- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Top European Dividend Stocks To Consider

Reviewed by Simply Wall St

As European markets show resilience with the pan-European STOXX Europe 600 Index rising 3.44% amidst easing tariff concerns, investors are keenly watching for opportunities that align with economic growth and inflation trends in the region. In this environment, dividend stocks can offer a compelling proposition by providing steady income streams while potentially benefiting from the broader market recovery.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 4.73% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.37% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.48% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.89% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.85% | ★★★★★★ |

| S.N. Nuclearelectrica (BVB:SNN) | 9.29% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.25% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.06% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.36% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 5.77% | ★★★★★☆ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

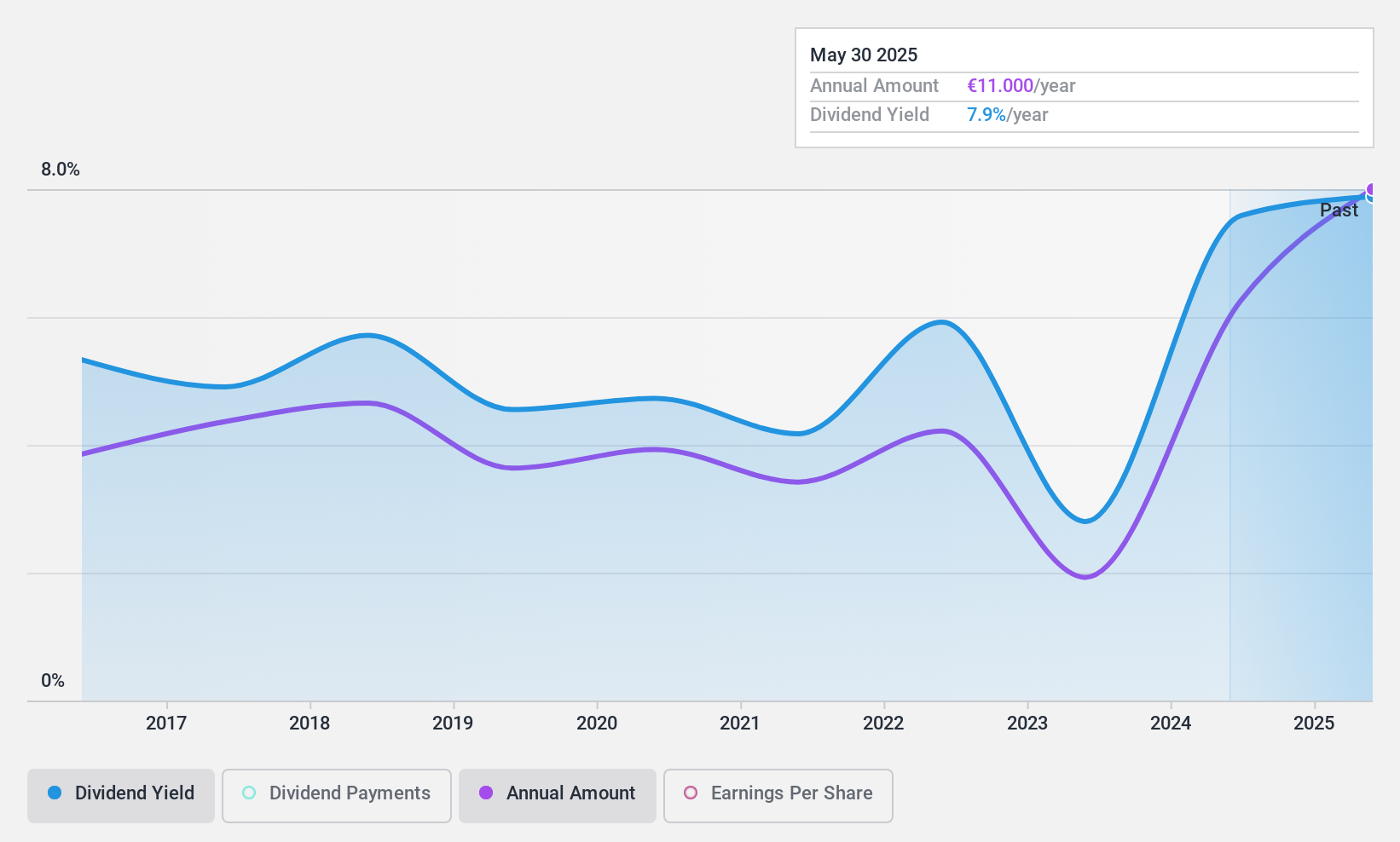

Prim (BME:PRM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prim, S.A. operates in Spain, offering health technology, mobility, and healthcare products with a market cap of €181.19 million.

