- Spain

- /

- Entertainment

- /

- BME:SQRL

How Much Did Vértice Trescientos Sesenta Grados' (BME:VER) Shareholders Earn On Their Investment Over The Last Three Years?

Vértice Trescientos Sesenta Grados, S.A. (BME:VER) shareholders should be happy to see the share price up 30% in the last quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 79% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

See our latest analysis for Vértice Trescientos Sesenta Grados

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

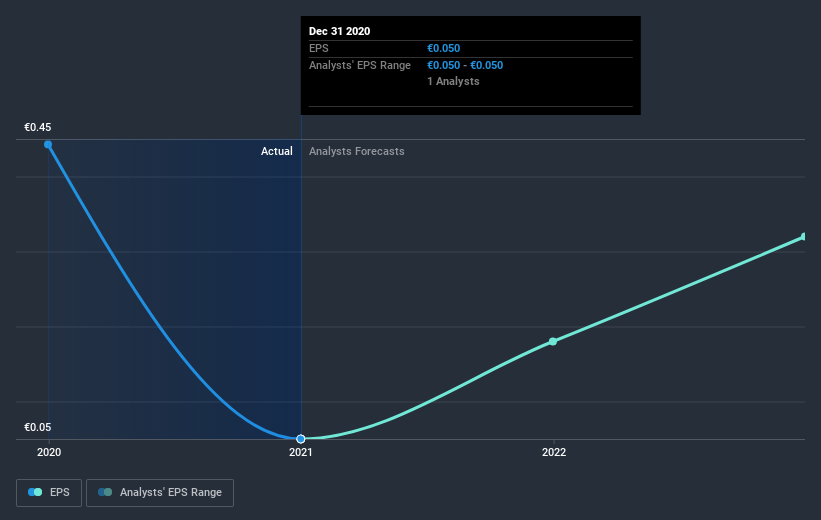

Vértice Trescientos Sesenta Grados saw its EPS decline at a compound rate of 83% per year, over the last three years. This fall in the EPS is worse than the 41% compound annual share price fall. So the market may not be too worried about the EPS figure, at the moment -- or it may have previously priced some of the drop in.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Vértice Trescientos Sesenta Grados has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Vértice Trescientos Sesenta Grados' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Vértice Trescientos Sesenta Grados hasn't been paying dividends, but its TSR of -46% exceeds its share price return of -79%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We're pleased to report that Vértice Trescientos Sesenta Grados rewarded shareholders with a total shareholder return of 67% over the last year. What is absolutely clear is that is far preferable to the dismal 14% average annual loss suffered over the last three years. We're generally cautious about putting too much weigh on shorter term data, but the recent improvement is definitely a positive. It's always interesting to track share price performance over the longer term. But to understand Vértice Trescientos Sesenta Grados better, we need to consider many other factors. Take risks, for example - Vértice Trescientos Sesenta Grados has 4 warning signs (and 2 which shouldn't be ignored) we think you should know about.

We will like Vértice Trescientos Sesenta Grados better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you decide to trade Vértice Trescientos Sesenta Grados, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BME:SQRL

Squirrel Media

Produces and distributes audiovisual contents in Spain and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026