- Switzerland

- /

- Building

- /

- SWX:MTG

3 Dividend Stocks Offering Yields Up To 4.9%

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes approaching record highs and broad-based gains, investors are navigating a landscape marked by geopolitical tensions and economic uncertainties. Amid this backdrop, dividend stocks emerge as an attractive option for those seeking steady income, particularly when yields reach up to 4.9%. In the current market environment, a good dividend stock typically offers consistent payouts and demonstrates financial stability, making it a potentially valuable component of an investment portfolio.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.73% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

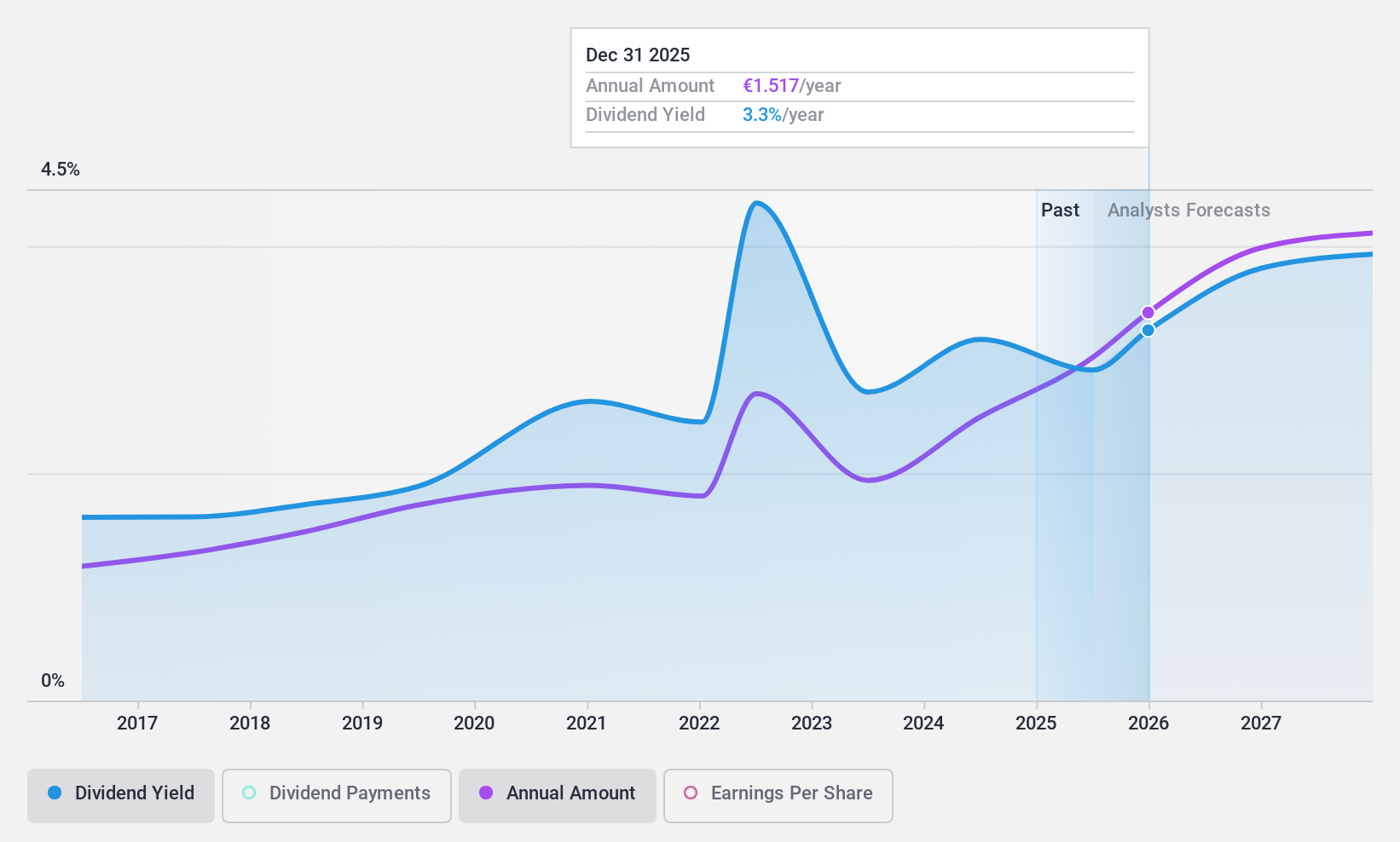

Construcciones y Auxiliar de Ferrocarriles (BME:CAF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Construcciones y Auxiliar de Ferrocarriles, S.A. operates in the transportation industry, focusing on the design, manufacture, and maintenance of railway vehicles and equipment, with a market cap of €1.10 billion.

Operations: Construcciones y Auxiliar de Ferrocarriles, S.A. generates its revenue from the design, manufacture, and maintenance of railway vehicles and equipment.

Dividend Yield: 3.4%

Construcciones y Auxiliar de Ferrocarriles, S.A. has shown a steady increase in earnings, reporting €61 million net income for the first nine months of 2024. Despite trading below analyst price targets and offering a dividend yield lower than the Spanish market's top tier, its dividends are well-covered by both earnings (35.5% payout ratio) and cash flows (75.9% cash payout ratio). However, its dividend history is unstable with volatility over the past decade.

