Exploring High Growth Tech Stocks Including 2 More Promising Picks

Reviewed by Simply Wall St

Amidst a backdrop of rising optimism in the global markets, major indices such as the S&P 500 and Nasdaq Composite have reached new highs, buoyed by enthusiasm around artificial intelligence and easing trade tensions. In this environment of growth stocks outperforming value shares for the first time this year, high-growth tech stocks present intriguing opportunities, particularly those with strong fundamentals and exposure to burgeoning sectors like AI.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Promotora de Informaciones (BME:PRS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Promotora de Informaciones, S.A., along with its subsidiaries, operates in the media industry both in Spain and internationally, with a market capitalization of €356.47 million.

Operations: Promotora de Informaciones, S.A. generates revenue primarily from its Education segment, amounting to €456.72 million. The company's operations focus on media exploitation across Spain and international markets.

Promotora de Informaciones (PRS) is navigating the challenging landscape of the media industry with a notable focus on innovation and market adaptation. Despite being unprofitable, PRS's revenue growth is projected at 6% annually, outpacing the broader Spanish market's 5.2%. This growth is underpinned by a substantial expected earnings increase of 125.9% per year. However, shareholders have faced significant dilution over the past year, which raises concerns about equity value erosion. The company’s commitment to R&D could be pivotal as it transitions towards profitability in an evolving digital media environment, aiming to surpass average market growth within three years.

SUNeVision Holdings (SEHK:1686)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: SUNeVision Holdings Ltd. is an investment holding company that offers data centre and IT facility services in Hong Kong, with a market capitalization of approximately HK$15.22 billion.

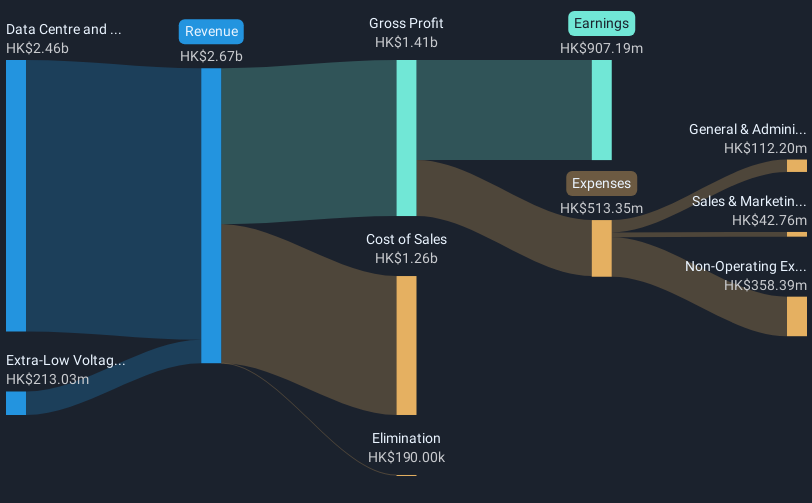

Operations: SUNeVision generates revenue primarily from its data centre and IT facilities, contributing HK$2.46 billion, while also offering extra-low voltage (ELV) and IT systems services with revenues of HK$213.03 million.

SUNeVision Holdings stands out in the Hong Kong tech sector with its robust revenue and earnings growth forecasts, surpassing local market averages with expected increases of 15% and 13.7% per year, respectively. This performance is particularly noteworthy given the broader market's growth rates of 7.7% for revenue and 11.3% for earnings. The company’s recent adoption of new bylaws underscores a strategic pivot that could further enhance governance and operational flexibility, aligning with its financial trajectory which also includes a promising forecast Return on Equity of 20.4%. Despite challenges such as not having positive free cash flow currently, SUNeVision's strong earnings quality and above-industry growth rates position it as a compelling entity within an increasingly competitive landscape.

- Dive into the specifics of SUNeVision Holdings here with our thorough health report.

Examine SUNeVision Holdings' past performance report to understand how it has performed in the past.

Chengdu KSW TechnologiesLtd (SHSE:688283)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chengdu KSW Technologies Co., Ltd. specializes in the research, development, manufacture, and sale of wireless channel emulators and radio frequency microwave signal generator products in China, with a market cap of CN¥2.94 billion.

Operations: KSW Technologies generates revenue primarily from its communications equipment segment, amounting to CN¥208.19 million. The company focuses on the development and sale of specialized wireless channel emulators and radio frequency microwave signal generators.

Chengdu KSW TechnologiesLtd. is capturing attention with its impressive annual revenue growth at 36.8%, outpacing the broader Chinese market's average of 13.3%. This surge is mirrored in its earnings, which are expected to climb by 44.4% annually, significantly ahead of the market norm of 25%. Despite a recent dip in net profit margins from 37.2% to 24.2%, largely due to one-off items totaling CN¥10M, the firm maintains a robust innovation cycle as evidenced by its R&D investments, crucial for sustaining long-term growth in the tech sector. Recent strategic maneuvers include a share buyback program where Chengdu repurchased shares worth CN¥16.3 million, enhancing shareholder value and affirming confidence in its financial health and future prospects.

Where To Now?

- Click this link to deep-dive into the 1231 companies within our High Growth Tech and AI Stocks screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1686

SUNeVision Holdings

An investment holding company, provides data centre and information technology (IT) facility services in Hong Kong.

Good value with reasonable growth potential.

Market Insights

Community Narratives