- Spain

- /

- Communications

- /

- BME:EZE

Investors in Grupo Ezentis (BME:EZE) from five years ago are still down 74%, even after 72% gain this past week

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Spare a thought for those who held Grupo Ezentis, S.A. (BME:EZE) for five whole years - as the share price tanked 74%.

The recent uptick of 72% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Grupo Ezentis

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During five years of share price growth, Grupo Ezentis moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Arguably, the revenue drop of 19% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

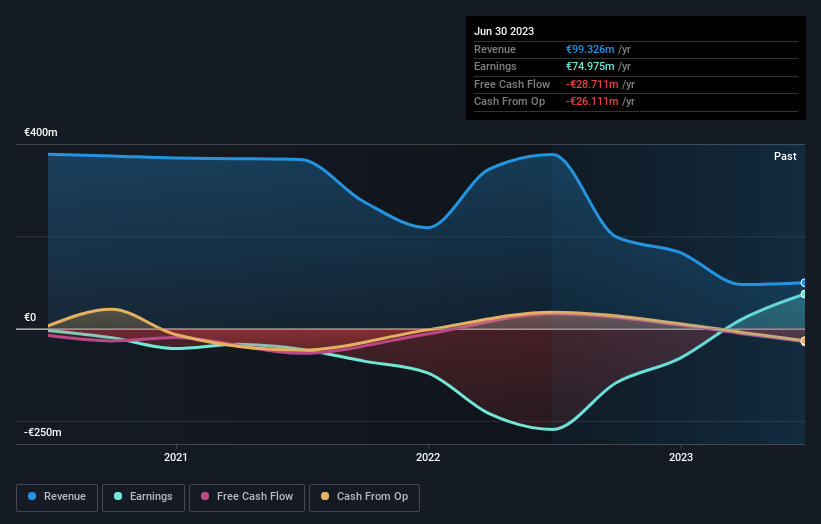

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Grupo Ezentis' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Grupo Ezentis shareholders have received a total shareholder return of 72% over one year. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Grupo Ezentis better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Grupo Ezentis (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

But note: Grupo Ezentis may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Spanish exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:EZE

Slight and overvalued.