- Spain

- /

- Specialty Stores

- /

- BME:ITX

Will Investor Buzz Around H1 2026 Results Shift Industria de Diseño Textil’s (BME:ITX) Narrative?

Reviewed by Simply Wall St

- Industria de Diseño Textil completed its H1 2026 earnings call on September 10, 2025, drawing significant investor attention ahead of the event.

- An increase in trending user interest suggests that expectations around these financial results played a substantial role in recent market sentiment.

- We'll explore how anticipation for the H1 2026 earnings call could influence Industria de Diseño Textil's investment outlook and future catalysts.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Industria de Diseño Textil Investment Narrative Recap

To be a shareholder in Industria de Diseño Textil, you need to believe in its ability to drive global growth through expanding logistics and technology integration while maintaining profitability amid a competitive retail sector. The recent H1 2026 earnings call provided incremental updates, but the most important short-term catalyst remains operational progress rather than headline results; risks such as growing inventories and currency pressures linger and do not appear materially altered by this news.

Among recent announcements, the significant capital expenditure of €1.8 billion earmarked for logistics infrastructure is especially relevant, as it underpins Inditex's primary growth catalyst cited by analysts: scaling operations to unlock new market opportunities and improve long-term efficiency. This focus may help the company buffer against sector risks if executed efficiently, though near-term financial impacts warrant close investor attention.

However, while the investment story is one of innovation and expansion, investors should also be aware of inventory growth and what that could mean for...

Read the full narrative on Industria de Diseño Textil (it's free!)

Industria de Diseño Textil's narrative projects €46.4 billion revenue and €7.3 billion earnings by 2028. This requires 6.2% yearly revenue growth and a €1.4 billion earnings increase from €5.9 billion today.

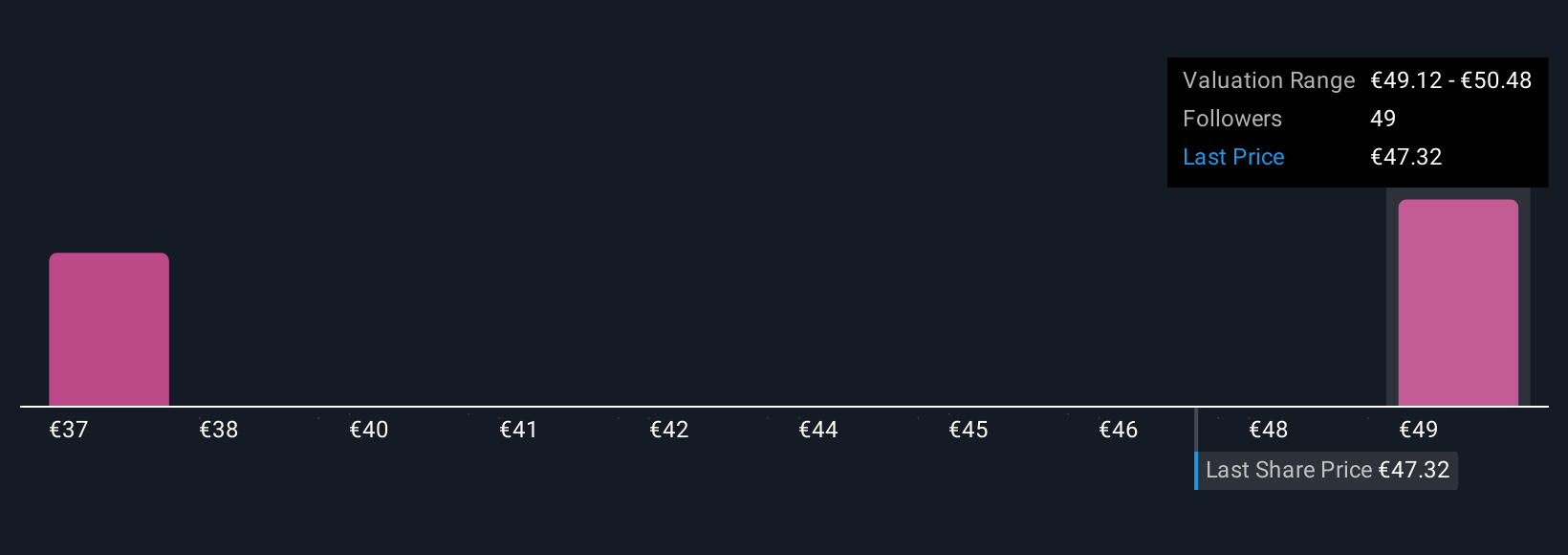

Uncover how Industria de Diseño Textil's forecasts yield a €50.48 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community investors set fair value estimates for Inditex between €37.41 and €50.48 across four independent forecasts. Against these wide-ranging opinions, rising inventories still present a key operational question that shapes future earnings quality, explore how these diverse viewpoints may impact your outlook.

Explore 4 other fair value estimates on Industria de Diseño Textil - why the stock might be worth as much as 18% more than the current price!

Build Your Own Industria de Diseño Textil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Industria de Diseño Textil research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Industria de Diseño Textil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Industria de Diseño Textil's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ITX

Industria de Diseño Textil

Engages in the retail and online distribution of clothing, footwear, accessories, and household products in Spain, rest of Europe, the Americas, Asia, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives