- Spain

- /

- Metals and Mining

- /

- BME:ACX

3 Stocks That May Be Priced Below Their Estimated Value In December 2024

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by positive sentiment from domestic and geopolitical developments, investors are keenly observing the broader economic landscape. Despite uncertainties such as potential trade tariffs and manufacturing slumps, opportunities may exist in stocks that appear undervalued relative to their intrinsic worth. Identifying such stocks involves assessing factors like strong fundamentals and resilience amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Corporativo Fragua. de (BMV:FRAGUA B) | MX$633.57 | MX$1257.07 | 49.6% |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR2.39 | 49.7% |

| Ramssol Group Berhad (KLSE:RAMSSOL) | MYR0.70 | MYR1.39 | 49.5% |

| Krsnaa Diagnostics (NSEI:KRSNAA) | ₹996.65 | ₹1971.74 | 49.5% |

| Equity Bancshares (NYSE:EQBK) | US$48.12 | US$96.15 | 50% |

| Pluk Phak Praw Rak Mae (SET:OKJ) | THB15.50 | THB30.86 | 49.8% |

| Acerinox (BME:ACX) | €9.92 | €19.82 | 49.9% |

| Nidaros Sparebank (OB:NISB) | NOK100.10 | NOK198.62 | 49.6% |

| Marcus & Millichap (NYSE:MMI) | US$40.88 | US$81.13 | 49.6% |

| FINEOS Corporation Holdings (ASX:FCL) | A$1.90 | A$3.77 | 49.5% |

Let's uncover some gems from our specialized screener.

Acerinox (BME:ACX)

Overview: Acerinox, S.A. and its subsidiaries manufacture, process, and market stainless steel products globally, with a market cap of €2.47 billion.

Operations: The company's revenue is primarily derived from its Stainless Steel Business, which accounts for €4.35 billion, and High Performance Alloys, contributing €1.37 billion.

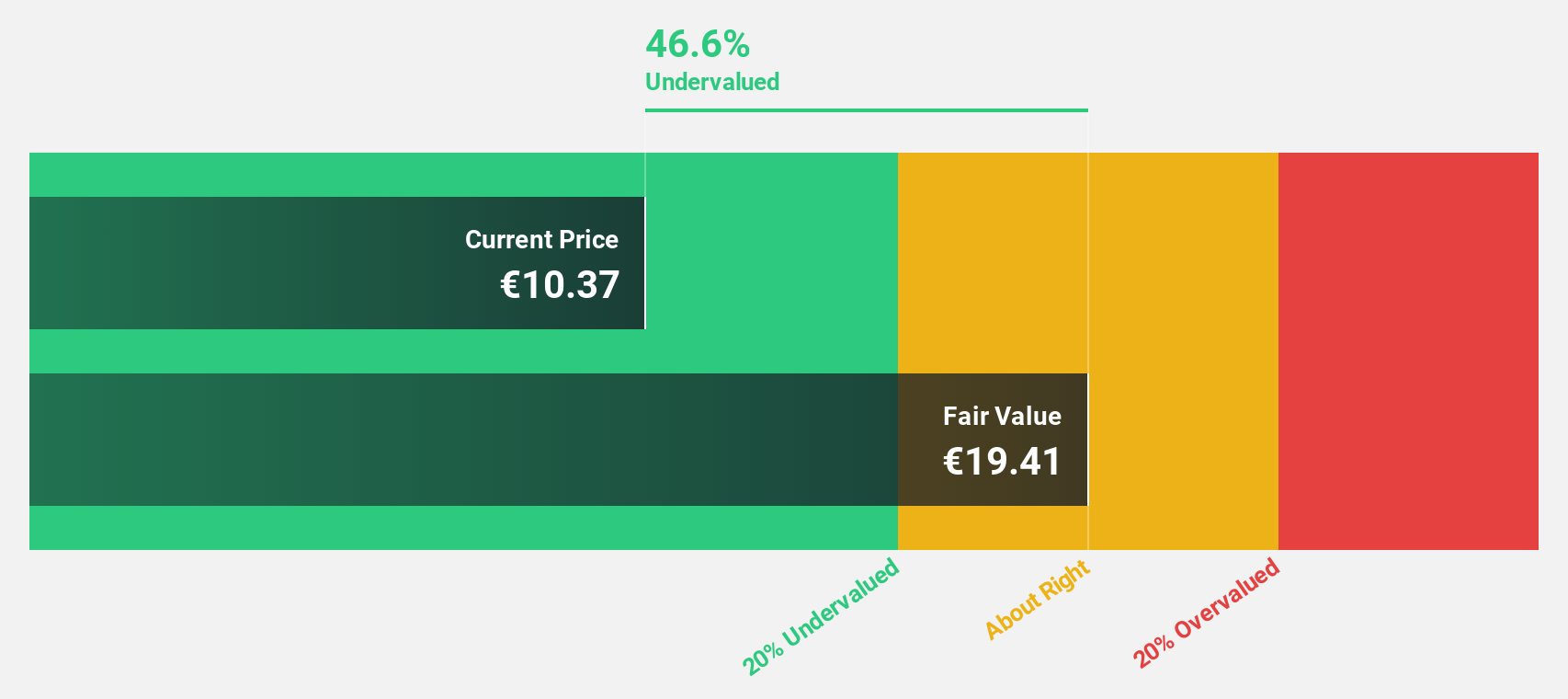

Estimated Discount To Fair Value: 49.9%

Acerinox is trading significantly below its estimated fair value of €19.82, with a current price of €9.92, suggesting it may be undervalued based on cash flows. Despite a low return on equity forecast and unsustainable dividend coverage, its earnings are projected to grow at 38.7% annually, outpacing the Spanish market's growth rate. However, recent profit margins have declined due to large one-off items impacting financial results.

- Our comprehensive growth report raises the possibility that Acerinox is poised for substantial financial growth.

- Get an in-depth perspective on Acerinox's balance sheet by reading our health report here.

Türk Telekomünikasyon Anonim Sirketi (IBSE:TTKOM)

Overview: Türk Telekomünikasyon Anonim Sirketi, along with its subsidiaries, offers integrated telecommunication services in Turkey and has a market cap of TRY164.50 billion.

Operations: The company's revenue segments consist of Mobile services generating TRY45.38 billion and Fixed-Line services contributing TRY67.30 billion.

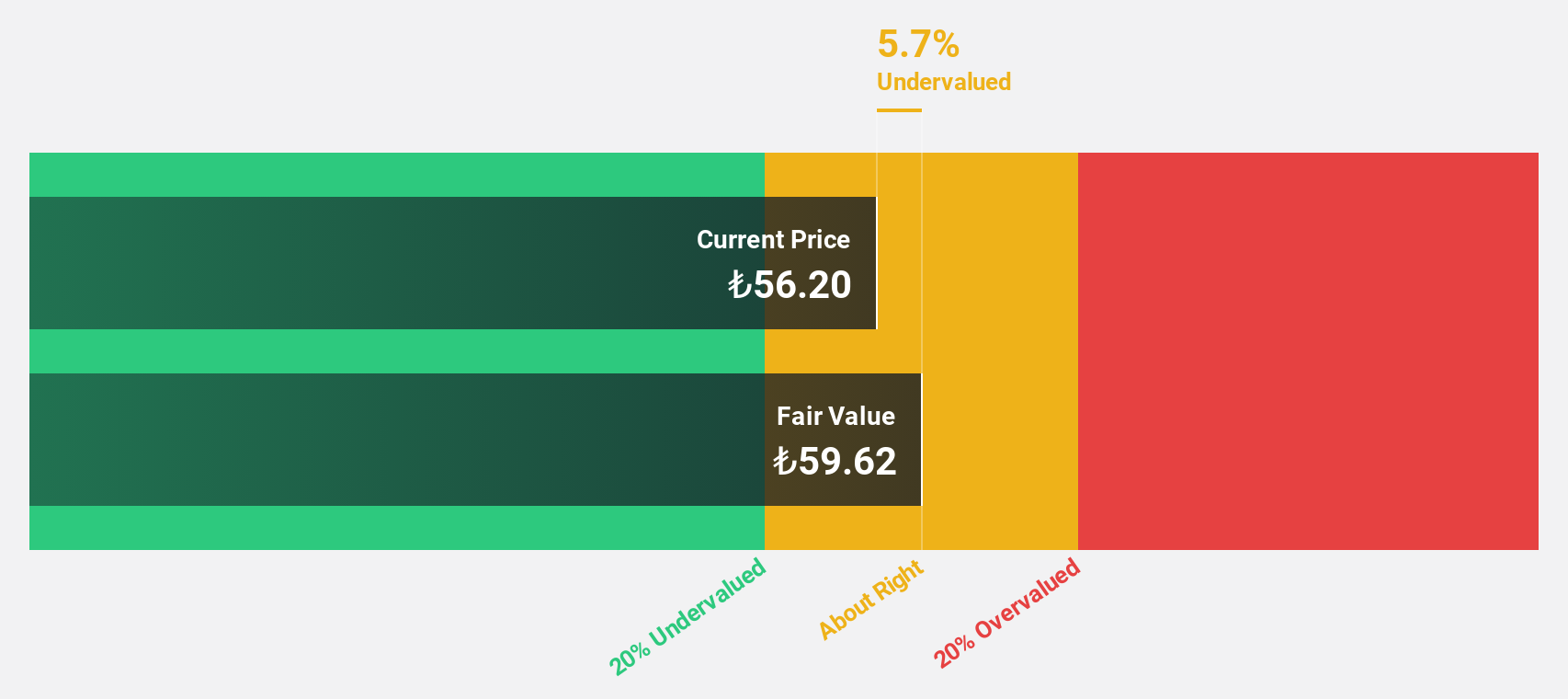

Estimated Discount To Fair Value: 35.1%

Türk Telekomünikasyon Anonim Sirketi is trading at TRY47, which is 35.1% below its estimated fair value of TRY72.44, highlighting potential undervaluation based on cash flows. The company reported strong revenue growth in the third quarter with sales reaching TRY40.35 billion, up from TRY34.83 billion a year ago, despite a decline in net income to TRY1.14 billion from TRY3.04 billion last year, reflecting challenges that may affect future profitability projections.

- According our earnings growth report, there's an indication that Türk Telekomünikasyon Anonim Sirketi might be ready to expand.

- Take a closer look at Türk Telekomünikasyon Anonim Sirketi's balance sheet health here in our report.

Cicor Technologies (SWX:CICN)

Overview: Cicor Technologies Ltd., with a market cap of CHF253.94 million, develops and manufactures electronic components, devices, and systems globally through its subsidiaries.

Operations: The company's revenue is derived from two main segments: the Advanced Substrates (AS) Division, contributing CHF46.24 million, and the Electronic Manufacturing Services (EMS) Division, which accounts for CHF377.46 million.

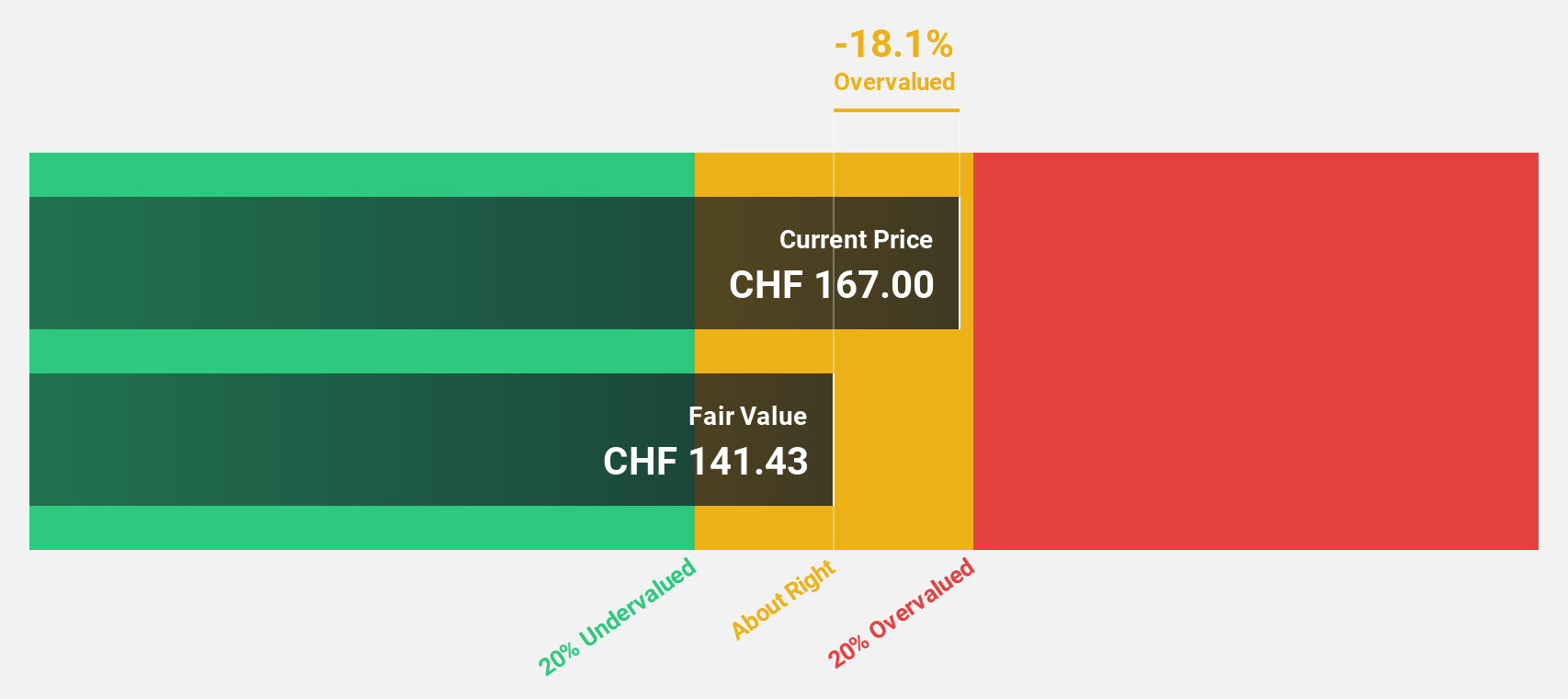

Estimated Discount To Fair Value: 48.9%

Cicor Technologies, trading at CHF59.8, is significantly undervalued with fair value estimated at CHF117.11. Despite a high debt level and recent shareholder dilution, its earnings are expected to grow substantially by 28.3% annually over the next three years, outpacing Swiss market growth of 11.5%. The company's M&A strategy has been transformative and continues to be central to its future plans, potentially enhancing financial performance further despite moderate revenue growth forecasts of 7.4% per year.

- The analysis detailed in our Cicor Technologies growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Cicor Technologies' balance sheet health report.

Next Steps

- Click here to access our complete index of 889 Undervalued Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Acerinox, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ACX

Acerinox

Manufactures, process, and markets stainless steel products in Spain, the United States, Africa, Asia, Rest of Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives