Grifols (BME:GRF) Valuation: Is Recent Momentum Signaling an Opportunity for Investors?

Reviewed by Simply Wall St

Grifols (BME:GRF) has recently been drawing attention among investors, and for good reason. The absence of a standout event does not mean the story is dull. Sometimes, the real signal is in the silence. When there is no single headline driving movement, it is natural for investors to wonder if the current trading activity hints at a turning point or just daily market noise.

Looking at Grifols’ stock performance this past year, the picture is more dynamic than it appears at first glance. Over the last twelve months, shares are up 35%, led by renewed momentum in the past three months, even after some pullback over the past month. This comes alongside a year of steady revenue expansion and a significant jump in net income, factors not always reflected directly in the share price.

After a run like this, the question is obvious: is Grifols undervalued right now, or has the market already caught on to its future growth story?

Most Popular Narrative: 24.7% Undervalued

According to the most widely followed narrative, Grifols is currently trading at a steep discount to its fair value. This suggests the stock could have significant upside if consensus analyst forecasts are achieved.

Grifols' investments in expanding and optimizing its global plasma collection network, combined with advanced process innovations (such as nomogram adoption and digitalization), are boosting plasma volumes and operating efficiencies. This is translating into improved gross and EBITDA margins, supporting future earnings growth.

Curious what is driving this bullish outlook? The narrative’s fair value is based on an ambitious set of growth assumptions centered around new therapy launches, expanding margins, and double-digit earnings targets. Can Grifols really deliver on this roadmap? Discover what makes this stock’s potential too compelling to ignore as analysts examine the numbers behind their projected price target.

Result: Fair Value of €16.48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent pricing pressure in key markets or operational disruptions at plasma collection centers could quickly undermine even the most optimistic forecasts.

Find out about the key risks to this Grifols narrative.Another View: A Different Valuation Lens

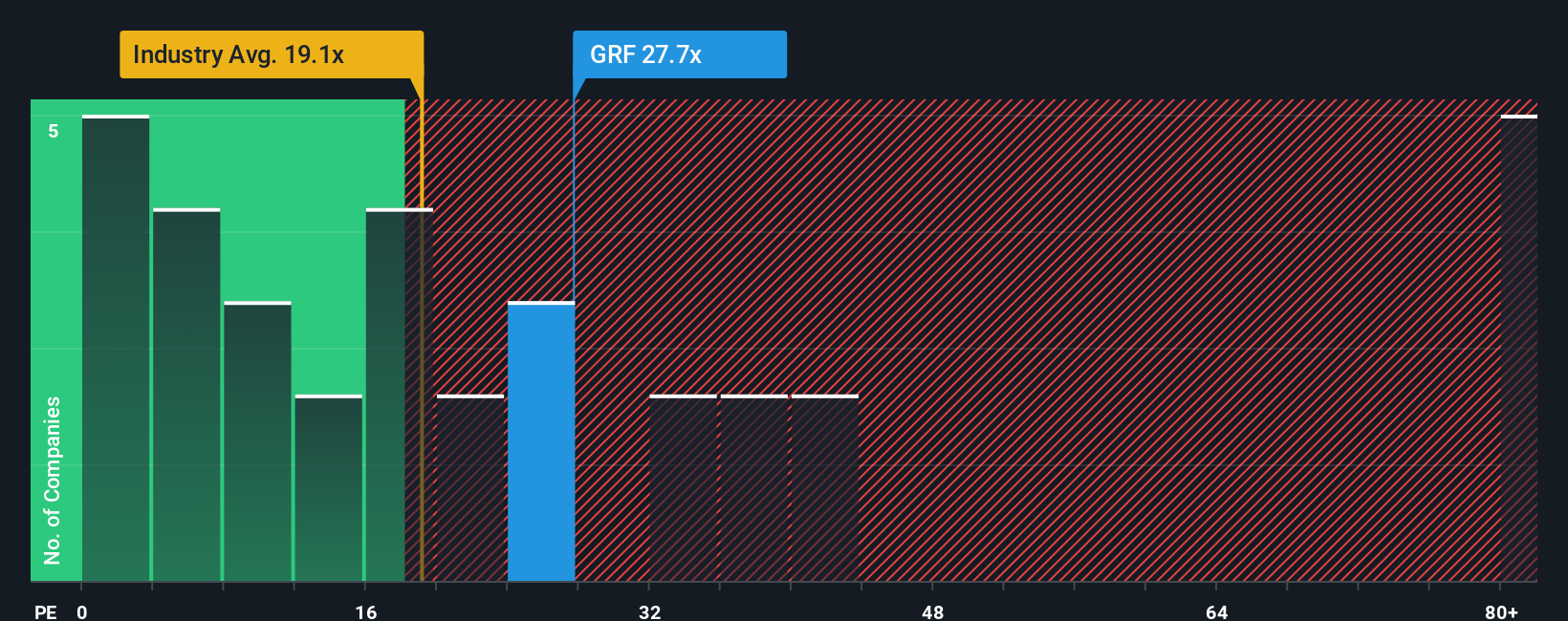

Looking through another lens, Grifols’ valuation compared to its industry peers suggests the stock might not be as much of a bargain as it first appears. Could the market be onto something others are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grifols Narrative

If you are curious to see how your own perspective compares, you can dig into the figures and shape your own analysis in just a few minutes. Do it your way.

A great starting point for your Grifols research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Give yourself the edge by seeking out new opportunities before the crowd. Let the Simply Wall Street Screener spark your next smart investment move.

- Tap into the explosive growth of artificial intelligence by checking out AI penny stocks. These stocks are set to reshape industries and power tomorrow’s breakthroughs.

- Snag bargains others might miss by scouting undervalued stocks based on cash flows for companies with strong fundamentals and potential for growth.

- Uncover companies transforming payments and digital security as you scan cryptocurrency and blockchain stocks for businesses positioned at the forefront of blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BME:GRF

Grifols

Operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives