In recent weeks, European markets have experienced significant turbulence, with the pan-European STOXX Europe 600 Index dropping 8.44%, marking its steepest decline in five years amid heightened global trade tensions and uncertainty over U.S. tariff policies. As investors navigate this volatile environment, identifying high-growth tech stocks that can withstand economic headwinds becomes crucial; these stocks typically exhibit strong innovation capabilities, robust financial health, and adaptability to changing market dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 20.52% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.94% | 26.69% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.52% | ★★★★★★ |

| Xbrane Biopharma | 33.71% | 82.67% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.68% | 36.76% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Grifols (BME:GRF)

Simply Wall St Growth Rating: ★★★★☆☆

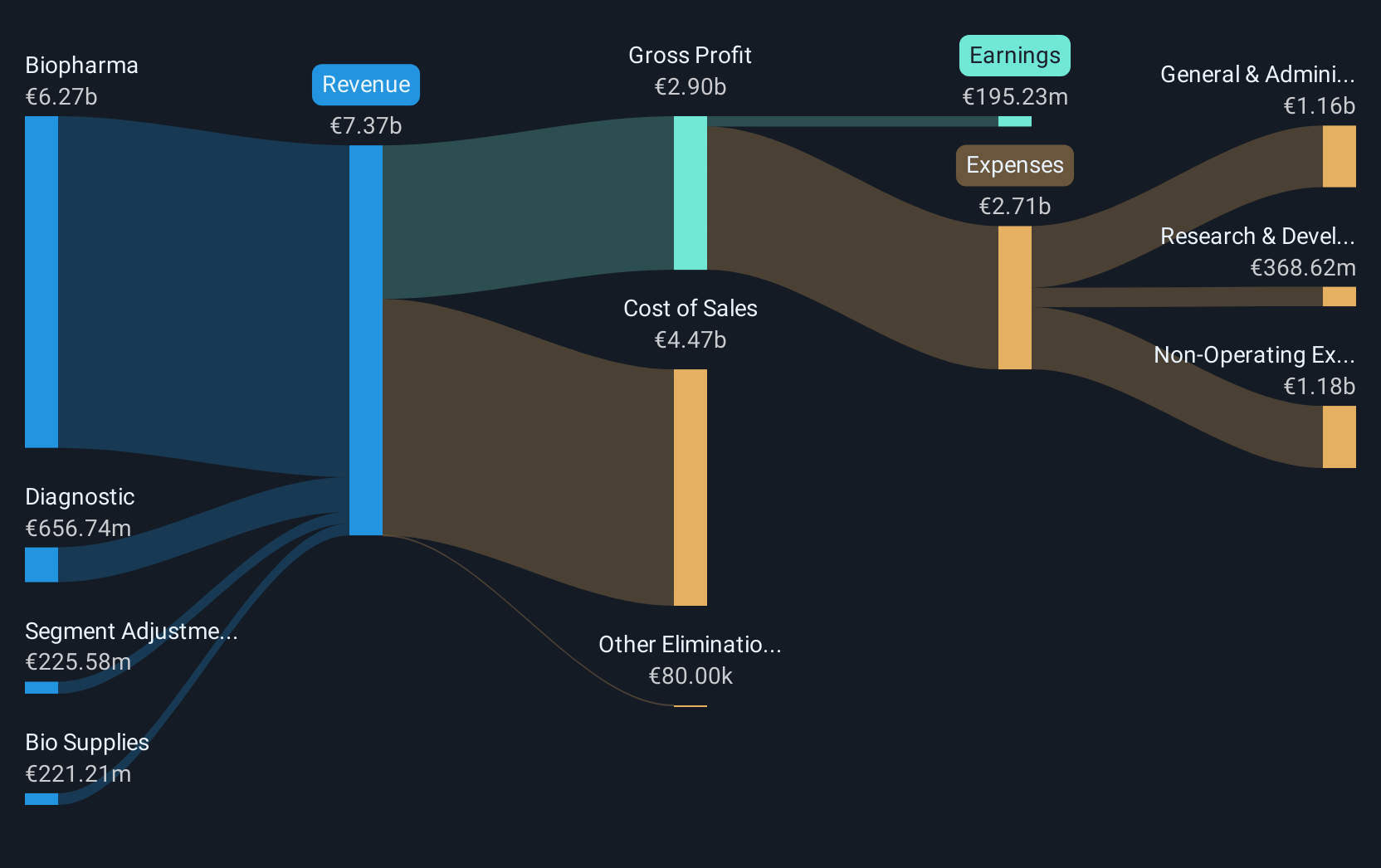

Overview: Grifols, S.A. is a plasma therapeutic company with operations in Spain, the United States, Canada, and internationally, and has a market cap of approximately €4.84 billion.

Operations: The company's primary revenue stream is from its Biopharma segment, generating approximately €6.14 billion, followed by the Diagnostic segment at about €644.90 million and Bio Supplies at €215.66 million.

Grifols has demonstrated a robust financial performance with a significant earnings increase of 270.8% over the past year, outpacing the Biotech industry's average. This surge is reflected in their recent annual figures, where net income soared to €156.92 million from €42.32 million, alongside a sales rise from €6.59 billion to €7.21 billion. Despite this growth, Grifols faces challenges such as highly volatile share prices and earnings that are not sufficiently covering interest payments, indicating potential risks in financial stability and investor confidence.

- Delve into the full analysis health report here for a deeper understanding of Grifols.

Understand Grifols' track record by examining our Past report.

AT & S Austria Technologie & Systemtechnik (WBAG:ATS)

Simply Wall St Growth Rating: ★★★★☆☆

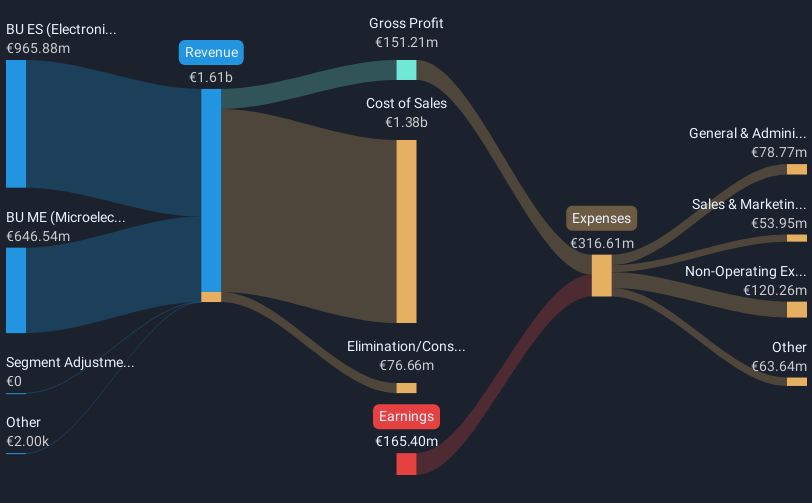

Overview: AT & S Austria Technologie & Systemtechnik AG, along with its subsidiaries, is engaged in the manufacturing and distribution of printed circuit boards across various regions including Austria, Germany, Europe, China, Asia, and the Americas with a market capitalization of approximately €442.11 million.

Operations: The company generates revenue primarily from two segments: Microelectronics, contributing €672.95 million, and Electronics Solutions, accounting for €953.08 million.

AT & S Austria Technologie & Systemtechnik, amidst a challenging market, is navigating with strategic leadership changes and robust revenue forecasts. The appointment of Dr. Michael Mertin as CEO heralds a focus on innovation, given his extensive background in technology and management. Financially, the company anticipates revenue between €1.5 billion and €1.6 billion for FY 2024/25, showcasing resilience with an expected growth rate of 15% annually. However, current unprofitability poses challenges; yet earnings are projected to surge by 94.27% annually over the next few years, suggesting potential for recovery and growth in the tech sector's competitive landscape.

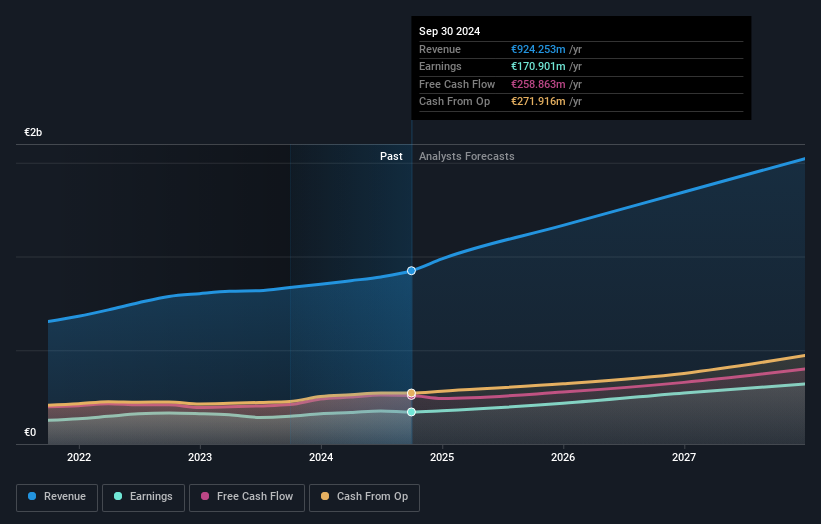

Nemetschek (XTRA:NEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nemetschek SE develops software solutions for the architecture, engineering, construction, media, and entertainment sectors across various global markets and has a market cap of €11.06 billion.

Operations: The company generates revenue primarily from four segments: Design (€488.77 million), Build (€340.68 million), Media (€120.09 million), and Manage (€49.87 million).

Nemetschek SE, a European tech entity, is demonstrating robust growth dynamics, evidenced by a 13% annual increase in revenue and an impressive 17.2% surge in earnings. With R&D expenses reaching €140 million last year, representing about 14% of its total revenue, the company is heavily investing in innovation—crucial for staying competitive in the software industry. The recent appointment of Sunil Pandita as Chief Division Officer underscores a strategic push towards digital transformation with his extensive background enhancing Nemetschek's capabilities in digital twin technologies. This leadership change aligns with their commitment to evolving market demands and could significantly influence future growth trajectories within the tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Nemetschek.

Evaluate Nemetschek's historical performance by accessing our past performance report.

Summing It All Up

- Take a closer look at our European High Growth Tech and AI Stocks list of 238 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:GRF

Grifols

Operates as a plasma therapeutic company in Spain, the United States, Canada, and internationally.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives