- China

- /

- Electronic Equipment and Components

- /

- SZSE:002456

Exploring High Growth Tech Stocks In February 2025

Reviewed by Simply Wall St

As global markets navigate a volatile start to 2025, with the Federal Reserve holding rates steady and AI competition shaking up the tech sector, investors are closely watching how these dynamics impact high-growth opportunities. In this climate of rapid technological advancements and shifting economic indicators, identifying promising tech stocks involves assessing their innovation potential and resilience in adapting to emerging challenges like those posed by new AI developments.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1222 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

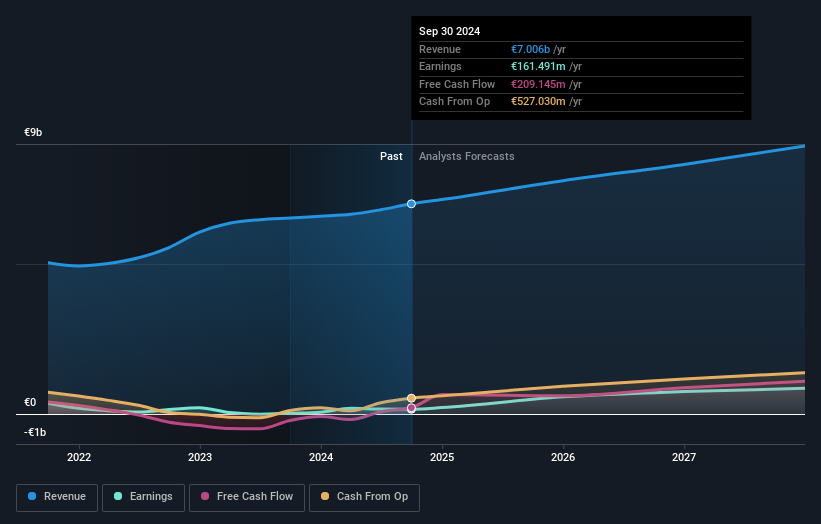

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grifols, S.A. is a plasma therapeutic company with operations in Spain, the United States, Canada, and internationally, and has a market capitalization of approximately €5.29 billion.

Operations: Grifols generates revenue primarily from its Biopharma segment, contributing approximately €5.95 billion, followed by the Diagnostic and Bio Supplies segments with €651.33 million and €204.55 million, respectively.

Grifols, a player in the biotech sector, recently secured €1.3 billion through debt financing to streamline its financial structure, demonstrating proactive financial management amidst market challenges. Despite significant earnings growth of 590.4% over the past year outpacing the industry's decline of 18.2%, concerns from investor activism highlight potential governance issues that could impact future performance and shareholder value. The company's strategic focus on R&D is evident with a notable allocation towards innovation, essential for maintaining competitiveness in biotechnology—a field where continuous advancement is critical.

- Click here to discover the nuances of Grifols with our detailed analytical health report.

Review our historical performance report to gain insights into Grifols''s past performance.

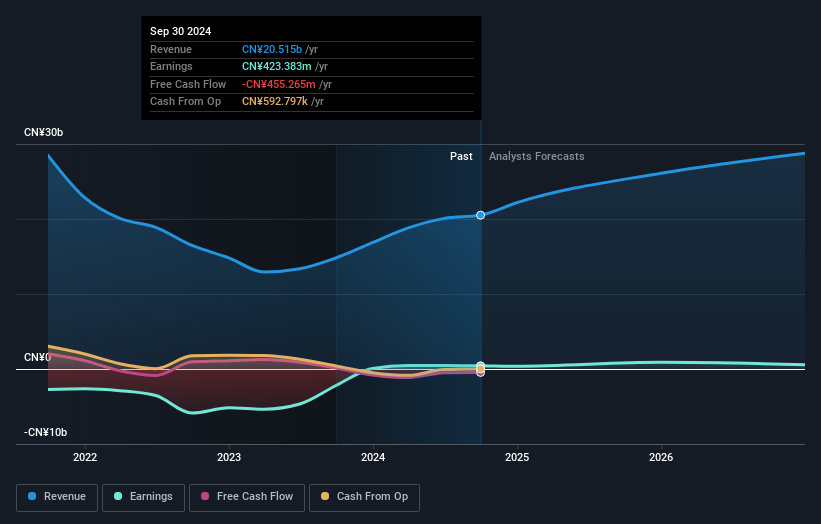

OFILM Group (SZSE:002456)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OFILM Group Co., Ltd. engages in the manufacturing and sale of optic and optoelectronic products both domestically in China and internationally, with a market capitalization of approximately CN¥42.42 billion.

Operations: The company generates revenue primarily from the manufacturing of optics and optoelectronic components, amounting to CN¥20.52 billion.

OFILM Group has shown a notable transition in its financial landscape, with a recent approval to amend its bylaws potentially streamlining operations for enhanced efficiency. This change comes as the company's earnings are expected to grow by 26.9% annually, outpacing the Chinese market's average of 25.3%. Despite challenges in maintaining free cash flow positivity, OFILM has managed an impressive annual revenue growth rate of 14.8%, slightly ahead of the broader market's 13.5%. These developments indicate a strategic pivot towards optimizing future growth prospects and shareholder engagement, underscored by significant R&D investments that align with industry demands for continuous innovation in technology sectors.

- Navigate through the intricacies of OFILM Group with our comprehensive health report here.

Assess OFILM Group's past performance with our detailed historical performance reports.

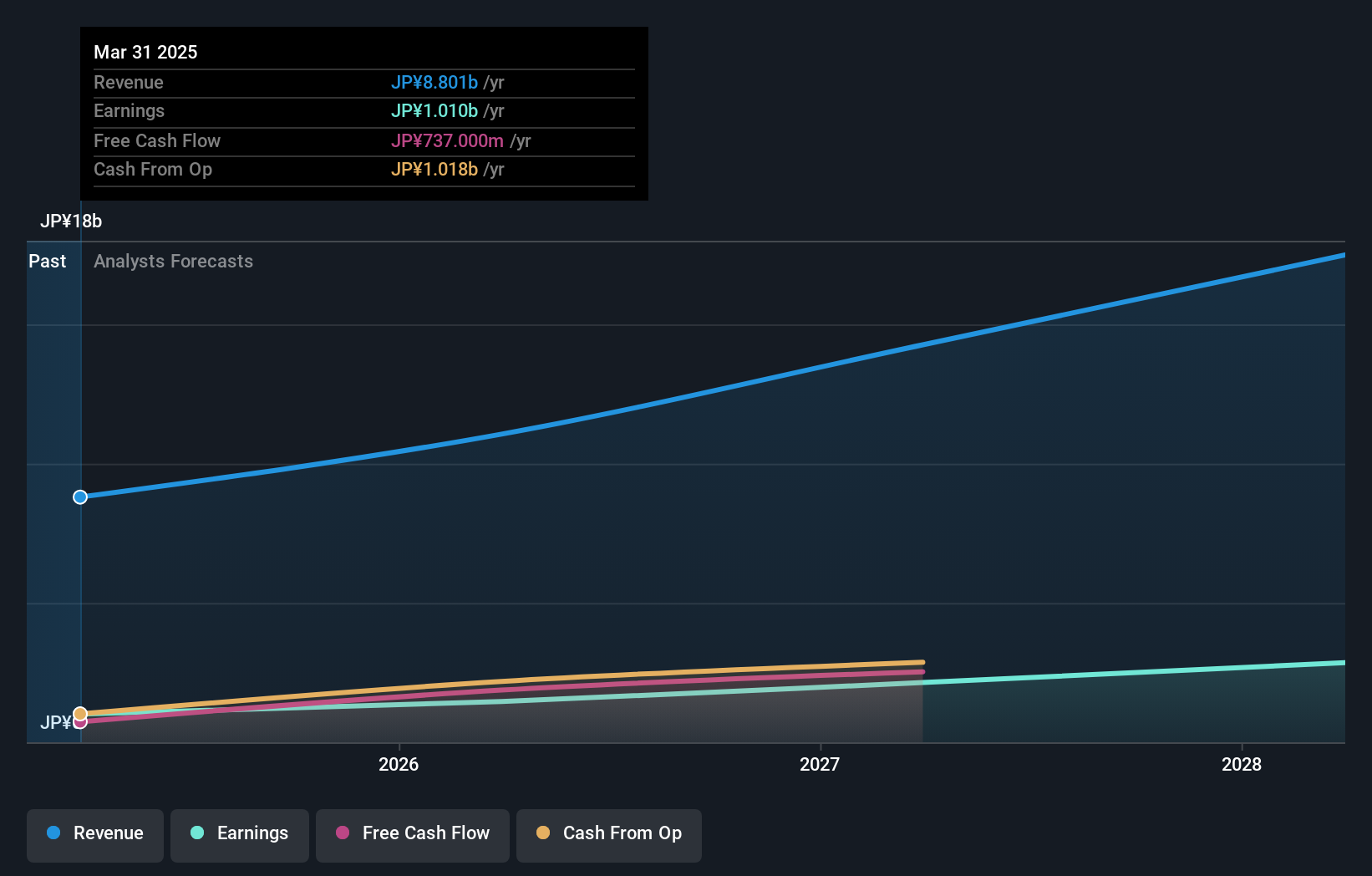

Global Security Experts (TSE:4417)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Global Security Experts Inc. is a Japanese company specializing in cybersecurity education, with a market capitalization of ¥41.27 billion.

Operations: The company generates revenue through its specialized cybersecurity education services in Japan. With a focus on training and development, it aims to enhance cybersecurity skills across various sectors.

Global Security Experts Inc. is navigating a dynamic growth trajectory with its revenue forecast to expand by 17% annually, outstripping the Japanese market's average of 4.3%. The firm's strategic emphasis on R&D is evident with substantial investments amounting to $1.2 billion last year, representing a significant proportion of their total revenue. This focus not only underscores their commitment to innovation but also aligns with industry trends towards enhanced security solutions. Moreover, an expected annual profit growth rate of 26.5% positions them well above the market norm of 7.8%, reflecting robust operational efficiencies and market demand for their cutting-edge products.

- Get an in-depth perspective on Global Security Experts' performance by reading our health report here.

Gain insights into Global Security Experts' past trends and performance with our Past report.

Key Takeaways

- Unlock more gems! Our High Growth Tech and AI Stocks screener has unearthed 1219 more companies for you to explore.Click here to unveil our expertly curated list of 1222 High Growth Tech and AI Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002456

OFILM Group

Manufactures and sells optic and optoelectronic products in China and internationally.

Reasonable growth potential with questionable track record.

Market Insights

Community Narratives