Operations: Prim, S.A. generates its revenue primarily from Medical Technologies (€118.75 million) and Mobility and Healthcare (€114.56 million) segments in Spain.

Dividend Yield: 4.2%

Prim, S.A. offers a mixed dividend profile with its dividends well-covered by earnings (payout ratio of 42.4%) and cash flows (cash payout ratio of 70.6%). Despite this coverage, the dividend yield is relatively low at 4.2% compared to top Spanish market payers and has been volatile over the past decade, experiencing annual drops over 20%. Recent financials show increased sales (€228.82 million) but decreased net income (€10.92 million).

- Click to explore a detailed breakdown of our findings in Prim's dividend report.

- The analysis detailed in our Prim valuation report hints at an deflated share price compared to its estimated value.

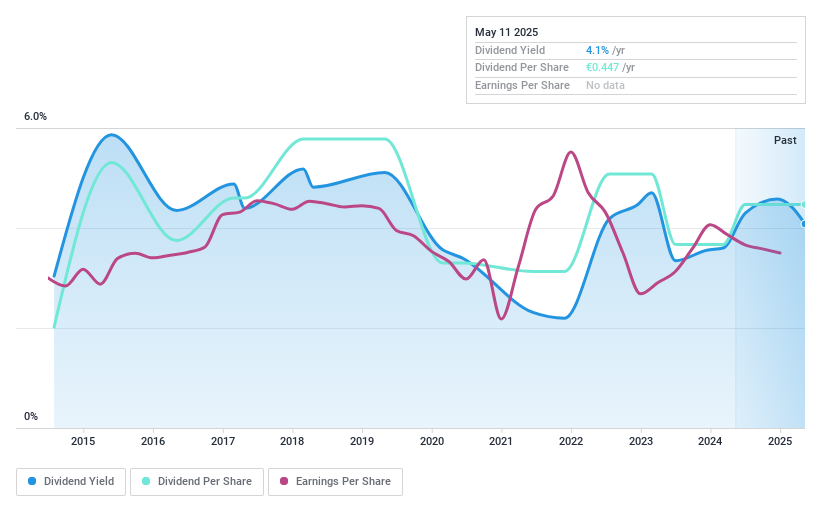

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €1.03 billion.

Operations: Électricite de Strasbourg Société Anonyme generates revenue from the consumption of electricity and gas (€311.39 million) and the production and marketing of electricity and gas (€1.12 billion).

Dividend Yield: 7.7%

Électricite de Strasbourg Société Anonyme's dividends are well-supported by earnings (payout ratio of 52.4%) and cash flows (cash payout ratio of 71%), with a competitive yield at 7.69%, placing it in the top quartile among French dividend stocks. Despite recent earnings growth, its dividend history has been volatile, marked by significant fluctuations over the past decade. Recent financials show a decline in sales to €1.42 billion but an increase in net income to €150.42 million for 2024.

- Click here to discover the nuances of Électricite de Strasbourg Société Anonyme with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Électricite de Strasbourg Société Anonyme shares in the market.

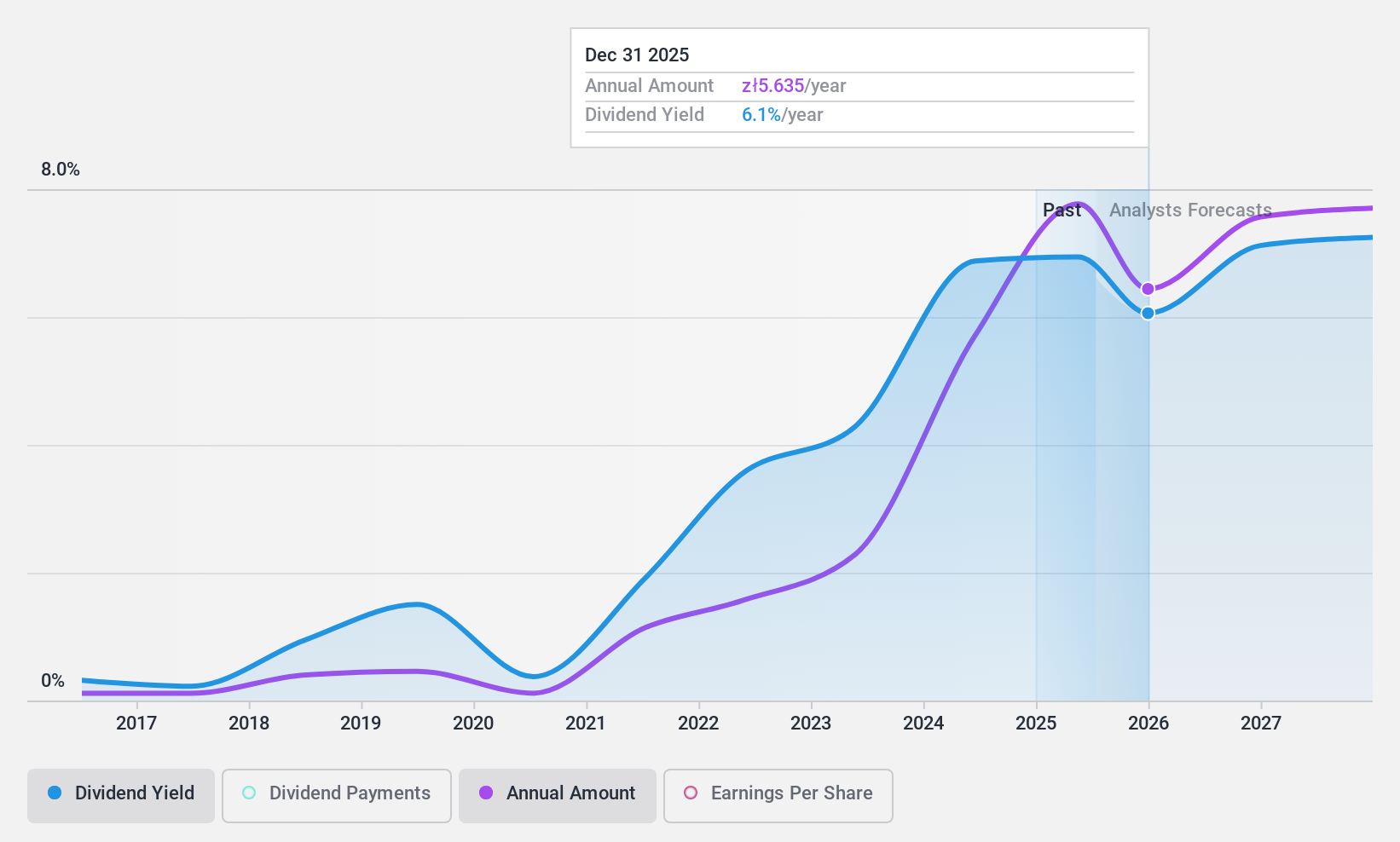

Oponeo.pl (WSE:OPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oponeo.pl S.A. operates as an online retailer of tires and wheels for motor vehicles both in Poland and internationally, with a market capitalization of PLN1.16 billion.

Operations: Oponeo.pl S.A.'s revenue is primarily derived from Car Accessories, which generated PLN1.79 billion, followed by Bicycles and Bicycle Accessories at PLN280.57 million, and the Tools Segment contributing PLN93.20 million.

Dividend Yield: 4.8%

Oponeo.pl's dividend of PLN 4.00 per share, despite recent earnings growth to PLN 84.73 million, reflects a history of volatility over the past decade. The payout ratio stands at 60.6%, indicating dividends are covered by earnings, though cash flow coverage is tighter at 84.4%. Its yield of 4.83% is below the top quartile in Poland, and while dividends have grown over ten years, their reliability remains questionable due to past instability.

- Unlock comprehensive insights into our analysis of Oponeo.pl stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Oponeo.pl is priced higher than what may be justified by its financials.

Make It Happen

- Explore the 237 names from our Top European Dividend Stocks screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Électricite de Strasbourg Société Anonyme, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Outstanding track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives