- Spain

- /

- Metals and Mining

- /

- BME:ACX

Acerinox (BME:ACX): Assessing Valuation as Market Optimism Sparks Interest in Undervalued Stocks

Reviewed by Kshitija Bhandaru

With European markets reaching new record highs and optimism driven by expectations of lower U.S. borrowing costs, Acerinox (BME:ACX) has caught investor attention as it trades below its estimated fair value.

See our latest analysis for Acerinox.

Acerinox's share price has gained real momentum lately, jumping nearly 16% over the past month and delivering an impressive year-to-date share price return of 28%. Over a longer period, a 1-year total shareholder return of 42% and more than 130% in five years show that patient investors have been well rewarded. This suggests optimism is building as the company is seen as undervalued and earnings growth expectations strengthen.

If this surge in performance has you curious about what other fast-rising names are out there, now is a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

So is Acerinox truly flying under the radar and undervalued, or are investors fully accounting for its future potential in the share price? Is there a genuine buying opportunity here, or has the market already priced in its next chapter?

Most Popular Narrative: 7.5% Undervalued

The most widely followed narrative prices Acerinox at €13.39, placing it above the last close of €12.39. While the gap is moderate, it hints that analysts see further to run if the narrative assumptions are met.

Increasing customer preference and regulatory focus on sustainability is accelerating adoption of recycled and low-CO2 stainless steel. Acerinox's successful EcoAcerinox product line, with over 90% recycled content and 50% lower CO₂ intensity, positions it for long-term share gains and higher-margin sales as ESG standards tighten and customers shift procurement, supporting margin improvement and top-line growth.

Wondering what really powers this valuation? There is a bold growth trajectory forecasted in both sales and profit margins. But what critical assumptions lie beneath the surface and could they be too ambitious? See how analyst predictions and hidden momentum shape this fair value.

Result: Fair Value of €13.39 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical tensions and surging low-cost imports could still derail demand recovery, potentially putting Acerinox's margins and revenue growth at risk.

Find out about the key risks to this Acerinox narrative.

Another View: What Do Market Ratios Say?

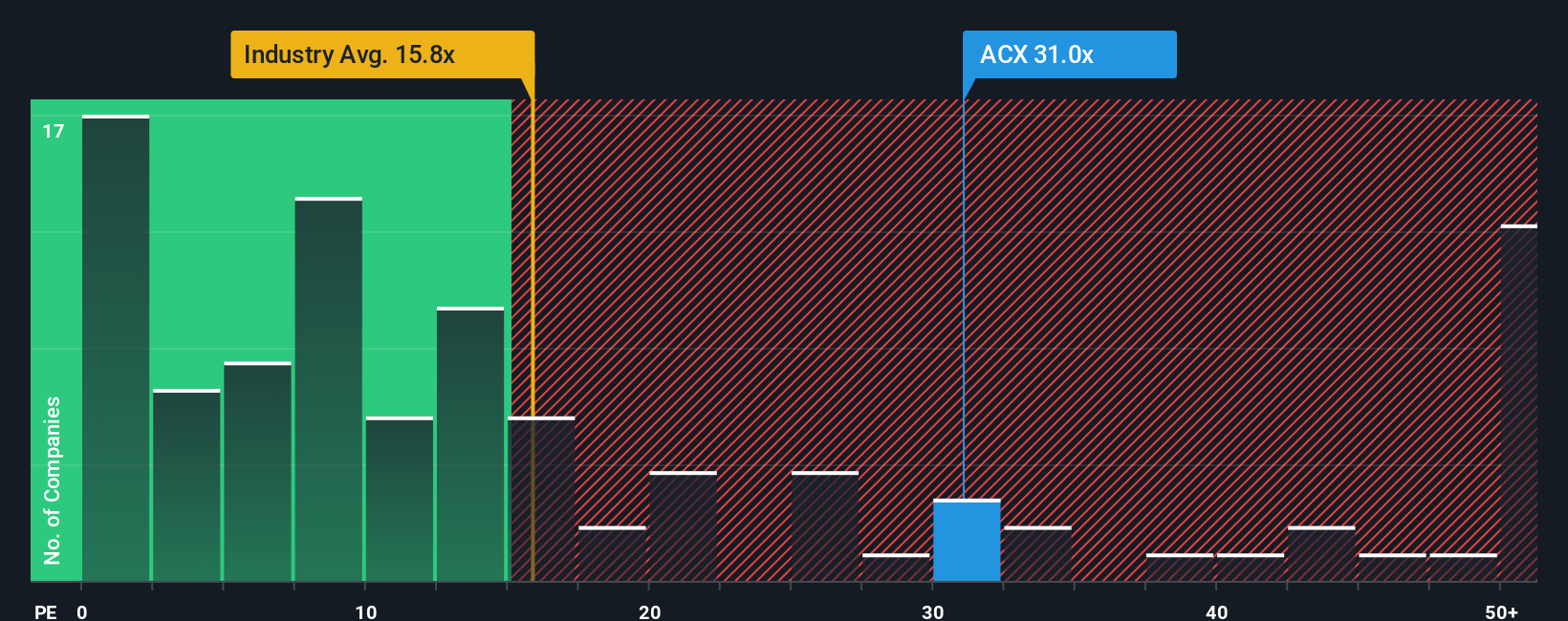

Looking at market ratios offers a different take. Acerinox currently trades at a price-to-earnings ratio of 33.2x, much higher than both the industry average of 15.7x and the peer average of 10.6x. Even compared to its fair ratio of 30.2x, the shares look expensive by this measure. This raises the question: is growth already fully priced in, or could rerating risks emerge if expectations shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Acerinox Narrative

If you see things differently or want to investigate Acerinox from your own perspective, you can explore the numbers and craft your own view in just minutes with Do it your way

A great starting point for your Acerinox research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Missing out on other standout stocks can leave real gains on the table. Make your next move count and upgrade your watchlist with high-potential picks you might have overlooked.

- Capture income by locking in reliable yields with these 19 dividend stocks with yields > 3%, which have consistently outperformed cash savings.

- Seize the momentum in the rapidly evolving world of machine learning and automation with these 25 AI penny stocks, shaping tomorrow's economy.

- Jump on emerging tech trends before they go mainstream with these 26 quantum computing stocks, leading the way in innovation and future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ACX

Acerinox

Manufactures, process, and markets stainless steel products in Spain, the United States, Africa, Asia, Rest of Europe, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives