- Spain

- /

- Specialty Stores

- /

- BME:ITX

How Should Investors View Inditex After Its Shares Jumped 15% This Month?

Reviewed by Bailey Pemberton

Thinking about whether to buy, sell or hold Industria de Diseño Textil? You are not alone. Investors have seen a whirlwind of movement recently, with the stock closing at 48.35 and posting an impressive 6.7% gain over just the past week. Over the past month, the rally has been even sharper, up 14.9%. That short-term momentum stands in stark contrast to the company’s year-to-date and one-year returns, which remain in negative territory at -3.9% and -4.3% respectively. If you zoom out for a longer view, the stock’s record is hard to ignore. It has posted growth of 144.7% over the last three years and 128.5% across five years, suggesting substantial value creation for early believers.

Some of these shifts align with broader market optimism for retail and textile brands, as changing consumer trends and global supply chain improvements have nudged the sector higher. As investors increasingly re-evaluate risk amid evolving interest rates and consumer spending patterns, a company like Industria de Diseño Textil stands out as a potential beneficiary, or as a case study in volatility depending on your vantage point.

So, is the stock a bargain or fully priced? A quick look at the numbers gives Industria de Diseño Textil a valuation score of 2 out of 6 possible checks, indicating undervaluation. We are about to break down what that means by examining each major valuation approach. But remember, there is more to the story. Later in the article, we will also discuss an even smarter way investors are sizing up value today.

Industria de Diseño Textil scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Industria de Diseño Textil Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting those values back to today’s terms. This approach is designed to capture both the current financial strength and the long-term earning power of the business.

For Industria de Diseño Textil, the latest twelve months of Free Cash Flow is approximately €6.28 billion. Analyst forecasts extend five years ahead, with projections further extrapolated beyond that period. For example, cash flows are expected to grow from €4.78 billion in 2026 to €11.14 billion in 2035, indicating a robust outlook for ongoing earnings power.

