- Spain

- /

- Specialty Stores

- /

- BME:ITX

Assessing Inditex (BME:ITX) Valuation After Earnings Lift IBEX 35 to New Highs

Reviewed by Simply Wall St

Industria de Diseño Textil (BME:ITX) just posted higher nine month sales and earnings, and the market reacted quickly as the stock climbed while the IBEX 35 pushed to fresh highs.

See our latest analysis for Industria de Diseño Textil.

The latest nine month numbers appear to have reignited interest in Industria de Diseño Textil, with a 26.38% 90 day share price return and a hefty 141.82% three year total shareholder return suggesting momentum is still building rather than fading.

If this earnings pop has you thinking more broadly about retail and consumer names, it might be worth exploring fast growing stocks with high insider ownership as another source of potential ideas.

With earnings still grinding higher and the share price hovering just below analyst targets, the key question now is whether Industria de Diseño Textil is still undervalued or if the market is already pricing in its future growth?

Most Popular Narrative Narrative: 1.9% Undervalued

With Industria de Diseño Textil closing at €53.90 against a narrative fair value near €54.93, the valuation gap is slim but still positive.

The analysts have a consensus price target of €50.483 for Industria de Diseño Textil based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €60.0, and the most bearish reporting a price target of just €38.4.

Want to see how steady mid single digit growth, margin creep, and a richer earnings multiple combine into that fair value call? The full narrative unpacks the specific revenue path, profitability lift, and valuation jump that have to line up almost perfectly for this price to hold.

Result: Fair Value of €54.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, currency headwinds and rising inventory levels could quickly challenge today’s upbeat assumptions if growth slows or margin gains prove harder to defend.

Find out about the key risks to this Industria de Diseño Textil narrative.

Another Take: Market Ratios Tell A Different Story

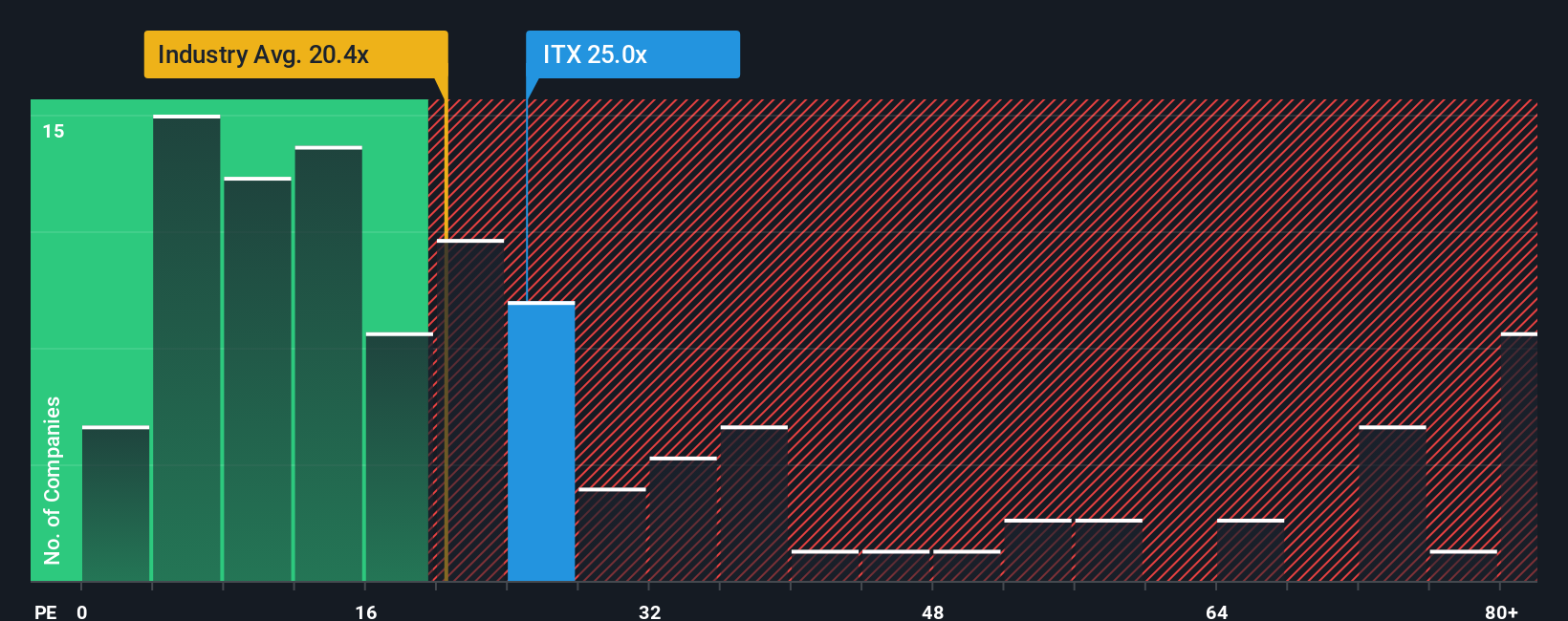

Step away from narratives and the picture shifts. On a price to earnings basis, Industria de Diseño Textil trades at 27.8 times earnings, richer than the European specialty retail average of 18.4 times, yet still below its own fair ratio of 33.3 times. Is that a cushion or a warning sign if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Industria de Diseño Textil for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Industria de Diseño Textil Narrative

If you see the story differently or want to stress test the assumptions with your own research, you can build a fresh view in minutes: Do it your way.

A great starting point for your Industria de Diseño Textil research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Use the Simply Wall St Screener now to uncover fresh, data driven opportunities so you are not the one hearing about the best ideas after they move.

- Secure potential bargains by targeting quality companies trading below their estimated worth with these 902 undervalued stocks based on cash flows.

- Tap into cutting edge innovation and growth by focusing on businesses powering the next wave of automation and intelligence through these 27 AI penny stocks.

- Strengthen your income stream by pinpointing reliable payers using these 15 dividend stocks with yields > 3% and keep your portfolio working harder for you.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ITX

Industria de Diseño Textil

Engages in the retail and online distribution of clothing, footwear, accessories, and household products in Spain, rest of Europe, the Americas, Asia, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026