- Take a closer look at Construcciones y Auxiliar de Ferrocarriles' potential here in our dividend report.

- The valuation report we've compiled suggests that Construcciones y Auxiliar de Ferrocarriles' current price could be quite moderate.

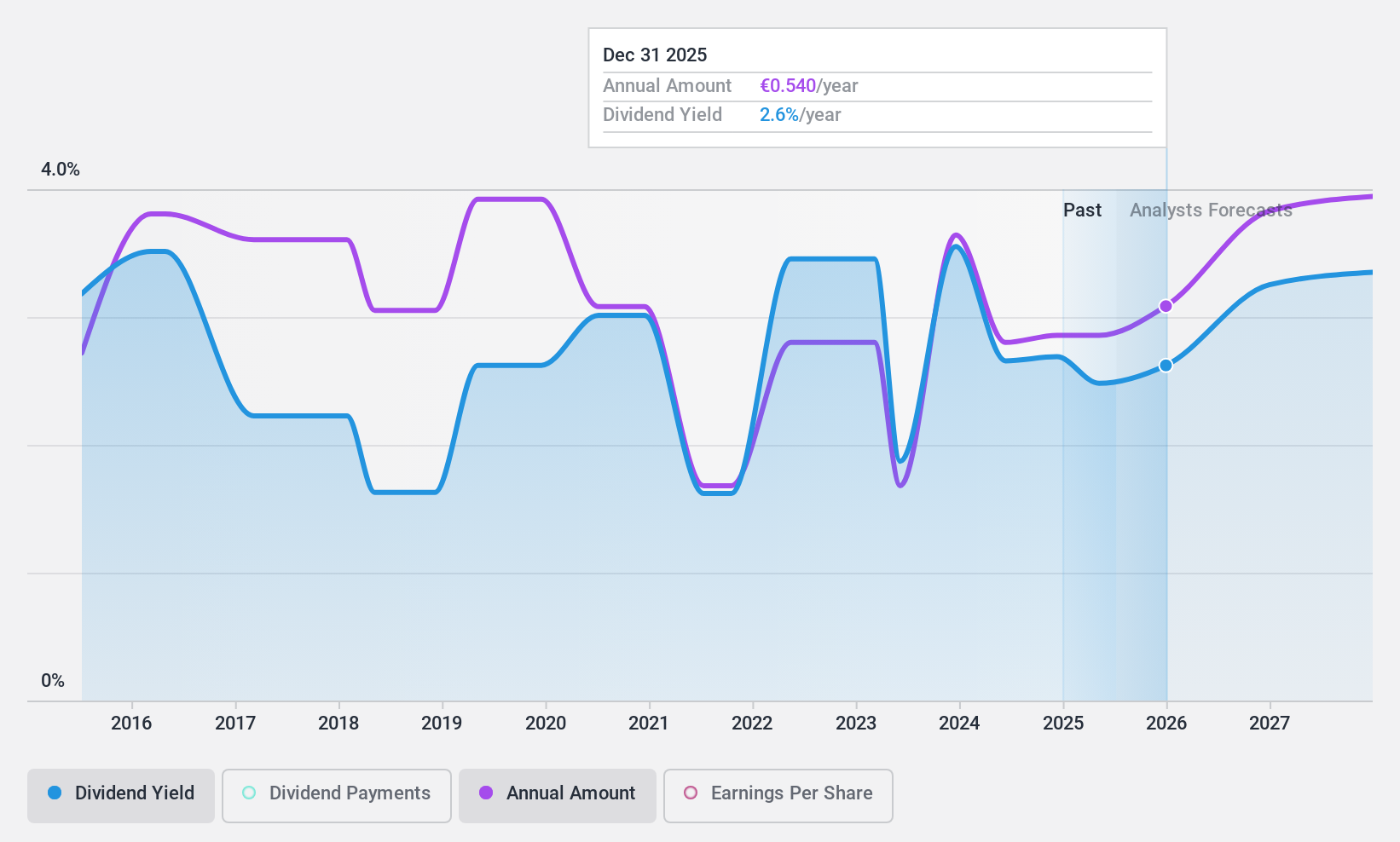

Iberpapel Gestión (BME:IBG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iberpapel Gestión, S.A., along with its subsidiaries, focuses on the manufacturing, selling, and exporting of writing and printing paper across Spain, the European Union, Africa, and other international markets with a market cap of approximately €199.41 million.

Operations: Iberpapel Gestión's revenue segments consist of €203.88 million from paper, €56.99 million from forestry and others, and €38.59 million from electricity (Cogeneracion Gas).

Dividend Yield: 3.4%

Iberpapel Gestión's dividend payments have been volatile and unreliable over the past decade, with a history of annual drops exceeding 20%. Despite this instability, dividends are well-covered by earnings (51.7% payout ratio) and cash flows (19.6% cash payout ratio). Recent earnings showed a decline in net income to €15.55 million for the first nine months of 2024 from €34.97 million last year, impacting its financial stability and dividend reliability further.

- Delve into the full analysis dividend report here for a deeper understanding of Iberpapel Gestión.

- Our valuation report unveils the possibility Iberpapel Gestión's shares may be trading at a discount.

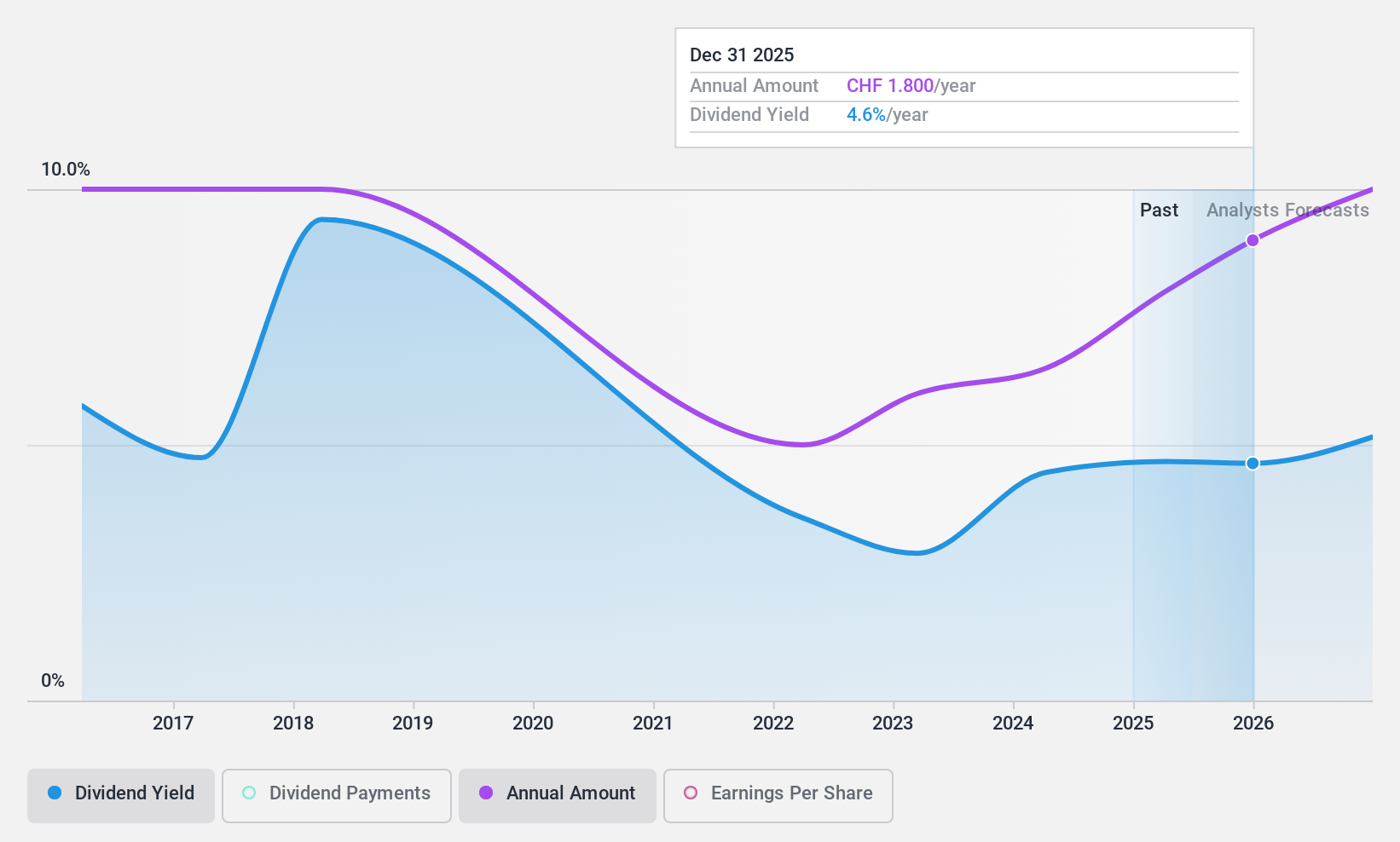

Meier Tobler Group (SWX:MTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meier Tobler Group AG is a trading and services company specializing in heat generation and air conditioning systems, with a market cap of CHF299.14 million.

Operations: Meier Tobler Group AG generates revenue through its Service segment, contributing CHF104.01 million, and its Distribution segment, contributing CHF404.27 million.

Dividend Yield: 4.9%

Meier Tobler Group's dividend yield of 4.91% ranks in the top 25% among Swiss stocks but is not well-supported by free cash flows, with a high cash payout ratio of 179.3%. Although dividends are covered by earnings at a 76.3% payout ratio, they have been volatile over the past decade, experiencing significant annual drops. The company's profit margins have decreased from last year and one-off items have affected financial results, raising concerns about dividend sustainability.

- Dive into the specifics of Meier Tobler Group here with our thorough dividend report.

- The analysis detailed in our Meier Tobler Group valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1970 Top Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MTG

Meier Tobler Group

Operates as a trading and services company in heat generation and air conditioning systems.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives