- Spain

- /

- Retail REITs

- /

- BME:PR2

Corpfin Capital Prime Retail II SOCIMI (BME:YPR2) Long Term Shareholders are 49% In The Black

Investors are understandably disappointed when a stock they own declines in value. But it can difficult to make money in a declining market. The Corpfin Capital Prime Retail II, SOCIMI, S.A. (BME:YPR2) is down 62% over three years, but the total shareholder return is 49% once you include the dividend. That's better than the market which declined 0.6% over the last three years.

Check out our latest analysis for Corpfin Capital Prime Retail II SOCIMI

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

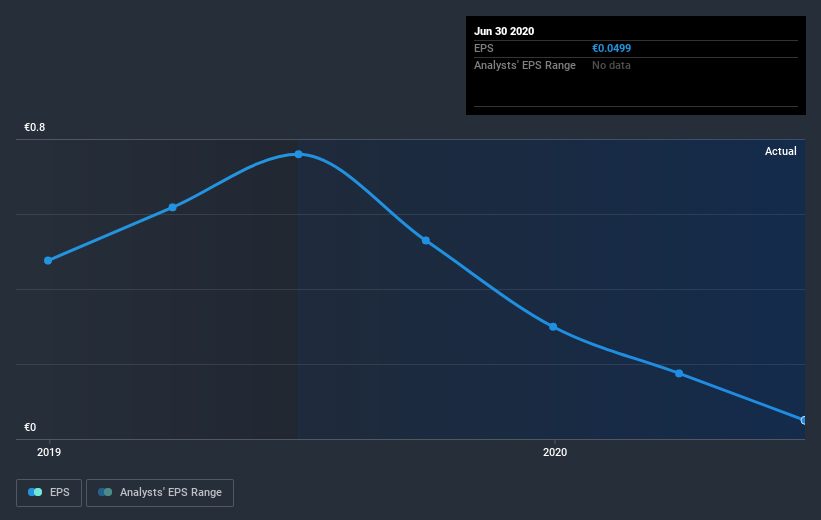

Corpfin Capital Prime Retail II SOCIMI saw its EPS decline at a compound rate of 30% per year, over the last three years. This change in EPS is reasonably close to the 27% average annual decrease in the share price. So it seems that investor expectations of the company are staying pretty steady, despite the disappointment. In this case, it seems that the EPS is guiding the share price.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Dive deeper into Corpfin Capital Prime Retail II SOCIMI's key metrics by checking this interactive graph of Corpfin Capital Prime Retail II SOCIMI's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Corpfin Capital Prime Retail II SOCIMI's share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Corpfin Capital Prime Retail II SOCIMI's TSR, at 49% is higher than its share price return of -62%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market lost about 1.8% in the twelve months, Corpfin Capital Prime Retail II SOCIMI shareholders did even worse, losing 2.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Corpfin Capital Prime Retail II SOCIMI , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you’re looking to trade Corpfin Capital Prime Retail II SOCIMI, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Corpfin Capital Prime Retail II SOCIMI, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:PR2

Corpfin Capital Prime Retail II SOCIMI

Slight and overvalued.

Market Insights

Community Narratives