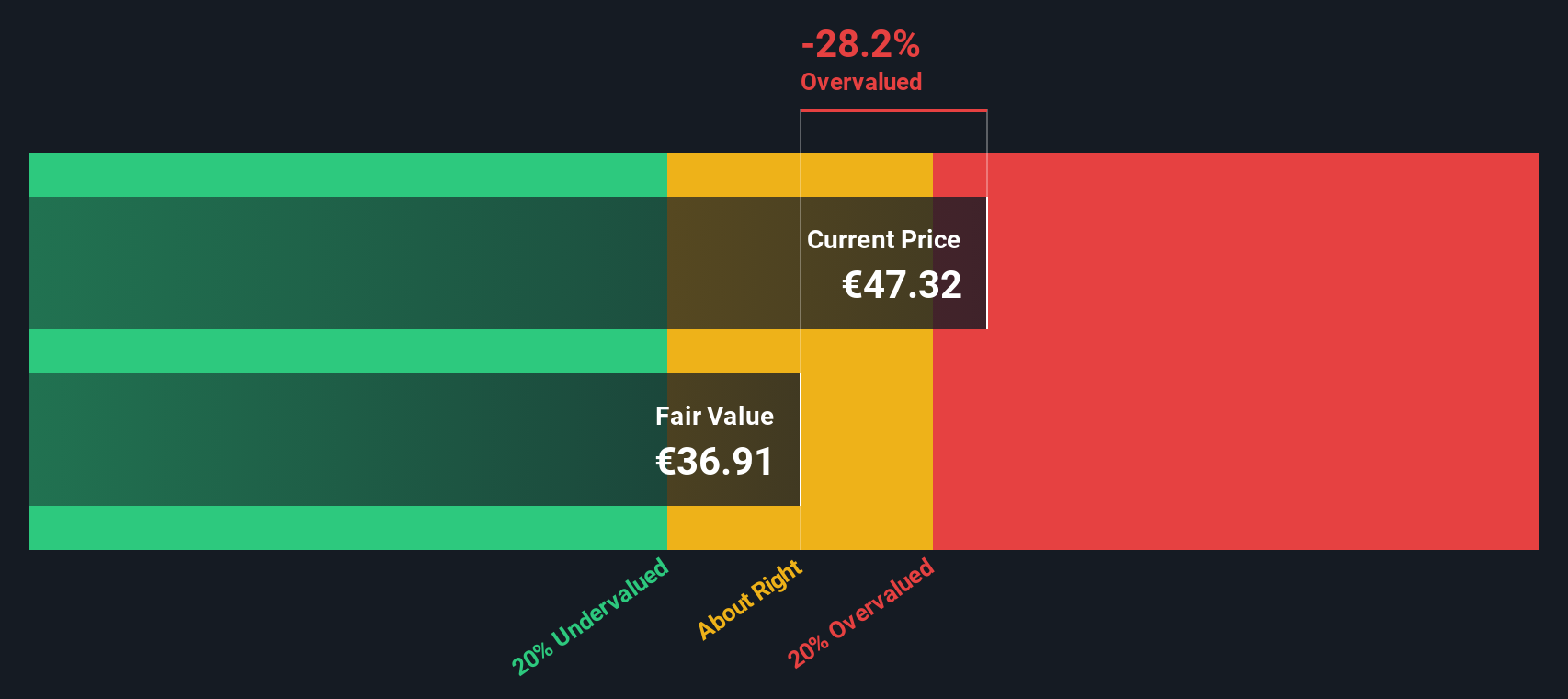

Based on these projections, the DCF model calculates a fair value of €36.80 per share. With Industria de Diseño Textil currently trading at €48.35, this suggests the stock is about 31.4% overvalued by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Industria de Diseño Textil may be overvalued by 31.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Industria de Diseño Textil Price vs Earnings

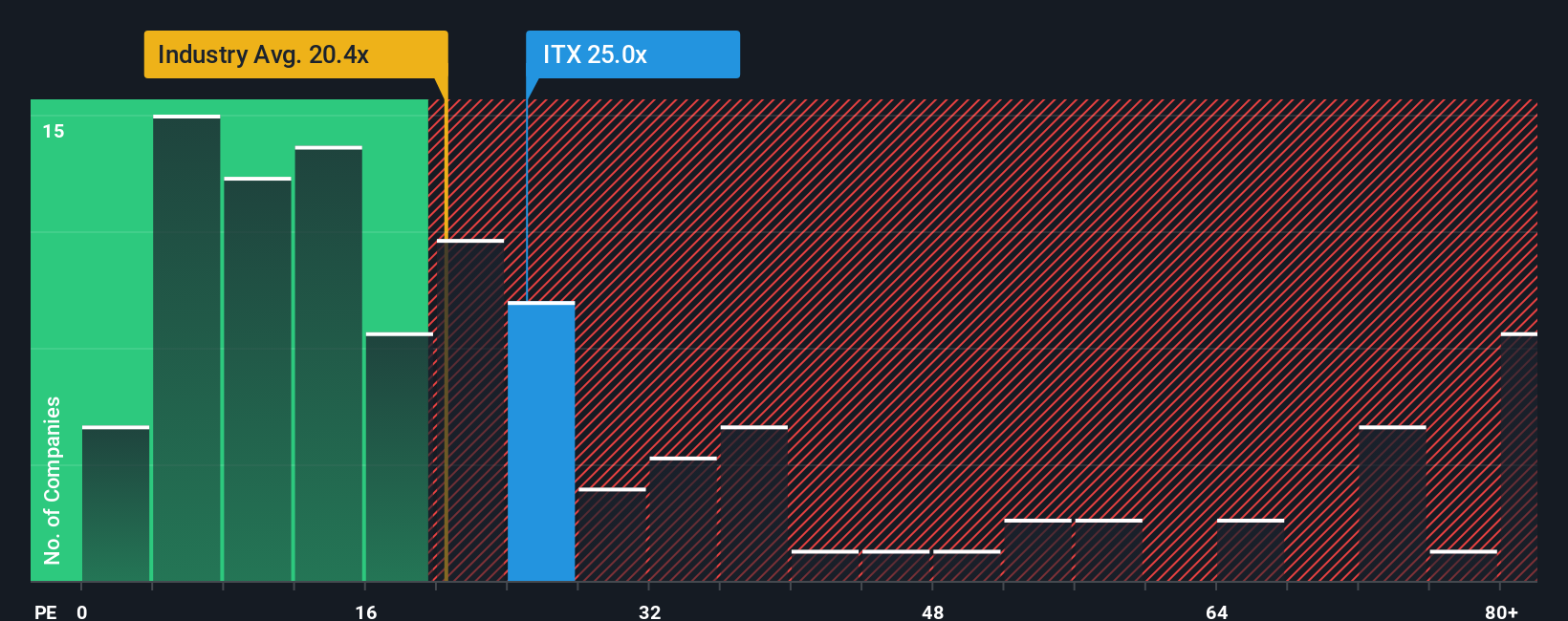

For profitable businesses like Industria de Diseño Textil, the Price-to-Earnings (PE) ratio is a widely used valuation tool. The PE ratio lets investors see how much they are paying today for each euro of company earnings. A higher ratio usually assumes more growth ahead or less risk, while a lower one can indicate limited growth prospects or higher risks.

