Some Confidence Is Lacking In Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros' (BME:LDA) P/S

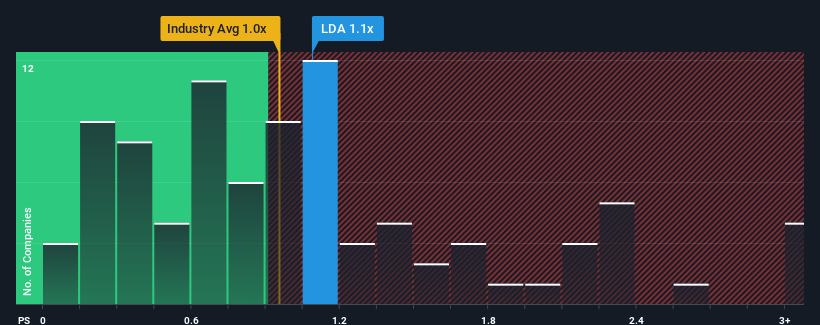

There wouldn't be many who think Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros' (BME:LDA) price-to-sales (or "P/S") ratio of 1.1x is worth a mention when the median P/S for the Insurance industry in Spain is similar at about 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Línea Directa Aseguradora Compañía de Seguros y Reaseguros

How Línea Directa Aseguradora Compañía de Seguros y Reaseguros Has Been Performing

Recent times haven't been great for Línea Directa Aseguradora Compañía de Seguros y Reaseguros as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Línea Directa Aseguradora Compañía de Seguros y Reaseguros will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Línea Directa Aseguradora Compañía de Seguros y Reaseguros' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.1% last year. The solid recent performance means it was also able to grow revenue by 9.9% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 1.8% each year as estimated by the six analysts watching the company. With the industry predicted to deliver 10% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Línea Directa Aseguradora Compañía de Seguros y Reaseguros is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Línea Directa Aseguradora Compañía de Seguros y Reaseguros' P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

When you consider that Línea Directa Aseguradora Compañía de Seguros y Reaseguros' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Línea Directa Aseguradora Compañía de Seguros y Reaseguros that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:LDA

Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Engages in insurance and reinsurance business in Spain and Portugal.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

Salesforce (CRM) The Agentic Pivot: Salesforce Redefines the SaaS Era

Nvidia (NVDA) The Sovereign of Silicon: Accelerating Beyond the $5 Trillion Horizon

IA Analysis

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks