Indra Sistemas (BME:IDR): Valuation Perspectives Following U.S. Debut of C-V2X Tolling Technology

Reviewed by Simply Wall St

If you are following Indra Sistemas (BME:IDR), the recent announcement that its connected vehicle tolling solution, C-V2X Toll, will be implemented on North Carolina’s I-485 Express Lanes may have caught your attention. This marks the first time such advanced tolling technology is being integrated into a U.S. highway. It signals not just a technical milestone but also a potential shift in how toll infrastructure and vehicle connectivity might evolve across the country. For current and prospective shareholders, this development could mean far-reaching implications for Indra’s presence in the U.S. market and its future growth trajectory.

Zooming out, Indra Sistemas has notched steady gains throughout the year, with its stock climbing nearly 100% over the past twelve months. Its three-year return sits comfortably above threefold. This momentum comes even as short-term prices have recently softened, suggesting that while some investors are locking in profits, others may be reassessing the company’s risk profile as it pushes into new technological territory. Alongside headline projects like the I-485 rollout, its expansion across major highways in the U.S. positions Indra as a unique contender in the advanced mobility landscape.

As the stock continues to ride this wave of innovation and global expansion, investors may be considering whether there is still an opportunity to invest at compelling value, or whether the market has already priced in the promise of future growth.

Most Popular Narrative: 19.6% Undervalued

According to the most widely followed narrative, Indra Sistemas is currently viewed as undervalued, with a calculated fair value notably higher than the current share price. This narrative draws on strong earnings growth and strategic industry shifts to justify its outlook.

The substantial acceleration of defense spending in Spain and across Europe, including the EU's ReArm Europe Plan and multi-year national budgets focused on strategic autonomy and onshoring of defense manufacturing, is set to drive a material expansion of Indra's order book and recurring revenue base. This supports robust long-term revenue growth and increased visibility.

Think the recent bull run is over? Not so fast. This narrative hinges on ambitious growth targets, evolving profit margins, and a reimagined future multiple that alters typical industry forecasts. Wondering which assumptions underpin this optimistic valuation and how Indra might defy expectations? The answers may challenge everything you know about traditional valuation models.

Result: Fair Value of €40.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts in defense spending or government contracts, as well as mounting challenges in global expansion, could put meaningful pressure on Indra's growth outlook.

Find out about the key risks to this Indra Sistemas narrative.Another View: DCF Model Puts a Twist on the Story

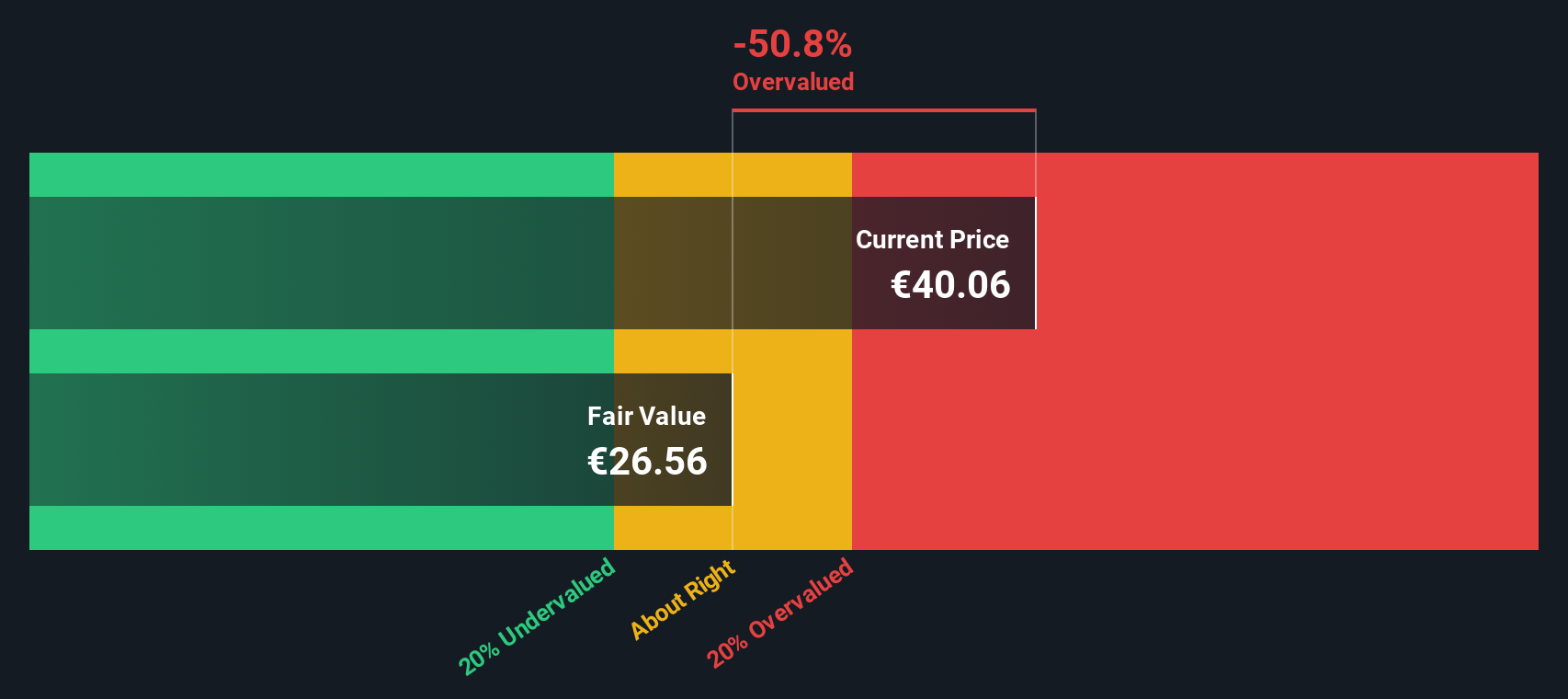

While analysts see strong upside based on future growth and industry trends, our DCF model challenges that optimism. It suggests the stock may not be as cheap as it looks. Which outlook holds up best?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Indra Sistemas Narrative

If you want to draw your own conclusions or dig into the numbers firsthand, you have all the tools to build an alternative perspective. Set up your own in minutes. Do it your way

A great starting point for your Indra Sistemas research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let fresh opportunities slip by. Tap into unique trends and market potential with our powerful investment screeners. The next big idea could be just a click away.

- Uncover stocks with reliable payouts and secure your portfolio with the yield advantage of dividend stocks with yields > 3%.

- Tap into rapid advancements in data and automation by finding market leaders driving tomorrow’s innovations through AI penny stocks.

- Spot shares trading below their intrinsic value and maximize your future returns using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:IDR

Indra Sistemas

Operates as a technology and consulting company for aerospace, defense, and mobility business worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success