Currently, Industria de Diseño Textil trades at a PE ratio of 25.6x. This is notably above the broader Specialty Retail industry average of 16.8x, but slightly below the average of its direct peers at 29.3x. This suggests investors are pricing in stronger prospects and/or lower perceived risk than the overall sector, though less optimism than its closest competitors.

The Simply Wall St Fair Ratio for Industria de Diseño Textil is 32.3x. Unlike comparisons to generic industry or peer benchmarks, the Fair Ratio accounts for factors including the company’s expected earnings growth, profit margins, business risks, market cap, and specific industry context. This comprehensive approach gives investors a clearer sense of whether the current PE multiple is justified.

Comparing the Fair Ratio of 32.3x to the current PE of 25.6x suggests that Industria de Diseño Textil is trading at a discount to its intrinsic valuation, indicating there could be untapped value in the stock at today’s price.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Industria de Diseño Textil Narrative

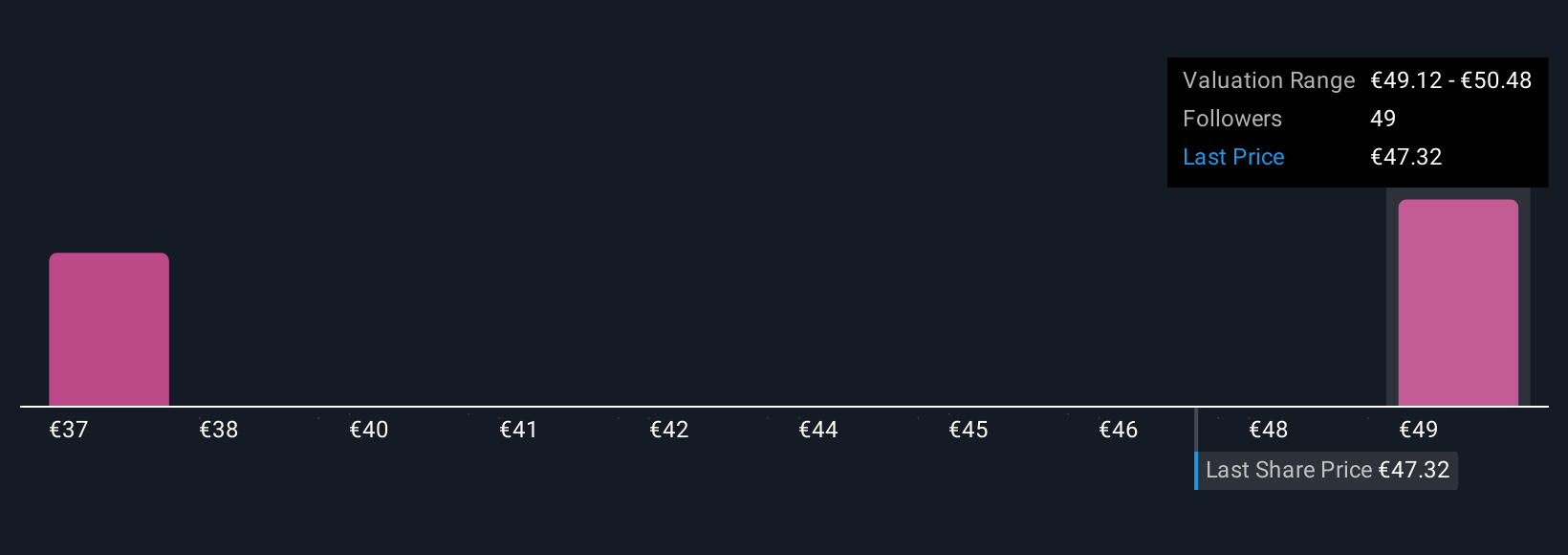

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story about a company, combining your assumptions about the future such as expected revenue growth, earnings and profit margins with what you believe the shares are worth today. On Simply Wall St’s Community page, creating a Narrative is easy and accessible for any investor; millions are already using this feature to connect the company’s story to its financial forecast and ultimately determine a fair value.

Instead of focusing only on static multiples or forecasts, Narratives let you adjust your expectations as new information emerges, such as earnings announcements or news events, so your strategy always stays relevant. With Narratives, you can instantly compare your fair value estimate against the current share price to decide whether it might be time to buy, hold, or sell. For example, on Industria de Diseño Textil, some investors have set their Narrative price target as high as €60.0 based on optimism about logistics expansion and technology integration, while the most cautious believe fair value could be as low as €38.4 if risks from competition and global uncertainty weigh the business down.

Do you think there's more to the story for Industria de Diseño Textil? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ITX

Industria de Diseño Textil

Engages in the retail and online distribution of clothing, footwear, accessories, and household products in Spain, rest of Europe, the Americas, Asia, and internationally.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives