- Japan

- /

- Diversified Financial

- /

- TSE:8566

Three Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets continue to navigate the implications of new political developments and economic indicators, major indexes such as the S&P 500 have seen record highs, while small-cap stocks face a more nuanced landscape. With large-cap stocks generally outperforming their smaller counterparts, investors may find opportunities in lesser-known small-cap companies that exhibit strong fundamentals and potential for growth amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Namuga | 14.66% | -1.45% | 33.57% | ★★★★★★ |

| ONEJOON | 9.85% | 24.95% | 4.85% | ★★★★★☆ |

| Giant Heavy Machinery Service | 17.81% | 21.88% | 48.77% | ★★★★★☆ |

| Primadaya Plastisindo | 10.46% | 15.41% | 23.92% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Miquel y Costas & Miquel (BME:MCM)

Simply Wall St Value Rating: ★★★★★★

Overview: Miquel y Costas & Miquel, S.A. is involved in the production and distribution of fine and specialty lightweight papers both domestically in Spain and internationally, with a market cap of €484.90 million.

Operations: Miquel y Costas & Miquel generates revenue through the manufacture and sale of fine and specialty lightweight papers, both in Spain and internationally. The company's financial performance is reflected in its market capitalization of €484.90 million.

Miquel y Costas & Miquel, a promising player in its field, has shown resilience with a debt to equity ratio dropping from 27.5% to 15.9% over five years, indicating prudent financial management. Despite a slight annual earnings decline of 1.2% over the past five years, recent growth of 15.5% suggests positive momentum against industry trends. With high-quality earnings and a satisfactory net debt to equity ratio of just 1.3%, it offers good value at a price-to-earnings ratio of 10.5x compared to the Spanish market's average of 19.5x, making it an intriguing prospect for those seeking value opportunities.

Morita Holdings (TSE:6455)

Simply Wall St Value Rating: ★★★★★★

Overview: Morita Holdings Corporation, with a market cap of ¥931.90 billion, specializes in developing, manufacturing, and selling ladder trucks, fire trucks, and specialty vehicles both in Japan and internationally through its subsidiaries.

Operations: Morita Holdings generates its revenue primarily from the Fire Engine segment, contributing ¥60.92 billion, followed by Disaster Prevention at ¥25.54 billion and Environmental Vehicle at ¥11.33 billion. The Industrial Machinery segment adds ¥6.27 billion to the total revenue stream.

Morita Holdings, a nimble player in its sector, has seen a remarkable earnings growth of 69.5% over the past year, outpacing the Machinery industry’s modest 1.6%. Over five years, it reduced its debt to equity ratio from 12.4% to just 1%, reflecting strong financial discipline. Trading at a significant discount of 52.6% below estimated fair value suggests potential upside for investors seeking undervalued opportunities. The company’s high-quality earnings and positive free cash flow further underscore its robust financial health, while having more cash than total debt indicates prudent management of resources and potential for future stability or expansion.

- Click here to discover the nuances of Morita Holdings with our detailed analytical health report.

Examine Morita Holdings' past performance report to understand how it has performed in the past.

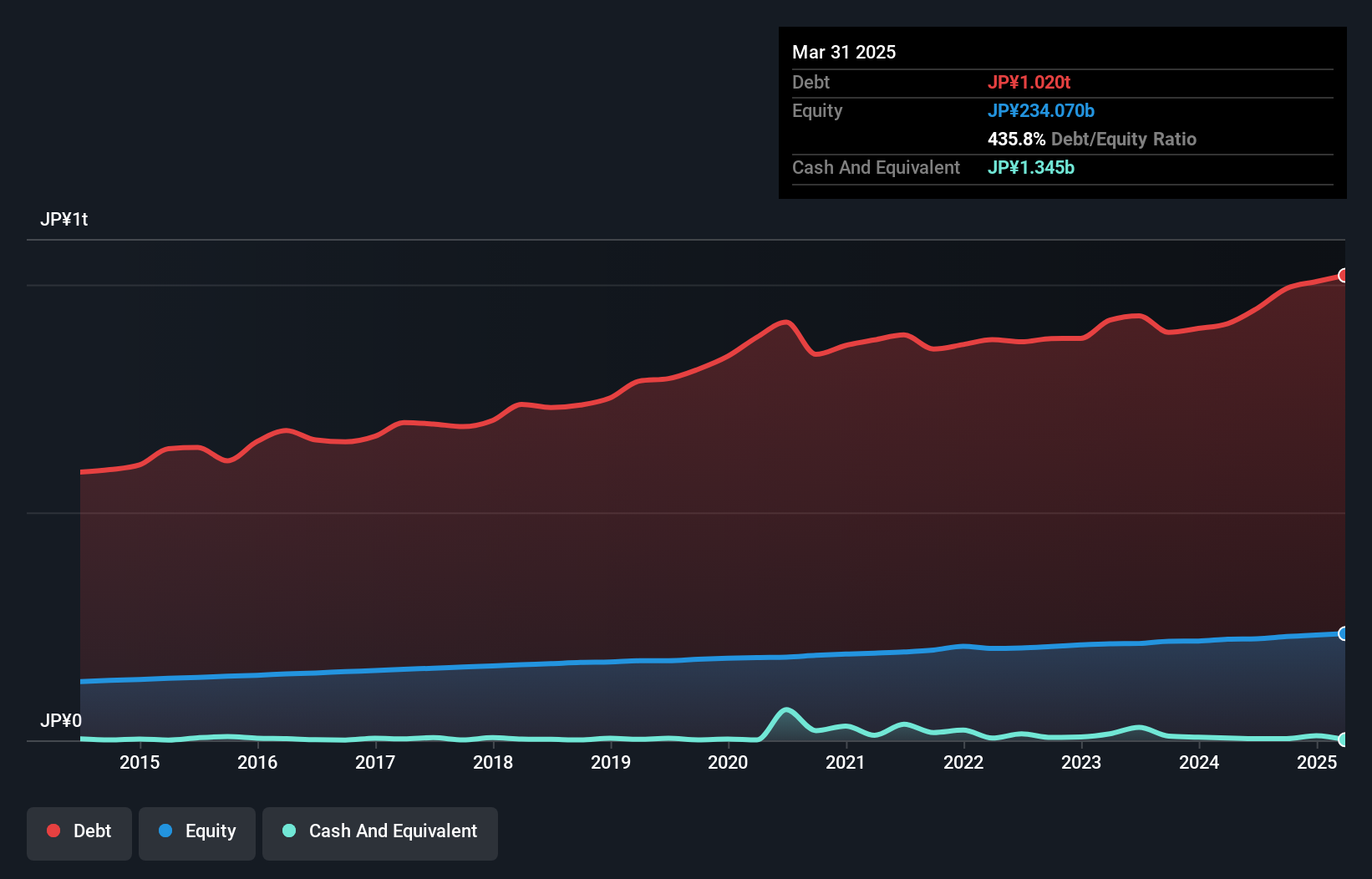

Ricoh Leasing Company (TSE:8566)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ricoh Leasing Company, Ltd. operates in Japan, providing leasing, investment, and financial services with a market capitalization of ¥1.57 trillion.

Operations: Ricoh Leasing generates revenue primarily from its Leasing & Finance Business, contributing ¥289.42 billion, followed by the Service Business at ¥9.05 billion and the Investment Business at ¥8.27 billion. The net profit margin for the company is a key financial metric to consider when analyzing its performance in these segments.

With a net debt to equity ratio of 433.9%, Ricoh Leasing's financial structure seems leveraged, yet it consistently covers interest payments without issue. Over the past five years, earnings have grown by 1.5% annually, indicating steady progress despite not outpacing the industry's recent growth rate of 28.6%. The company trades at a notable discount of 36.1% below its estimated fair value, suggesting potential undervaluation in the market. Recent developments include an increased dividend forecast for March 2025 and projected net sales of ¥315 billion alongside an operating profit of ¥21 billion for the same period.

- Get an in-depth perspective on Ricoh Leasing Company's performance by reading our health report here.

Evaluate Ricoh Leasing Company's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Investigate our full lineup of 4671 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8566

Ricoh Leasing Company

Engages in leasing, investment, and financial service businesses in Japan.

Solid track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives