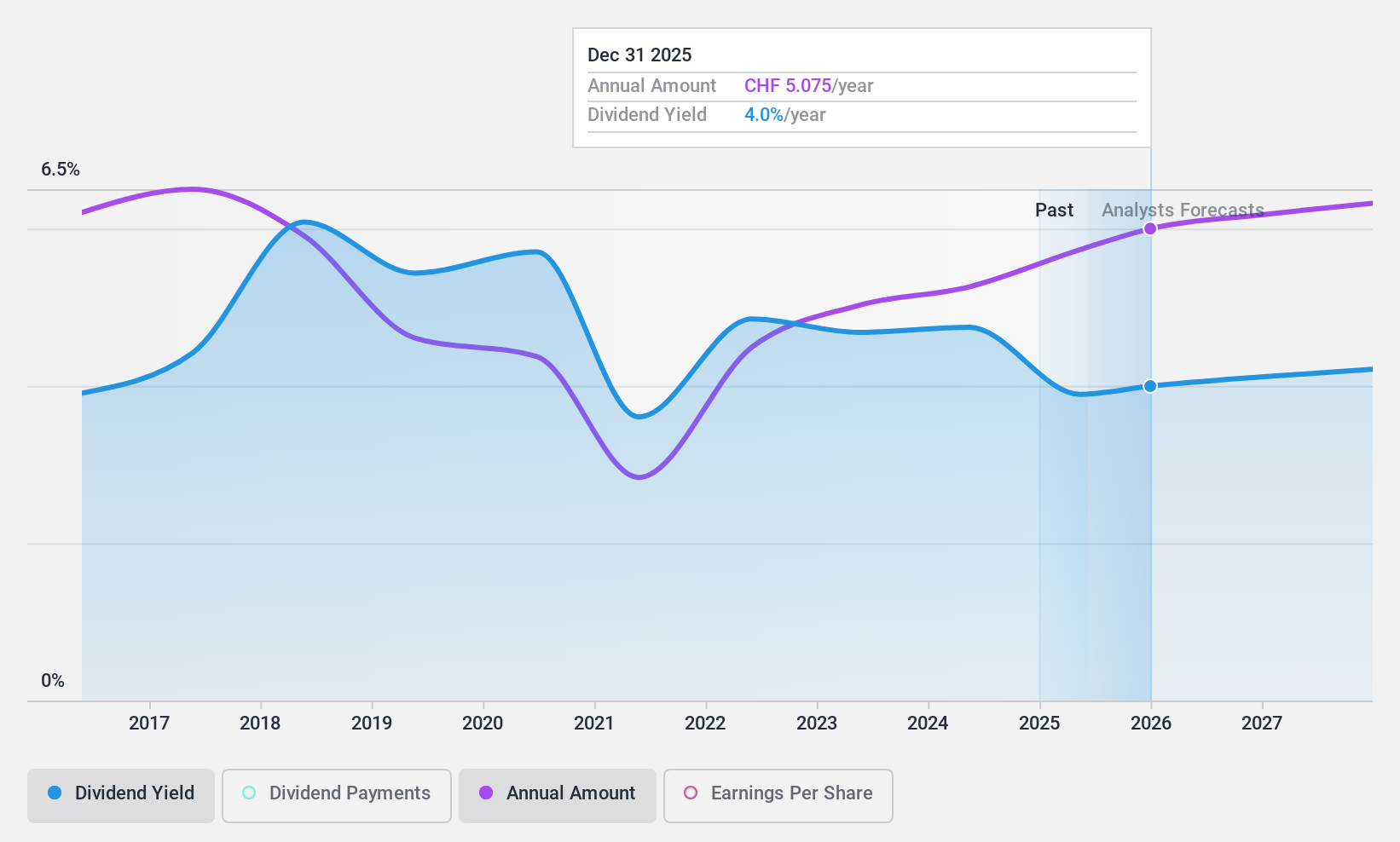

Dividend Yield: 4.9%

Burkhalter Holding's dividend yield of 4.93% places it among the top 25% in the Swiss market, with a payout ratio of 87.4% indicating coverage by earnings. The cash payout ratio is also reasonable at 59.7%. However, its dividend history is marked by volatility and unreliability over the past decade, despite some growth in payments. While earnings grew by 10.3% last year and are forecasted to continue growing modestly, high debt levels remain a concern for sustainability.

- Get an in-depth perspective on Burkhalter Holding's performance by reading our dividend report here.

- Our expertly prepared valuation report Burkhalter Holding implies its share price may be too high.

Next Steps

- Take a closer look at our Top Dividend Stocks list of 1968 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burkhalter Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BRKN

Burkhalter Holding

Through its subsidiaries, provides electrical engineering services to the construction sector primarily in Switzerland.

Established dividend payer with adequate balance sheet.

Market Insights

Community Narratives